States, debt, nationalisation and money

- Published

Imagine you got a bargain. You bought a £1m house for £100,000. And imagine you get a great deal on the mortgage. It's only a tiny portion of your disposable income. Anyone hearing that would think you'd done well.

Anyone except an official from a finance ministry.

All around the world, governments use a particular way of thinking about debt. If they applied it to our story, they would see the £100,000 debt and the flow of payments to service the mortgage.

But they would not notice you had a £1m asset and were living in a cavernous house rather than a tiny flat.

That is the consequence of a focus on a particular sort of net debt and the deficit. Governments have a way of thinking that focuses on cash-flows and liabilities.

Debts and assets

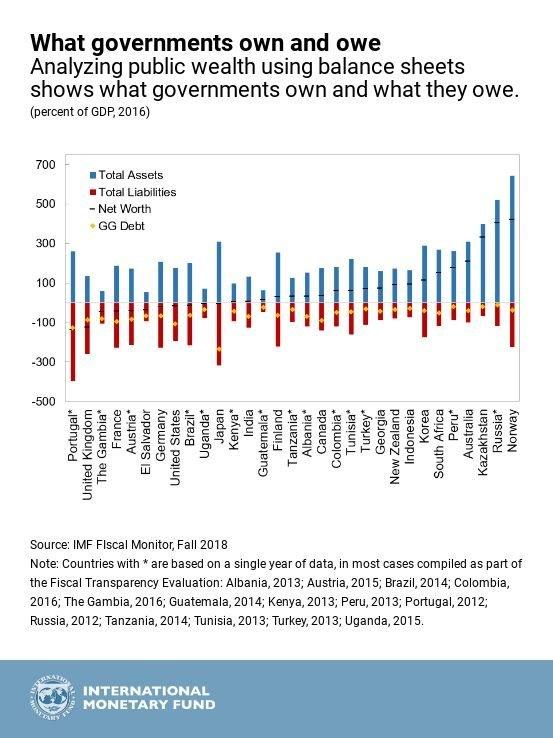

But a new IMF report,, external released today, has pointed out that this focus - which misses the benefit of non-financial assets - can be extremely misleading.

The Japanese state, for example, looks like a global laggard if you just look at debt - it has debt three times its national output.

But because it owns a lot of stuff, the aggregate fiscal position is a lot better. It has a big mortgage. They also have a lot to show for it.

Conversely, Germany has little debt, but also little stuff to offset it. (Norway, which has a huge fund of oil money salted away, is in clover.)

Britain's debt looks like a bigger problem when you consider that our government owns relatively little to offset it. Of the states they analysed, only Portugal has a worse overall position, relative to the size of their economy.

This is not the only thing worth considering: Russia's apparent solvency on this measure is a rather rosy way of presenting its current state.

And there are risks to states owning a lot of stuff: if our state still owned Pickfords removals, would you trust it not to make regulation work better for them than other removers? They could end up dampening competition, which can lead to poor outcomes for consumers.

And the state can be a bad owner: if it is politicians who decide on what gets investment, politics can make it difficult to get money into things. Our railways, under nationalisation, were not renowned for being a growing network crawling with slick new locomotives.

Slightly odd accounting

Our Treasury has tended to take the view that it should seek to minimise the complexity of its balance sheet. It dislikes holding onto assets that it could sell - even if that means selling things at a steep discount, For example, it loses money when it sells tranches of the student loan book.

But this is rarely recognised: the slightly odd way we do public sector accounting means that even if I take a £100bn asset and sell it for £10bn, it shows up in the accounts as a £10bn windfall. The real effect - a net loss of £90bn - is disguised.

Conversely, if the state buys up private assets - as Labour has proposed - then our official national accounts will turn blood-red because we will need to issue debt to buy out the current owners. But that is because we ignore the assets: so long as the Treasury pays a fair price we will really be exchanging, say, £100bn of government debt for £100bn of shares.

There are strange consequences to our aversion to holding public assets.

The government is keen, for example, for hospitals to shed extra land they have nearby. Sell it and use the money to build, they say. This is also a bet that we will not be desperate for land adjacent to large hospitals for expansion in the next few decades. A bold punt - and one we took without much thought for decades ahead.

Governments could learn a lot from what people ask when they hear from friends who are first-time buyers: they are more interested in the house than the mortgage.

You can watch Newsnight on BBC 2 weekdays 22:30 or on Iplayer. Subscribe to the programme on YouTube, external or follow them on Twitter, external.

- Published10 October 2018

- Published10 October 2018