Autumn Statement 2016 summary: Key points at-a-glance

- Published

- comments

Philip Hammond has delivered his first Autumn Statement as chancellor. These are the key points.

Public borrowing/deficit/spending

Government finances forecast to be £122bn worse off in the period until 2021 than forecast in March's Budget

Debt will rise from 84.2% of GDP last year to 87.3% this year, peaking at 90.2% in 2017-18

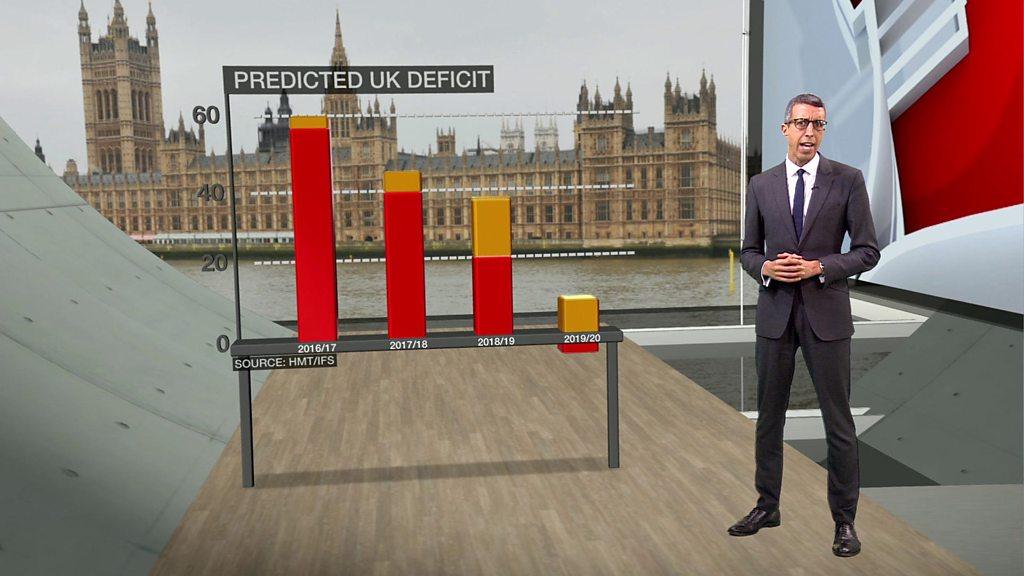

Office for Budget Responsibility (OBR) forecasts borrowing of £68.2bn this year, then £59bn in 2017-18, £46.5bn in 2018-19, £21.9bn in 2019-20 and £20.7bn in 2020-21

Public spending this year to be 40% of GDP - down from 45% in 2010

Departmental spending plans set out in 2015 Spending Review to remain in place

Government will meet commitments to protect budgets for key public services, defence, overseas aid and the pension "triple lock" until the end of this Parliament

The state of the economy

OBR growth forecast upgraded to 2.1% in 2016 - from 2.0% - then downgraded to 1.4% in 2017, from 2.2%

Forecast growth of 1.7% in 2018, 2.1% in 2019 and 2020 and 2% in 2021.

Government no longer seeking a budget surplus in 2019-20 - committed to returning public finances to balance "as soon as practicable"

Taxation/pay

Income tax threshold to be raised to £11,500 in April, from £11,000 now

Higher rate income tax threshold to rise to £50,000 by the end of the Parliament

Tax savings on salary sacrifice and benefits in kind to be stopped, with exceptions for ultra-low emission cars, pensions, childcare and cycling

National Living Wage to rise from £7.20 an hour to £7.50 from April next year

Employee and employer National Insurance thresholds to be equalised at £157 per week from April 2017

Insurance premium tax to rise from 10% to 12% next June

Welfare

Universal Credit taper rate to be cut from 65% to 63% from April at a cost of £700m

No plans for further welfare savings in this Parliament

Housing

Ban on upfront fees charged by letting agents in England "as soon as possible"

£2.3bn housing infrastructure fund to help provide 100,000 new homes in high-demand areas

£1.4bn to deliver 40,000 extra affordable homes

Fuel

Fuel duty rise cancelled for seventh year in succession - at a cost of £850m, saving average car driver £130 and van driver £350 a year

For the oil and gas sector, the Carbon Price Support capped until 2020 and business rates reductions worth £6.7bn

Transport/infrastructure/regions

£1.1bn extra investment in English local transport networks

£220m to reduce traffic pinch points

£23bn to be spent on innovation and infrastructure over five years

£2bn per year by 2020 for research and development funding

£110m for East West Rail and commitment to deliver Oxford to Cambridge Expressway

More than £1bn for digital infrastructure and 100% business rates relief on new fibre infrastructure

£1.8bn from Local Growth Fund to English regions

Rural Rate Relief to be increased to 100%, "giving small businesses a tax break worth up to £2,900"

£7.6m for repairs to Wentworth Woodhouse, near Rotherham, said to be inspiration for Pemberley in Jane Austen's Pride and Prejudice

Business

Doubling UK Export Finance capacity

£400m into venture capital funds through the British Business Bank to unlock £1bn in finance for growing firms

Other

Funding for 2,500 more prison officers

Reforms to compensation for whiplash to cut the cost of motor insurance

Promise to abolish Autumn Statement, with Budgets happening in the autumn from next year, along with "Spring Statement" from 2018

- Published23 November 2016

- Published23 November 2016

- Published22 November 2016