Housing: Corbyn and Cameron clash over 'right-to-buy'

- Published

Labour leader Jeremy Corbyn accused David Cameron of presiding over a "very damaging housing crisis," at Prime Minister's Questions.

Mr Corbyn said the PM had failed to replace homes sold off under "right-to-buy", which is being extended to housing association tenants in England.

He said the government's action on housing was "simply not good enough".

Mr Cameron hit back by saying he would "increase the housing supply in the social sector".

He said two new homes would be built for each one sold off by local authorities in London, where shortages are the most acute.

But Mr Corbyn said measures in the Housing Bill would result in the loss of 180,000 affordable homes while only one in every eight council homes sold under "right-to-buy" had been replaced with a social home.

'High value homes'

He accused Mr Cameron of "overseeing a very damaging housing crisis, it's pricing out people from buying, it's not providing enough social housing, therefore many people are forced to rely on the private rented sector".

A committee of MPs earlier warned that the flagship Conservative policy of housing association tenants in England, the "right-to-buy" their homes, could reduce the stock of affordable housing.

Those taking advantage of it will get a discount, to be funded by the sale of "high value" council houses.

But the Commons communities and Local Government committee says this could leave councils short of cash to replace sold-off properties.

It predicts a "substantial surge" of demand to buy homes from the 1.3 million housing association tenants in England when the new scheme comes into effect, leading to the risk that the policy will "stall" for lack of funds.

It also raises concerns that a 1% rent cut for four years imposed on housing associations would threaten their ability to build new homes and provide other services to tenants.

The government says it wants to ensure "anybody who works hard and aspires to own their own home should have the opportunity to realise their dream".

But the Communities and Local Government committee says the funding model it is using, which will force councils to compensate housing associations with the money raised from council house sales, is "extremely questionable" and is effectively a "levy" on councils.

It says the scheme should be funded by central government and questions how ministers are going to meet their target of replacing every property sold off with a new one.

How will new scheme work?

Potential buyers must have been tenants for at least three years, the same as with council tenants.

The government says that means up to 1.3 million housing association tenants will be eligible in England. Around 500,000 housing association tenants are already eligible for some discounts. So the new scheme will extend rights to a further 800,000 tenants, and increase the discounts available.

Committee chairman Clive Betts said: "The fundamental success of this policy depends not just on whether more tenants come to own their home but on whether more homes are built.

"The government needs to set out in more detail how it will meet its target of at least one-for-one replacement of the sold homes, particularly given issues such as the availability of land, the capacity of the building industry and the uncertainty of income from council home sales."

The scheme, which is partly designed to reverse the steady decline in home ownership levels in recent years, is currently being piloted in Norfolk, Oxfordshire, Surrey, Merseyside and a number of London boroughs.

'Portable discounts'

It will be phased in across the rest of England in due course, although it is voluntary - housing associations are not being forced to adopt it. The government is updating interested tenants on its progress here, external.

Housing associations taking part in the scheme will be expected to sell properties to tenants interested in buying them at a discount of £103,900 in London and £77,900 elsewhere.

The government is committed to building 400,000 new affordable homes by 2020-21.

Under the the Housing Bill, external currently going through Parliament, local authorities make payments to government based on the value of their housing stock, on the expectation that more expensive properties would be disposed of when falling empty.

Ministers say that the sums raised from selling "high-value" council homes will pay not only for "right to buy" discounts, but also for the construction of cheaper social housing to replace them and a new £1bn Brownfield Regeneration Fund to support building on derelict land.

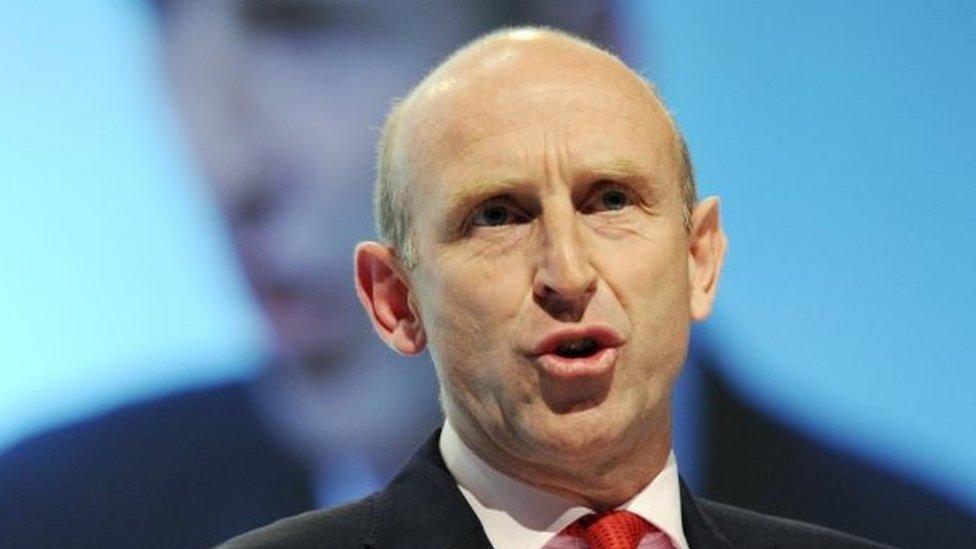

Labour's John Healey says the policy is a 'cash grab' by central government

But the committee's report quotes estimates from the Chartered Institute of Housing which suggest that the sale of high-value homes will raise only £1.2bn - £2.2bn a year of the £4.5bn needed.

The committee warns that the amount raised from the sale of vacant council homes will vary across the country, depending on property prices.

It warned that a large number of properties sold through the existing right-to-buy scheme had quickly been put on the rental market and that it might be necessary to limit the ability of housing association tenants to become private sector landlords.

It also called for safeguards to protect the amount of affordable housing in rural areas, including allowing housing associations to offer tenants "portable discounts" to purchase an alternative property to the one they live in where it was difficult to replace.

How easy is it to get a mortgage?

It's more difficult to get a mortgage on an ex-local authority or housing association flat than privately-owned equivalents. The comments of the surveyor are key and various things can cause problems:

Number of storeys - flats above the fifth (or sometimes seventh) storey are often rejected - not least because they're less popular with buyers and harder to sell on in the event of repossession

Block make-up - most lenders like blocks to be 75% or more owner-occupied and can be unhappy with flats above commercial premises

Access - a balcony or communal deck, especially common in post-war period blocks, can put lenders off

Materials - concrete constructions are often a no-no because of fears about so-called "concrete cancer" leading to possible crumbling and collapse

Management - if the property is in a good estate and/or a council with a good maintenance record, lenders are more likely to say yes. Fears about hefty services charges, for example, to install a new lift, can put them off

'Pet project'

The Department for Communities and Local Government said more details about the sale of vacant council houses would be set out in due course but the principle of using them to pay for new house building was the right one.

"There are billions of pounds locked up in local authority housing assets. It is only right that when they become vacant they are sold enabling the receipts to be reinvested in building new homes and supporting home ownership through right-to-buy," a spokesman said.

He added: "Anybody who works hard and aspires to own their own home should have the opportunity to realise their dream."

Labour housing spokesman John Healey said: "Government policies should be funded by government, not a cash-grab from councils forced to sell off their own housing to pay for right-to-buy discounts.

"Unless the legislation is changed, ministers will force cash-strapped councils to pay for their pet policy project."

The Labour government in Wales is planning to abolish right-to-buy entirely while in Scotland it will be phased out by August. A separate scheme exists in Northern Ireland.

- Published7 February 2016

- Published10 January 2016

- Published20 September 2015