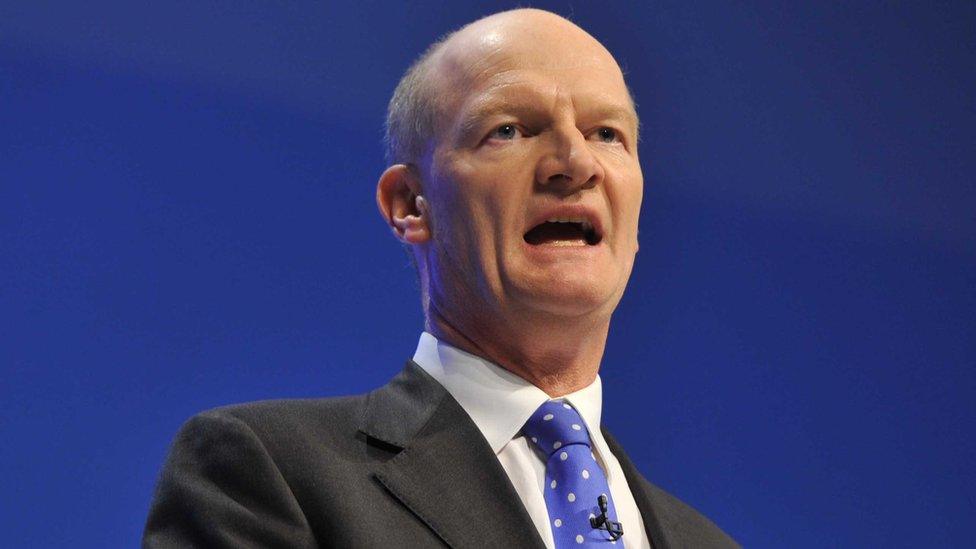

Tax baby boomers' wealth, David Willetts says

- Published

A former Conservative minister says his baby boomer generation have to "reach into our own pockets" to fund a spiralling bill for public services.

Lord Willetts said the alternative was future generations facing an extra 15p on the basic rate of income tax.

He called for council tax and inheritance tax reforms, adding that "the age of tax cuts is over".

The ex-higher education minister is now executive chairman of the Resolution Foundation think tank.

In a speech in London, he said that spending on health, education and social security would be up £20bn by 2030 and up £60bn by 2040.

"The time has come when we boomers are going to have reach into our own pockets," he said.

"The alternative could be an extra 15p on the basic rate of tax, paid largely by our kids.

"Is that kind of tax really the legacy we - a generation who own half the nation's wealth - want to bequeath our children and grandchildren?"

The Tory peer said baby boomers - the generation born in the 15 years or so after the Second World War - had benefited from the welfare state and the house price boom, with tax cuts seen as "the normal state of British politics".

"We have done so well compared with the younger generation in so many ways that we cannot just turn to them to pay for our health and social care," he said, adding that a "tipping point" had been reached because "the boomers are growing old".

"Politics is going to be very different as the baby boomers age. The age of tax cuts is over."

'Widely abused'

Lord Willetts said people's property was an obvious source of tax revenue, but added that the current council tax system was "just about the most regressive property tax you could have", with a disproportionate effect on people in lower-value homes.

He also said the inheritance tax system was "poorly designed, widely abused and under utilised" and should be looked at.

"I know these taxes are unpopular. But the alternatives are far worse," he said.

"Unless we act, at some point we will face a choice between changing our approach to taxation, or cutting access to the NHS and letting social care get into an even deeper crisis," he added.

"We can't delay that debate any longer."