Liberal Democrats call for tax cut in local elections launch

- Published

- comments

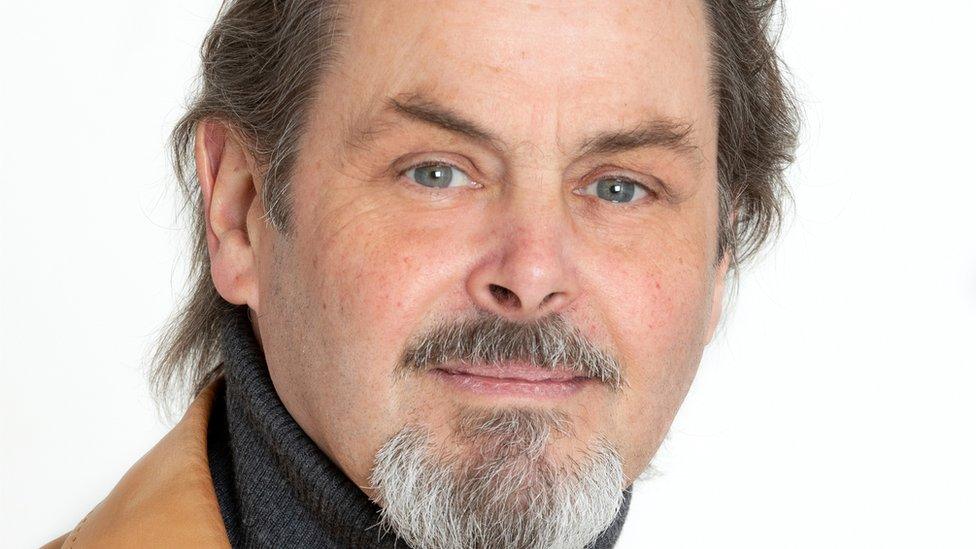

Lib Dem leader Ed Davey is calling on the government to cut taxes to ease the cost of living

The Liberal Democrats have been calling for a tax cut to ease a "cost of living emergency" as they start campaigning for upcoming English local elections.

Lib Dem leader Ed Davey launched the party's campaign with a call to slash VAT, which he claimed would save households £600.

He said budgets are being stretched by a National Insurance (NI) rise taking effect on Wednesday.

He accused the Tories of breaking promises by raising taxes.

The rising cost of living - driven by global economic turmoil and the war in Ukraine - has been a key issue ahead of the elections, which will test support for political parties across the UK.

The polls will take place on 5 May, when votes will be held to elect local councils in England, Wales and Scotland, and the government in Northern Ireland.

The Lib Dems will compete with Labour in some places in these elections, but the party's priority will be targeting long-standing Tory voters.

To woo these voters, the Lib Dems say they will put the cost of living at the centre of their election campaign in England.

One measure they are proposing is a cut to value added tax (VAT) from 20% to 17.5% for one year, a move they predict would save households an average of around £600.

The party says its plans would give a boost to struggling high street businesses by encouraging spending, and help keep costs under control by reducing prices in the shops.

"There's a cost of living emergency and that's why Liberal Democrats are calling for this emergency tax cut," Mr Davey told the BBC. "It is a large one, but it's right for the times."

The Lib Dem local elections offer includes proposing a 16% sewage tax on water companies' annual profits.

The government has faced a public backlash over the amount of sewage discharge into rivers and the sea. Water firms are under pressure to reduce sewage spillages after 1,000 a day were recorded in 2021.

Kicking off the campaign by the River Wandle in south-west London, Mr Davey accused Tory MPs of failing to act on the issue of sewage discharge.

The Lib Dems also want to establish a national community ambulance fund to allow trusts to reopen ambulance stations and cancel planned closures.

Lib Dem analysis of Office for Budget Responsibility figures shows that Chancellor Rishi Sunak will receive a VAT windfall of £38.6bn over the next four years.

That calculation takes into account rising costs, which the party says will see a typical family will pay an estimated £430 more in VAT next year.

Leader of the Liberal Democrats Sir Ed Davey believes a cut in VAT would help the "average family".

The party says the rising VAT bill "comes on top of the Conservative government's manifesto-breaking increases" to tax, with the income tax threshold frozen and NI rising by an extra 1.25p in the pound.

The hike in NI contributions is forecast to raise £39bn over three years and is being used to fund the NHS and social care.

Together, the tax rises will leave a typical family £535 a year worse off, even before the extra VAT pinch is felt, according to the Lib Dems.

Mr Davey said the government's approach to tax policy was not fair "because it puts the burden on working people, particularly low-paid people".

"Now, more than ever, they deserve a fair deal, but the rising cost of energy, soaring energy bills, are overwhelming millions of families and pensioners," he said at the launch.

Is there a VAT windfall for the government?

Rising prices raise money with one hand, but take it away with the other.

The government will be getting more money in than they expected a year ago. Prices are rising faster than was expected back then. And when prices go up, you pay more VAT.

But rising prices also put a squeeze on the government's budgets: for example, energy for hospitals or schools will cost more and benefits will eventually rise in line with this year's price hikes.

So rising prices are less of a windfall than they might appear at first glance.

- Published1 April 2022

- Published11 March 2022

- Published18 February 2022