Cost of living: What Tory MPs want from Rishi Sunak

- Published

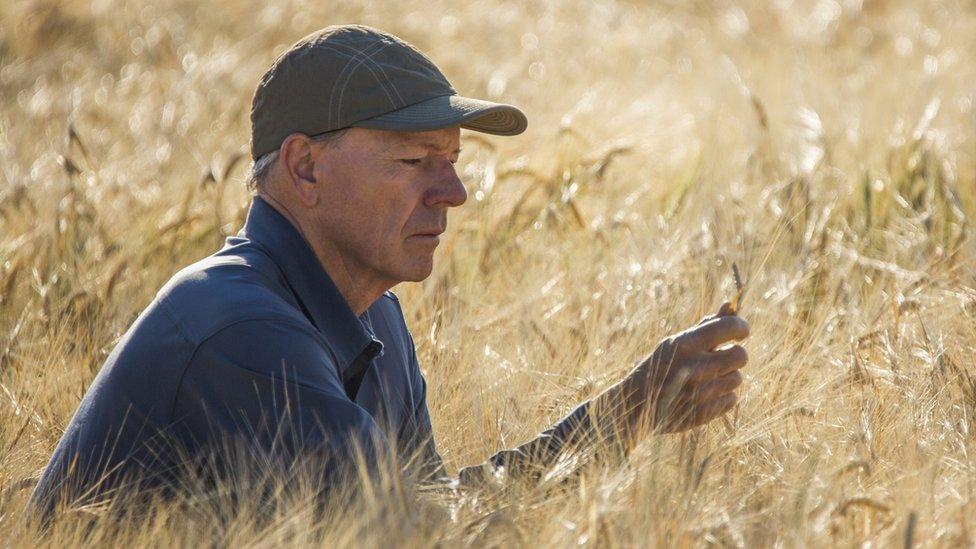

Rishi Sunak is set to make a statement against a backdrop of rising prices

Conservative MPs have been breaking ranks with the government to demand action on the rising cost of living as the global economy reels from shocks including the war in Ukraine.

They have been appealing to Chancellor Rishi Sunak ahead of his spring economic statement on 23 March.

The BBC understands Mr Sunak is considering options to ease the squeeze on budgets before a rise in energy bills and a tax hike from April.

As MPs pressure him to act, we assess some of their proposals, and their likelihood of being adopted.

Relief from green taxes

A record rise in global gas prices, driven by high demand and tight supplies, has sent energy costs skyrocketing.

