Kwarteng's mini-budget: Shock-and-awe tactics from an unapologetic chancellor

- Published

Chancellor Kwasi Kwarteng unveiled the biggest package of tax cuts in 50 years in his budget on Friday, hailing a "new era" for the UK economy. But will the dramatic change of direction kickstart growth as intended, or, as Labour claims, just reward the already wealthy.

On a balmy autumn day, Westminster witnessed one of those rare political moments that will resonate for decades.

With many MPs still dressed in mourning for the Queen, Kwasi Kwarteng outlined a Growth Plan which broke away from longstanding conventional thinking.

The chancellor unveiled the biggest tax giveaway in 50 years which will overwhelmingly benefit the better off and, initially, will be paid for from additional government borrowing.

In the minutes after the chancellor's Commons statement, Conservative MPs were staggering around the corridors of Westminster in shock. A divided party was united on one point, this was momentous and it marked a sharp break with the past.

"At last we are Conservatives again," came the cry from supporters of Liz Truss, hailing the cuts to National Insurance contributions and the higher income tax rate.

"This is a momentous event which really does break with our party's recent past," one cabinet minister told me. "It is very clear where we stand and opens up really clear dividing lines with Labour."

In contrast, the prime minister's Conservative critics held their heads in their hands, worrying her chancellor had embarked on a dangerous throw of the dice which will have devastating consequences if it goes wrong. "This is one almighty bet," one Tory MP said.

Ms Truss thought most of her predecessors were too timid and shied away from core Conservative values

Multiple emotions and thought processes swirled around in the air at Westminster, trying to explain why this was such a seismic moment.

The sheer daring nature of the announcement - so soon after Liz Truss's appointment as prime minister - caused shockwaves because it was both a surprise and unsurprising.

Ms Truss had made clear during the leadership campaign that she is a small state Conservative who believes tax cuts are one of the best ways to promote economic growth. Hardly a surprise then, that she should start cutting taxes.

But to act so quickly - and to deliver about £45bn in tax cuts - was a shock for both her supporters and her detractors. This was a supreme example of the shock-and-awe tactics that Ms Truss believes lie at the heart of political success.

Then there was Mr Kwarteng's unapologetic dismantling of decades of orthodoxy on two fronts. These are that tax cuts should largely benefit the less well off and that borrowing should not be used, in normal times, to fund day-to-day government spending.

In his statement, the new chancellor cast aside years of delicate tiptoeing by his predecessors on the impact of tax changes as they tried to show the Tories were the party of progressive taxation. "For too long in this country we have indulged in a fight over redistribution," Mr Kwarteng said. "Now we need to focus on growth, not just how we tax and spend."

As Tories digested that break with every Conservative chancellor since George Osborne, they then grasped the sheer scale of the tax cuts. Scrapping the top 45p rate of income tax and reducing the basic rate from 20p to 19p next year will, with the other measures, amount to the biggest round of tax cuts in 50 years.

Former chancellor Anthony Barber embarked on a "dash for growth" with dramatic tax cuts in his 1972 budget.

A reason to cheer for many Conservatives. But for others, going beyond the ranks of the Truss detractors, that revives memories of Ted Heath's chancellor who became a byword of how not to run an economy.

Anthony Barber, who coincidentally later became the young John Major's patron in the banking world, was notorious for the "Barber Boom". Barber embarked on a "dash for growth" with dramatic tax cuts in his 1972 budget. The economy over-heated, inflation shot up and Heath lost the election in February 1974.

There is one big difference: the chancellor today only controls fiscal policy - tax and spending. He does not control monetary policy - interest rates - which has rested with the independent Bank of England (BoE) since 1997.

This means that the BoE could respond to the chancellor's loosening of fiscal policy (cutting taxes) by an ever-greater tightening of monetary policy (raising interest rates) in order to tame inflation. The signals from the bank are that it sees inflation as a dragon to be slayed.

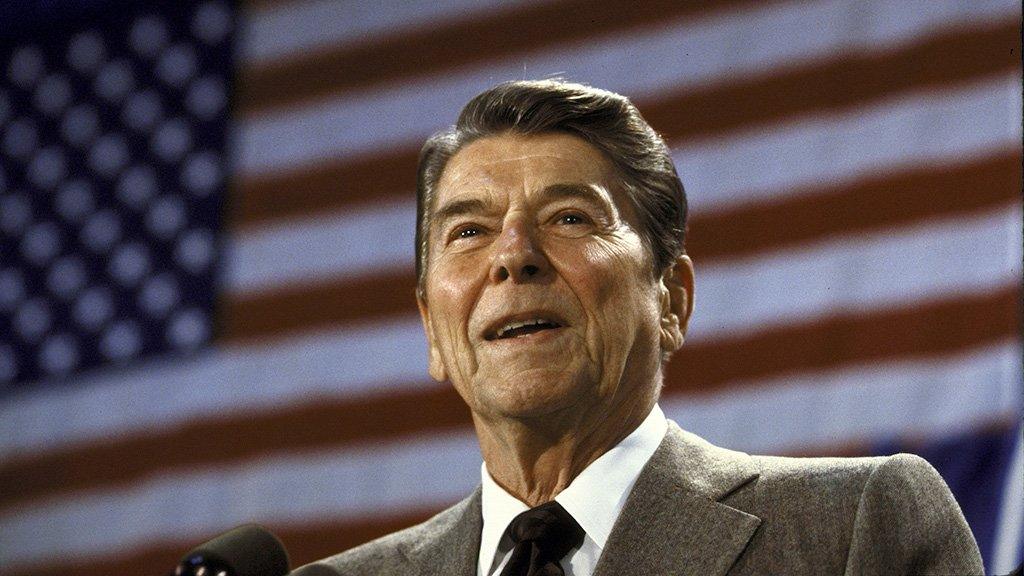

US President Ronald Reagan, who ran up a massive pile of debt to finance his tax cuts in the 1980s

The bank will be watching the increased level of borrowing with care. It may note the criticism of some Tory MPs that Ms Truss appears to be behaving like the late US President Ronald Reagan, who ran up a massive pile of debt to finance his tax cuts in the 1980s. The difference was that the US dollar is, unlike the pound, the global reserve currency, which means the US would be much less likely to ever have a problem finding buyers for its debt.

The big focus on tax cuts meant that one core political objective was somewhat overlooked. This is that Liz Truss, with Kwasi Kwarteng, is beginning to deliver the "Singapore-on-Thames" Brexit of light regulation spurned by her predecessor, Boris Johnson.

The architect of the Vote Leave campaign was at pains to stress that his idea of Brexit was not to use new-found freedoms for a widespread slashing of regulations.

Mr Kwarteng and Ms Truss take a very different view. They believe the whole point of freeing the UK from the EU is to allow the UK to pursue a different economic path. That means cutting taxes and scrapping regulations, many of which derive from the EU.

Ms Truss has waited years for this moment. Sitting round the cabinet table for the past eight years, this former Liberal Democrat thought most of her predecessors were too timid and shied away from core Conservative values.

To her, those values had a virtue in freeing an economy to grow. To supporters of the recent Conservative mainstream, they carried a painful burden of history.

Related topics

- Published17 October 2022

- Published23 September 2022