Welfare cuts postponed, not axed

- Published

George Osborne was in the end not just for turning, but for totally reversing his position on those controversial tax credits that were set to hit millions of working families.

But as ever with big political set-piece statements, the real crunching of the numbers takes some time. Some of those details just released by the independent think-tank the Resolution Foundation, make abundantly clear that the same kind of families still stand to lose out in the longer term.

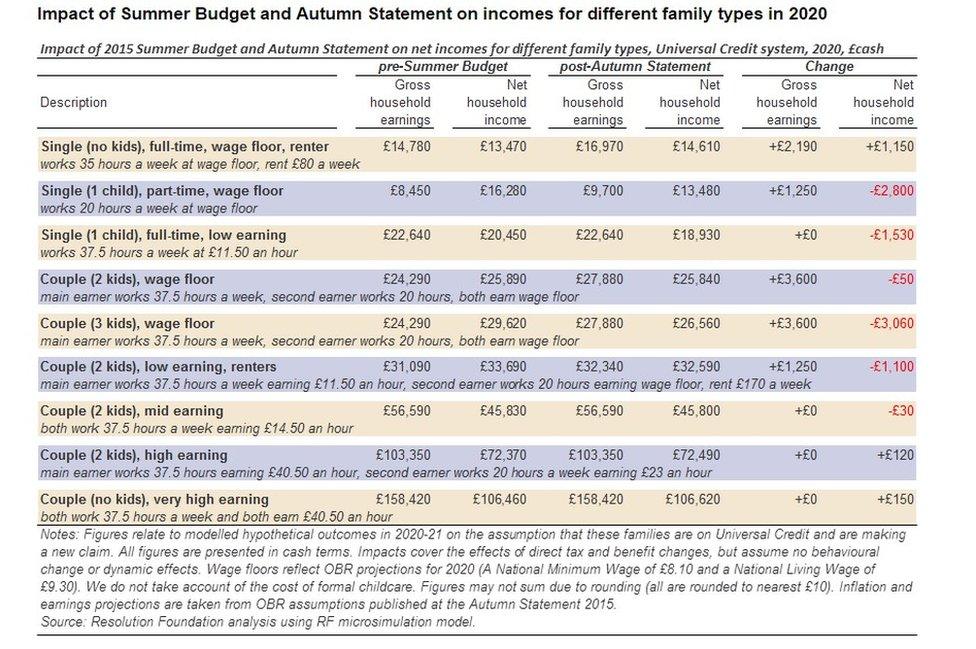

While existing claimants to Tax Credits won't lose in cash terms, once the welfare cuts work their way through, the foundation says similar working households in future on Universal Credit, a different system that will wrap in lots of different payments, will lose an average of £1,200 in 2020, rising to £1,300 for those with children.

For some families, they assert, the loss will be as much as £3,000. But the Treasury contends by the time this squeeze on welfare comes to fruition, higher wages and other changes should help the same kind of people.

The foundation, which is led by the former Labour adviser Torsten Bell, but chaired by the former Cabinet minister David Willetts, has also worked out that families at the bottom half will lose on average, £650 from all of the changes made in the Summer Budget and the Autumn Statement.

As the number crunching continues, the independent IFS hast just released their assessments of the U-turn. Paul Johnson, its boss says: "People will be protected in cash terms even as they roll off tax credits and on to Universal Credit. But the long term generosity of the welfare system will be cut just as much as was ever intended as new claimants will receive significantly lower benefits than they would have done before the July changes."

But, while many families stand to lose under that new system, others stand to gain. Johnson says: "Universal Credit will now involve 2.6 million working families being an average of £1,600 a year worse off than they would have been under the current system while 1.9 million will be £1,400 a year better off."

George Osborne bowed to the political pressure yesterday, and delighted some of his colleagues with the flourish of his reversal. Letters with grim news will no longer be landing on doormats before Christmas.

But this work shows clearly that in the longer term, the government, as it would say it was elected to do, is making very significant changes and reductions to spending on welfare, and for some of the kinds of lower income families who stood to lose from tax credit cuts, will still end up with significantly less support from the state.