Senior MP urges ministers to get a grip of £150 tax rebates

- Published

- comments

Ministers need to "get a grip" of the system giving homes in England a £150 council tax rebate, the chair of the levelling up select committee has said.

The scheme is due to come into force next month, but Clive Betts expressed concern people would be "unable to access help quickly and smoothly".

Councils have also warned payments could be delayed to those who don't pay their tax by direct debit.

Those who pay by direct debt will get an automatic rebate.

However, people who do not will be contacted by their council and invited to make a claim.

Levelling Up Secretary Michael Gove has said the £3bn rebate would help people facing pressures as inflation levels rise.

The one-off payment will be made to people living in properties in council tax bands A to D and the government estimates around 20 million households will benefit.

Residents can check which council tax band their home is in on the government website., external

Labour MP Mr Betts has now written to Mr Gove raising questions about how the rebate will work in practice.

He said it was "already proving to be complex and there are a variety of issues which risk people being unable to access this help quickly and smoothly".

"The government needs to get a grip on the operation of the council tax rebate and give clear guidance to councils so that this rebate is delivered to households reliably and effectively," he said.

He also raised concern payments could go to landlords rather than the tenants.

And he asked if the government had any information on how many households did not pay council tax by direct debit - and would therefore not automatically receive their payment.

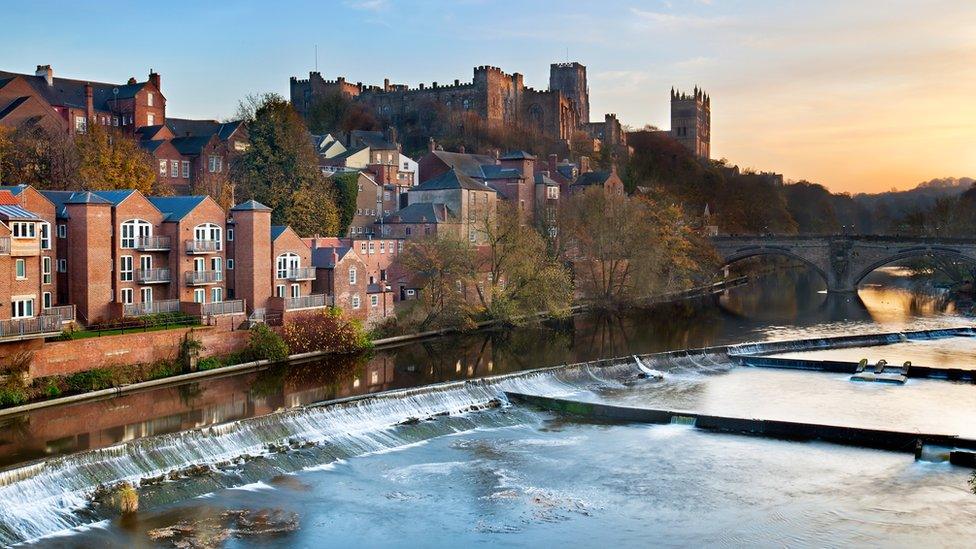

Earlier this month, figures sourced by the Local Democracy Reporting Service found that 320,000 households in County Durham and Northumberland did not pay council tax by direct debit.

The government has encouraged people to set up direct debits to ensure quick payment of the rebate.

Related topics

- Published9 March 2022

- Published3 February 2022