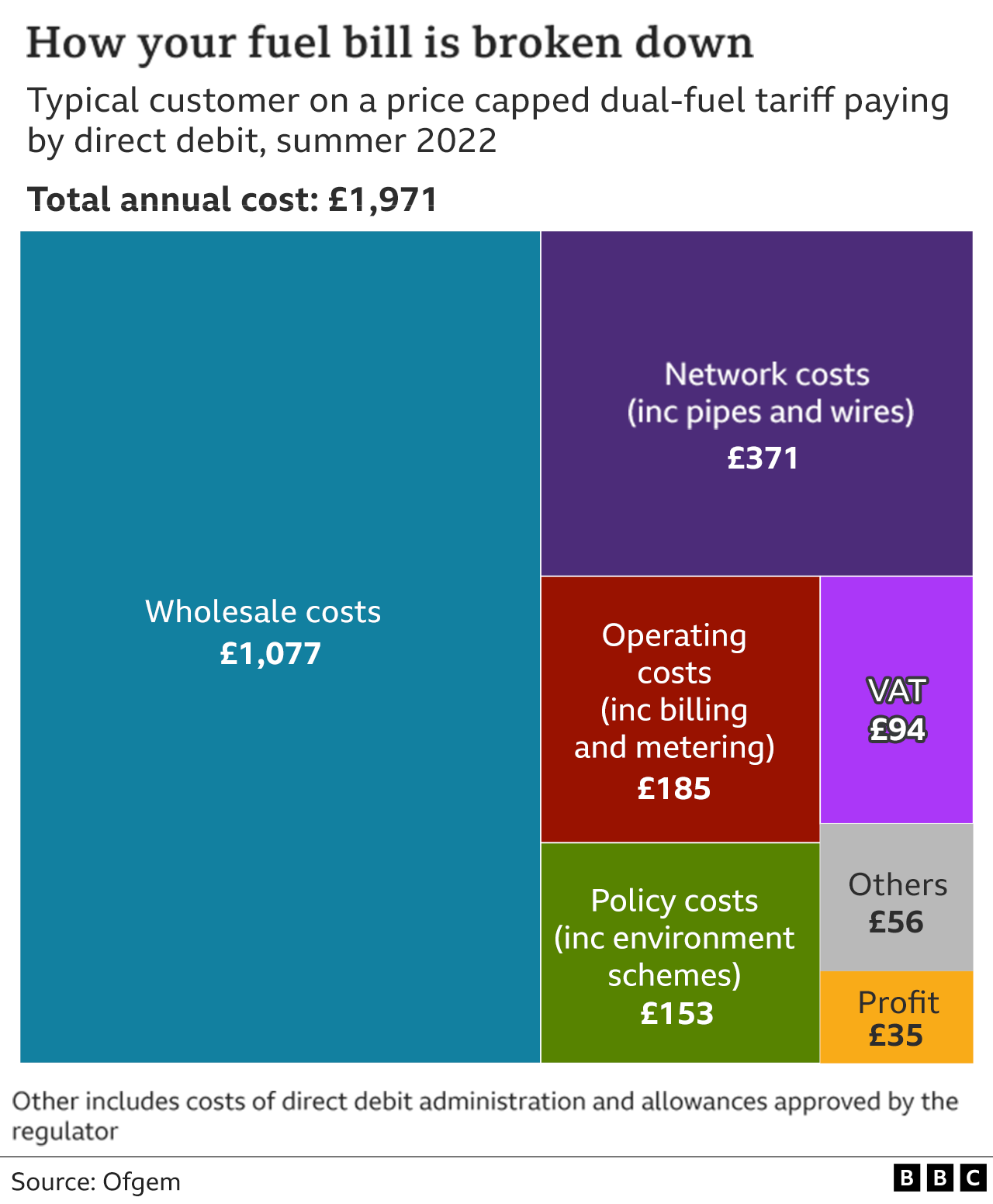

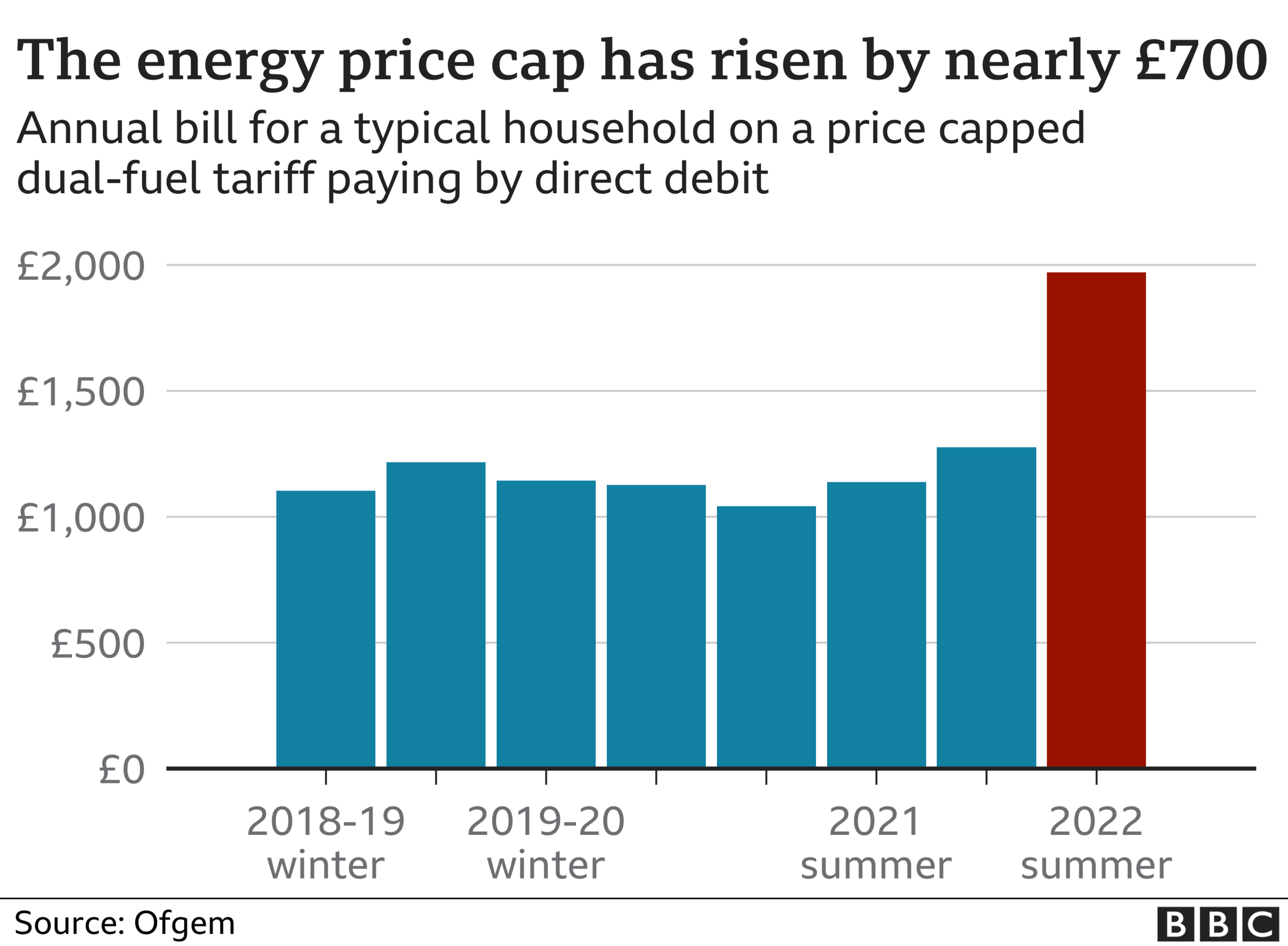

One consequence is a new UK price cap, which will increase energy bills by about £700 a year from 1 April.

Energy regulator Ofgem estimates, external about 8% of those bills will go towards environmental taxes, which fund home insulation and renewable power.

A campaign to scrap these so-called green levies is being led by Craig Mackinlay, the chairman of the Net Zero Scrutiny Group, which is urging the government to rethink its climate policies.

Keeping green levies, Mr Mackinlay told the BBC, would be "politically very bad" because voters will "think the government isn't really on my side".

How likely?

Government insiders have suggested this was "not a go-er".

The money raised from green levies is tied up in contracts to curb carbon emissions in partnership with the private sector. One government source argued that the taxpayer would have to cover the costs of these contracts if they were cancelled.

While sceptics have pointed to Germany, whose coalition of Greens, Social Democrats and liberals has moved to scrap a renewables levy, government sources stress they are still committed to the UK's net-zero target.

