John Major: Universal credit could repeat poll tax problems

- Published

Sir John Major warns the Conservatives over universal credit

Benefit changes coming into force next year have been compared to the poll tax - the policy that helped end Margaret Thatcher's time as prime minister.

Mrs Thatcher's successor as PM, Sir John Major, said universal credit was being rushed in without enough funding.

About 3.2 million households will be worse off by an average of about £50 a week, according to the Resolution Foundation think-tank., external

Prime Minister Theresa May has promised financial help for those affected.

But the compensation system is not in place yet - and the Resolution Foundation said less than 20% of affected families are expected to receive support from it.

People whose circumstances change, who make a brand new claim, or who come off benefits and then go back on them, will not be protected.

The switch to universal credit will also create winners, the Resolution Foundation says, with 1.1 million households an average of £53 a week better off.

But, overall, working families will be worse off than under the current benefit system, with the biggest losers likely to be people with children who are currently in receipt of tax credits, analysts say.

Veteran anti-poverty campaigner Frank Field said families in his Birkenhead constituency were being forced into "destitution" by the introduction of universal credit.

He urged the government to pause the rollout to fix the problems with it and ensure extra money was pumped into the system so that "people don't face up to a £2,000 a year wipe out of their meagre living standards".

The chair of the commons work and pensions committee said Theresa May faced a choice between "going down the road Mrs Thatcher faced" over the poll tax or acting now to fix the new benefit.

The poll tax - whose official name was the Community Charge - was supposed to make local council finance fairer and more accountable by getting all adults to have to pay it, rather than charging a tax per property.

However it proved unpopular, with many refusing to pay it, riots in London and a rebellion in the Conservative Party which contributed to the fall of Margaret Thatcher as prime minister.

Universal credit is a new benefit for working-age people that consolidates into one monthly payment six separate benefits:

income support

income-based jobseeker's allowance

income-related employment and support allowance

housing benefit

child tax credit

working tax credit

Read more: What is universal credit?

Currently being phased in for different types of claimant across the UK, it is aimed at making the system simpler and more flexible so people who are able to work are rewarded for doing so.

The plan is to move all existing claimants on to universal credit next year.

Thousands took to the streets to protest against the poll tax

The Conservatives note that the numbers of people in work has been increasing, but universal credit has been criticised for running over budget and causing delays to people's payments.

On Wednesday, another former prime minister, Labour's Gordon Brown, also attacked the scheme, calling for it to be put on hold.

The current Labour leadership has gone further and vowed to scrap it.

Speaking on the BBC's Political Thinking podcast, Sir John - who was PM from 1990 to 1997 - said the theory behind the reform was "impeccable" and "entirely logical" - but he warned against it being introduced "too soon and in the wrong circumstances".

He said people who faced losing out in the short term had to be protected, "or you run into the sort of problems the Conservative Party ran into with the poll tax in the late 1980s".

Sir John, who scrapped the poll tax when he replaced Mrs Thatcher in Downing Street, said he was not predicting riots as a result of universal credit.

But, referring to reports that millions of households, external faced losing £2,400 a year, he said: "I am saying that if you have people who have that degree of loss, that is not something that the majority of the British population would think of as fair.

"And if people think you have to remove yourself from fairness, then you are in deep political trouble."

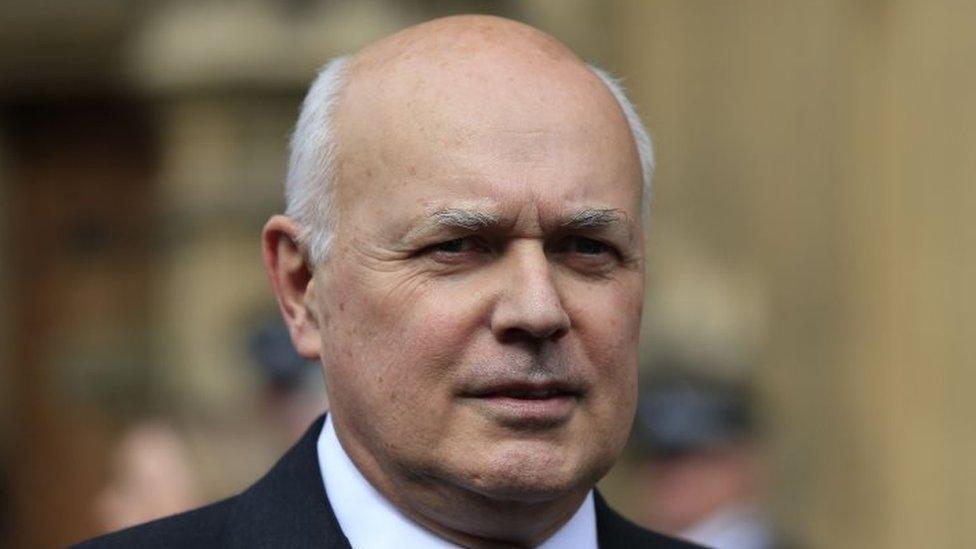

Iain Duncan Smith: £2bn was 'taken out of universal credit'

Downing Street has said no-one moving on to universal credit would lose out and that the nationwide rollout next year would proceed gradually, in order to identify difficulties.

But the man who designed universal credit, Iain Duncan Smith, is calling on Philip Hammond to scrap promised income tax cuts for low-paid workers and put the money into universal credit instead.

Universal credit is meant to make work pay by only steadily removing benefits as people gain more hours at work, rather than having cut-off points beyond which the amount of hours worked is not worth it because of a sudden loss of benefits.

But it was made significantly less generous by former Chancellor George Osborne in his 2015 Budget, who raided it to pay for an increase in the personal allowance, the point at which people start paying income tax.

It is these changes that are due to come into effect at the start of next year for millions of people on working age benefits.

When Mr Duncan Smith quit as work and pension secretary he cited Mr Osborne's decision, which he claimed robbed universal credit of its original purpose.

The Conservatives promised to raise the personal allowance to £12,500 at last year's general election.

Mr Duncan Smith told BBC Radio 4's Today programme on Thursday the government should ditch that promise and "direct the money back into universal credit exactly as it was originally planned to be rolled out".

Asked how much more needed to go into the system, he replied: "The reality is the £2bn that was taken out."