Paradise Papers: Lord Ashcroft 'ignored rules' on offshore trust

- Published

Watch Lord Ashcroft try to avoid Richard Bilton’s questions about his offshore trust

Tory donor Lord Ashcroft ignored rules around the management of his offshore investments, leaked documents suggest.

The peer gave assets worth hundreds of millions of dollars to the Punta Gorda Trust in Bermuda in 2000.

The Paradise Papers suggests he sometimes made decisions without consulting trust officials. Such action could see the trust challenged by HMRC.

Lord Ashcroft said he would not respond because of the way he has been treated by BBC Panorama in the past.

Panorama approached Lord Ashcroft during last month's Conservative Party conference in Manchester but he declined to answer any questions about the trust.

The 71-year-old former party deputy chairman has given millions of pounds to the Tories.

He fell out with David Cameron in 2010 and later he co-authored a controversial unauthorised biography of the then prime minister but remains involved in UK politics through his polling and publishing interests.

Journalist Peter Oborne says Lord Ashcroft has been a "hugely significant figure" in the Conservative Party over the last 20 years.

He said: "Lord Ashcroft has been one of the most significant donors to the... party. But it's not just... that he's been a giver of money, he's also been very important organisationally. He's involved himself in the internal politics."

Other documents in the Paradise Papers show Lord Ashcroft has secretly remained non-domiciled in the UK for tax purposes.

'Inadequate supervision'

The structure of a trust involves one entity legally entrusting a second to look after assets for a third, essentially removing ownership for tax purposes.

Wealthy people can legally avoid paying tax on assets that they have given to a trust because they can tell the authorities they no longer own or control the assets in them.

But for a trust to work as a tax break, decisions about its assets have to be taken independently by the trustees.

A series of leaked emails between trustees and Lord Ashcroft's advisers suggest he was was willing to ignore the rules.

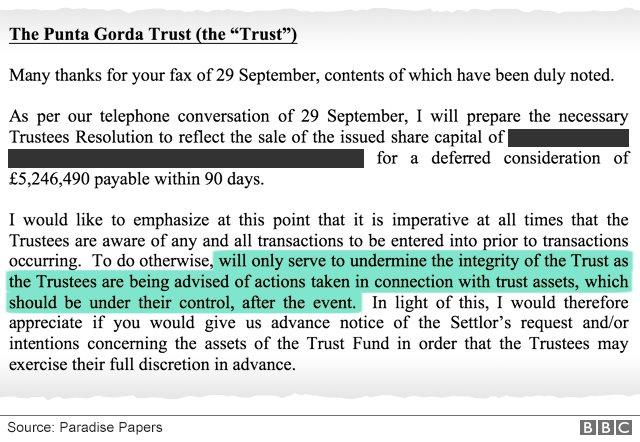

Source document

Despite the warning, Lord Ashcroft appears to have continued to make decisions about the Trust's assets.

In October 2000, one of the trustees says: "I would like to emphasize at this point that it is imperative at all times that the Trustees are aware of any and all transactions to be entered into prior to transactions occurring.

"To do otherwise, will only serve to undermine the integrity of the Trust as the Trustees are being advised of actions taken in connection with trust assets, which should be under their control, after the event."

A review of the trust in 2009, discovered that significant payments out had been made that had not been properly recorded.

In an internal email, a lawyer representing the trust says: "There have been very large sums of money involved and I am very concerned that there has been inadequate supervision of both transactions and distributions... to put it bluntly we seem to be told nothing whereas we carry the responsibility of acting as trustee."

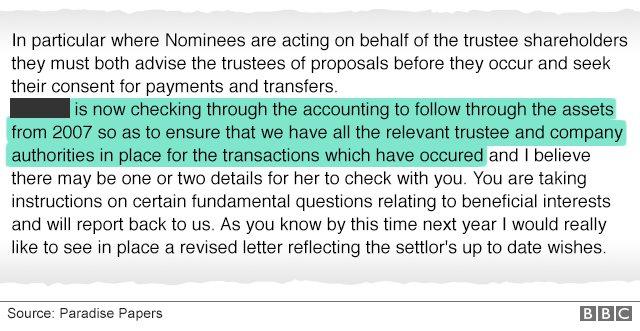

Source document

Paperwork then appears to have been put in place retrospectively "to ensure that we have all the relevant trustee and company authorities in place for the transactions which have occured [sic]".

'Red flag'

Trust experts say anybody who puts their money into a trust could face a challenge by tax authorities if it was felt rules had been abused.

Lord Ashcroft's trust was based in Bermuda

This could include a challenge from HM Revenue & Customs if it was to take the view an overseas trust had been controlled from the UK.

Nicholas Shaxson, the author of Treasure Islands, an expose of the workings of tax havens, told Panorama: "On the evidence I have seen, it looks like something that is abusive behaviour and an abusive structure. If the trustees are worried, the trustees are expressing alarm about that, that's a clear red flag."

Professor Brooke Harrington, the author of Capital Without Borders, said: "It's important that trustees be independent because the whole concept of a trust is that a settlor gives over legal ownership of an asset to the trustee.

"That's why you get these tax benefits and other legal benefits from the trust structure."

Lord Ashcroft's spokesman, Alan Kilkenny, is quoted in the Guardian newspaper as saying the peer had never engaged in tax evasion, abusive tax avoidance or tax avoidance using artificial structures.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)