Fuel duty cut

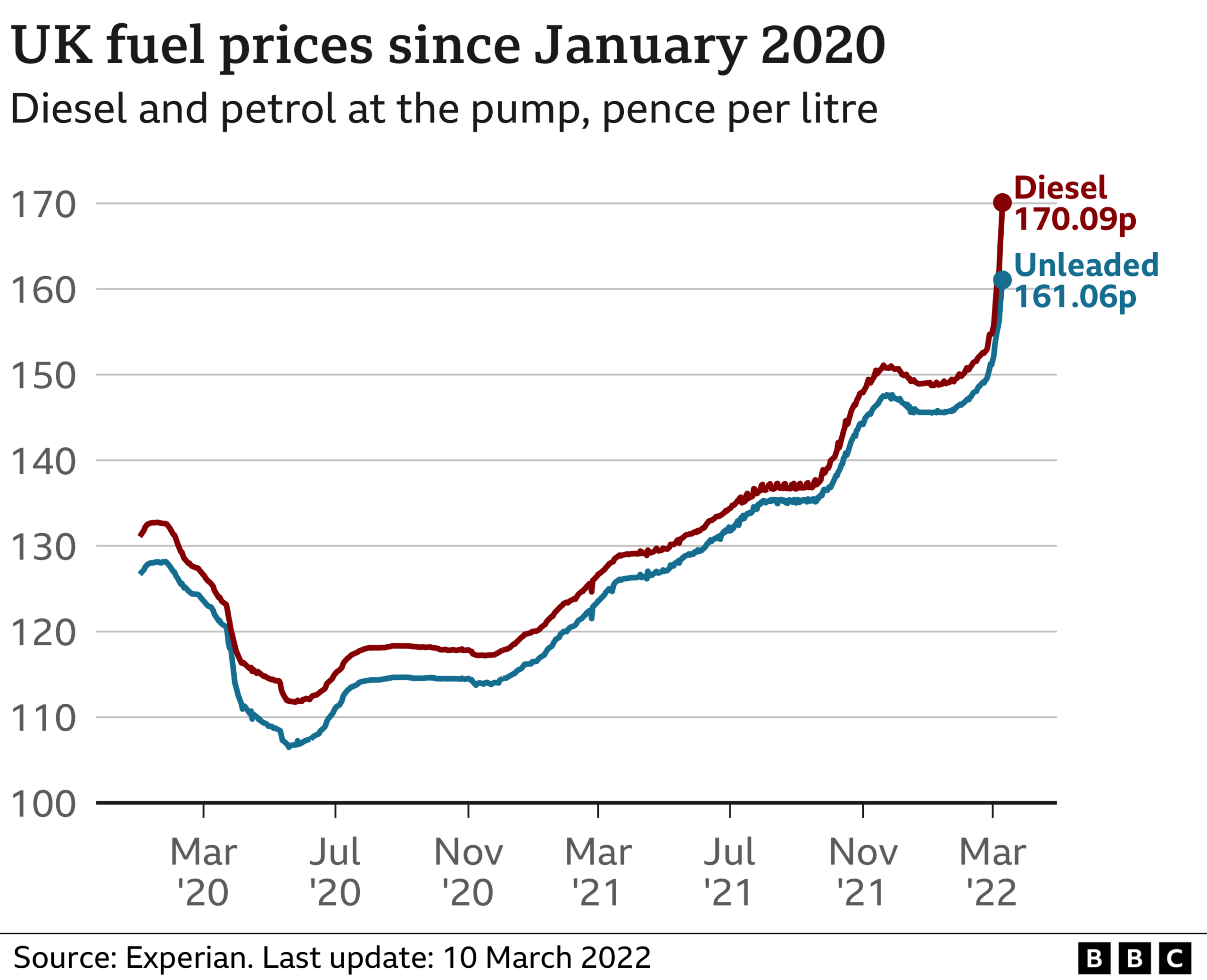

Fuel prices have soared to record highs since the invasion of Ukraine, leaving motorists astonished by ever-high prices at petrol pumps.

On 1 March, the average price for a litre of unleaded petrol was 151.67p - compared to 123.58 on that date a year earlier, according to motoring services firm RAC, external.

"A year's worth of petrol price rises in six days"

This dramatic increase "is not hurtling down the track, it is here already", Tory MP and fuel campaigner Robert Halfon has warned.

He said surging fuel costs would have consequences for businesses, public services and the increasing price of everyday items, known as inflation.

Mr Halfon has urged the chancellor to:

Cut fuel duty, which currently stands at 57.95p per litre and has been frozen by Conservative chancellors for years

Introduce a Pumpwatch monitor to "protect motorists from the rapaciousness of big oil companies that jack up the price" when global demand is high

How likely?

The murmurings about increasing pump prices are getting louder among MPs - and ministers are noticing.

One government source claimed it was now being raised more with them than energy bills. The transport industry has also lobbied for a cut to fuel duty.

The official line from the Treasury is that all taxes are kept under review, and the existing 2022-23 fuel duty freeze saves consumers "almost £8bn over the next five years".

But some government insiders admit the arguments against a cut are less clear and they are watching how prices develop over the year closely.

Tax policy will not be updated in the chancellor's spring statement, but the door to further intervention on fuel prices isn't necessarily completely shut.

Universal credit top-up

For almost six million people claiming universal credit, a £20 top-up to help families through the pandemic was withdrawn last October.

The cut was an emotive issue that, according to one think tank, external, would determine whether 500,000 more people fell into poverty or not.

More on the cost of living:

Before the top-up was abolished, some Tory MPs joined Labour in calling for the extra £20 to be made permanent. Among them was Peter Aldous who, in August last year, told the BBC the cut would "cause an awful lot of problems to a lot of people".

More recently, Conservative peer Lord Forsyth said the uplift should be restored "in the name of humanity".

How likely?

The government's response to these calls was to cut the universal credit taper rate, which meant people on benefits could keep more of what they earn.

This appeased some vocal Tory MP critics at the time, some of whom felt this struck a balance between incentivising work and making benefits more generous.

Facing fresh calls to pull this lever further, government insiders have stressed they are conscious of the financial squeeze on those on middle incomes, as well as the poorest households.

That was the thinking behind the recently announced energy bills rebate, which about 80% of households will receive.

Scrap National Insurance hike?

Mr Sunak has attempted to position himself as a "tax-cutting" Conservative in the mould of his political idol, former Prime Minister Margaret Thatcher.

