Reality Check: How much does pensions triple-lock cost?

- Published

The claim: Pensioners would be £872 worse off if the triple-lock was taken away. The triple-lock is a commitment to raise the basic state pension by average earnings, inflation or 2.5%, whichever is higher.

Reality Check verdict: In the long-term, pensioners would be worse off without the triple-lock. How much worse off would depend on what replaces it. Ian Blackford's figure is a forecast of what would happen if the state pension was only increased in line with inflation predictions for the next five years. He appears to have misspoken, because the research actually said that pensioners would lose £817 over five years.

Speaking at Prime Minister's Questions, Theresa May refused to say whether the Conservatives will keep the same protections for the state pension if they win the general election.

Responding to a question from Angus Robertson, the SNP's leader in Westminster, she pledged that pensioners' incomes would continue to rise, but would not specify by how much.

The government is currently committed to maintaining the pension triple-lock until 2020, which means it will raise the basic state pension by average earnings, inflation or 2.5%, whichever is higher.

Labour, the Liberal Democrats and the SNP are all committed to maintaining the triple-lock.

But the Work and Pensions Committee has said it should be scrapped on the grounds that it is "unsustainable" and "unfair" on younger families.

It suggested that pensions should rise in line with earnings and be protected against inflation being higher than earnings, but with no minimum annual increase.

John Cridland, who published a report on the future of state pensions, external last month, suggested that the triple-lock would also eventually need to be abandoned in favour of an earnings link.

In the long-term, the triple-lock is a big issue, with the number of people of pension age per person of working age forecast by the Office for National Statistics (ONS) to rise considerably over the next 50 years.

Speaking on BBC Newsnight, Mr Blackford cited research from the House of Commons Library, which found that "over a five-year period, pensioners would be £872 worse off if the triple lock was taken away".

Giving a bit more detail, the library was asked to take Office for Budget Responsibility forecasts for the next five years of inflation and average earnings figures.

It then compared what would happen to pensions under different scenarios.

It turned out that protecting it in line with with earnings would make almost no difference, because average earnings are expected to be more than 2.5% throughout the period.

Protecting only in line with inflation would cost a total of £642 over five years for a pensioner on the basic state pension and £817 over five years for someone on the new state pension.

Mr Blackford presumably remembered that figure wrongly when he said it would cost £872.

Clearly these figures are based on forecasts for what will happen in the future, which are uncertain. An alternative is to look at how much the triple-lock has cost in the past as the Institute for Fiscal Studies (IFS) has done., external

The triple-lock makes a particularly big difference in periods of relatively low earnings growth and low inflation as the UK has experienced recently.

It found that the triple-lock had cost about an extra £6bn a year compared with only protecting with earnings and £4bn a year compared with adjusting in line with inflation.

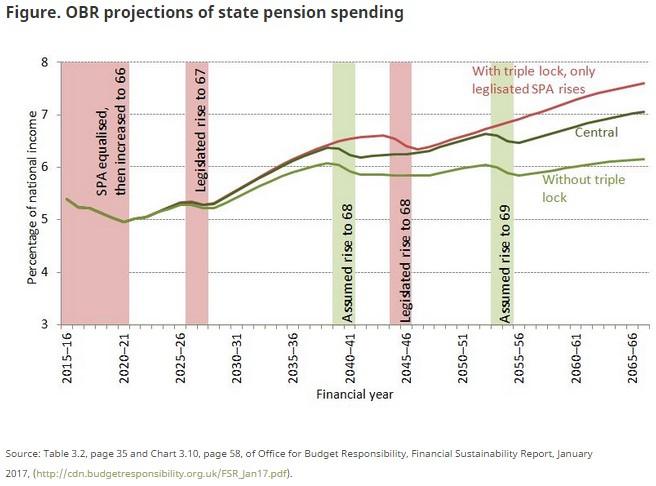

The IFS made this chart showing the difference in the percentage of national income spent on the state pension with or without the triple-lock, also based on OBR forecasts.

The IFS suggested that the government should decide what proportion of earnings it wants the state pension to be and then stick to that, rather than arbitrarily increasing it gradually through the triple-lock.

What happens to the triple-lock is highly significant because it has made such a difference in incomes for pensioners compared with workers.

In-work benefits are protected less generously than state pensions.

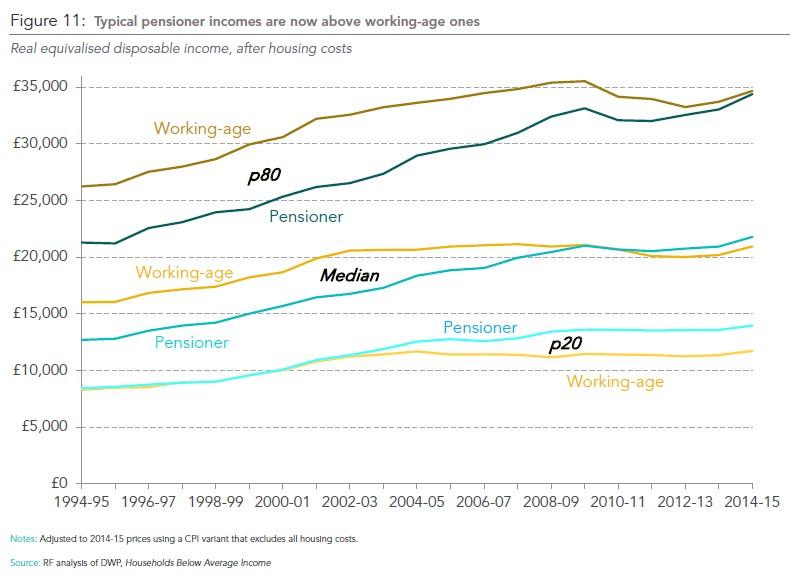

The Resolution Foundation brought out research recently suggesting that pensioner households on average are better off than working households after housing costs have been taken into account.

Taking income after housing costs makes a huge difference because pensioner households are more likely to own their own homes and to have relatively small or paid-off mortgages.

This chart from the Resolution Foundation gives income after housing costs for the median pensioner and working household as well as a richer one and a poorer one.

Former pensions minister Baroness Altmann told Newsnight that the triple-lock was particularly unfair on younger families because it was putting pressure on the government to keep raising the pension age to keep pension costs down, so the time when they could claim their own pensions was being delayed.

Among the options for replacing the triple-lock are:

A double-lock, raising state pensions by the higher of earnings or inflation

A single-lock based on either earnings or inflation

A lock based on earnings, which rises by inflation if inflation is higher than earnings, but then does not enjoy the full increases in earnings in future years to return the state pension to the same proportion of earnings it had previously.

- Published26 April 2017

- Published24 March 2017

- Published13 February 2017