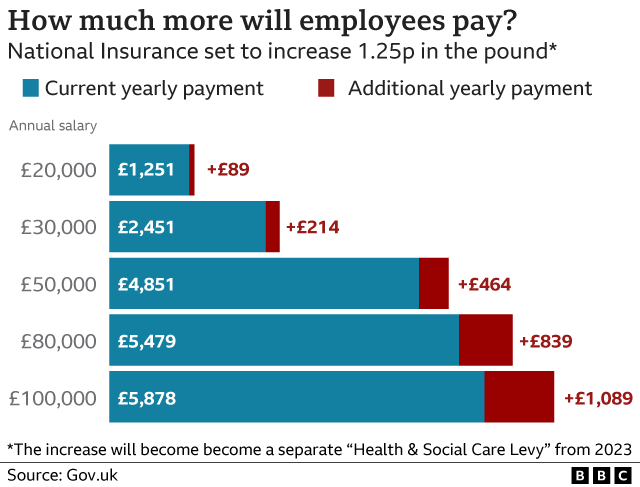

But his Thatcherite credentials have been under scrutiny following a £12bn hike in National Insurance (NI).

In April, the policy will see NI contributions rise by 1.25% to fund social care and health services in England.

Tory critics who hold seats in Labour heartlands in northern England have said the increase will have a disproportionate impact on the lower-paid.

The first £12,570 of their income should be exempt from NI, the Northern Research Group of Tory MPs - led by Jake Berry - has suggested.

Several veteran Conservative MPs have been more vociferous in their opposition to the tax.

One, former Conservative leader Sir Iain Duncan Smith, has said the increase would slow down the economy, while another David Davis, has told the BBC the tax would be "a disincentive to work".

How likely?

While nothing can ever be ruled out in politics, we can be pretty certain this is not going to happen. Both the prime minister and chancellor have been definitive that they will not backtrack on this policy, and government sources say it is "off the table".

Freeze energy price cap

As the Bank of England warned of the biggest fall in living standards in decades, the chancellor announced a plan he said would "take the sting" out of higher bills.

In February, Sunak promised a £150 council tax rebate for properties in bands A to D, and a £200 cut to energy bills in October, to be repaid over five years.

Tory MP Stephen McPartland told the BBC the schemes were "obviously a step forward as it is some support, but we have to find a way to insulate families from these huge costs".

One solution, he said, would involve keeping the energy price cap at the current level. This could be done by offering loans worth £25bn to energy firms.

These loans would "smooth out the volatility" in energy prices and allow them to spread the rise in bills over time.

The BBC understands Mr McPartland has raised this idea with cabinet ministers.

How likely?

No 10 asked the business secretary to come forward with a series of proposals to ease energy bills.

These included changes to the chancellor's rebate scheme, such as doubling the loan, delaying repayments or making it more generous for poorer households.

But Treasury sources have rejected calls to tweak the existing scheme. While some ministers have been more receptive to Mr McPartland's idea of a "credit facility", government sources have steered away from this.

A windfall tax on oil and gas firms

On the opposition benches, one idea that has been floated is a one-off tax on profits made by oil and gas firms.

Dubbed a "windfall tax", the measure has been backed in various forms by Labour, the Liberal Democrats and some Tory MPs.

Labour's version involves increasing corporation tax by 10 percentage points for North Sea oil and gas producers from April.

This, Labour says, would raise £1.2bn, which could be used to help households struggling to cope with the 54% rise in energy bills from April.

Labour would do this by:

Getting rid of VAT on domestic fuel bills (currently 5%)

Increasing the warm homes discount from £140 to £400

Extend this discount to nine million families, up from the 2.2 million that currently receive it

Some Tories support slashing VAT on energy bills, and making the warm homes discount more generous.

Lib Dems meanwhile have backed the latter, and also demanded an emergency 2.5% cut to VAT, which they say would "put an average of £600 back into the pockets of UK families".

How likely?

The Treasury is not keen on cutting VAT on energy bills because it is untargeted - and believes it would only help people out to the tune of £7 when the energy price gap goes up in April.

One government source said it would be "politically" difficult to backtrack on this given it has already been publicly ruled out.

Its proponents argue VAT raised from rising fuel or energy prices could be put towards cutting this, but a Treasury spokesperson said there "has been no 'VAT windfall' and receipts this year are forecasted to be £2 billion below the amount collected directly before the pandemic".

Ministers also are not keen on a windfall tax for energy firms because they fear it would "deter investment" in North Sea energy production at a time when the government is trying to source more energy domestically.

Related topics

- Published11 March 2022

- Published10 March 2022

- Published9 March 2022