Key questions about Nadhim Zahawi's tax affairs

- Published

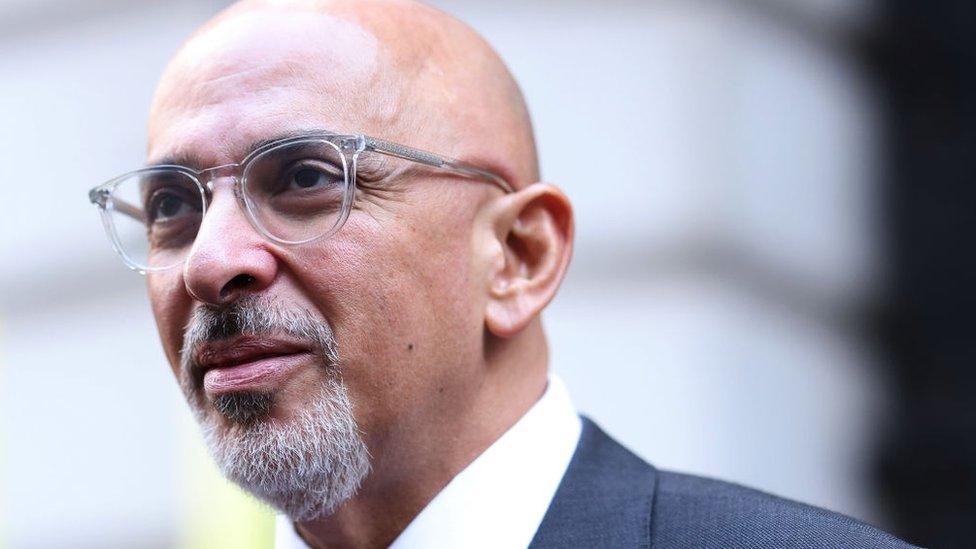

Nadhim Zahawi says he made a payment to settle a tax issue with HM Revenue & Customs, the tax authority

The chairman of the Conservative Party, Nadhim Zahawi, is coming under increasing political pressure to fully explain the circumstances of a multimillion-pound tax settlement.

The BBC has been told Mr Zahawi paid a penalty over previously unpaid tax while he was chancellor.

But despite acknowledging the tax issue, Mr Zahawi has left some questions unanswered.

1) Why did Mr Zahawi need to settle a tax bill?

Let's start with the basics.

The tax bill is connected to shares in YouGov, a polling company Mr Zahawi co-founded in 2000 before he became an MP.

As the word suggests, shares represent who owns what percentage of a company.

In most cases, UK residents are taxed on the profits - or "gains" - they make from the sale of shares in a company.

But this is where it gets complicated.

At its founding, YouGov allocated 42.5% of its shares to Balshore Investments, which is a company registered offshore in Gibraltar.

Balshore was described as the "family trust of Nadhim Zahawi" in YouGov's 2009 annual report.

In a statement on Saturday, Mr Zahawi said his father took founder shares in YouGov "in exchange for some capital and his invaluable guidance".

Eventually, YouGov became a successful business and shares in the company owned by Balshore were sold. Tax expert Dan Neidle has analysed company records and made the assumption that Balshore had sold its shares by 2018 for an estimated £27m.

Mr Zahawi has denied being a beneficiary of or having any involvement with Balshore.

But in his statement, Mr Zahawi said "questions were being raised about my tax affairs" when he was appointed as chancellor in July last year.

"Following discussions with HMRC, they agreed that my father was entitled to founder shares in YouGov, though they disagreed about the exact allocation," Mr Zahawi said.

He said HMRC concluded he had made an "error" that was "careless and not deliberate", but gave no further details.

"I chose to settle the matter and pay what they said was due, which was the right thing to do," Mr Zahawi said.

At the moment, that's about the gist of it.

2) When did issues with Mr Zahawi's tax affairs come to HMRC's attention?

It's not exactly clear, but let's run through what we know, from the top.

On 9 July last year, the Independent reported, external that HMRC experts were investigating the tax affairs of Mr Zahawi.

In that report, a spokesperson for Mr Zahawi said he was "not aware of any formal investigation by HMRC" and insisted "his taxes are fully paid and up to date".

A day later, the Observer reported, external a "flag" had been raised by officials over the financial affairs of Mr Zahawi before his appointment.

The reports emerged as Mr Zahawi was preparing to launch his leadership bid to succeed Boris Johnson as Tory leader and prime minister.

When the issue of his tax affairs came up in an interview with Sky News, external, Mr Zahawi was bullish.

He said: "I was clearly being smeared. I was being told that the Serious Fraud Office, that the National Crime Agency, that HMRC are looking into me. I'm not aware of this."

We don't know when Mr Zahawi originally became aware of the tax issue with HMRC.

But over the weekend, the BBC's political editor, Chris Mason, was told the issue was resolved while Mr Zahawi was chancellor, which was between 5 July and 6 September last year.

Mr Zahawi's allies say before his appointment, he raised the matter with senior civil servants in a little-known department of government, the propriety and ethics team.

3) What amount has Mr Zahawi paid to settle the tax issue?

Again, we don't know exactly.

Mr Zahawi has not confirmed how much his penalty amounted to, nor the total value of the final settlement with HMRC.

On Friday, the Guardian newspaper reported, external he had agreed to pay a penalty as part of a seven-figure settlement. The newspaper quoted experts saying they estimated the tax bill to be about £5m.

The BBC has been told the total amount paid was close to sums that have been reported elsewhere, in other words, about £5m.

4) What did the prime minister know?

According to Mr Zahawi, the tax issue was settled before his appointment as chairman of the Conservative Party.

He took that role on the same day Rishi Sunak became prime minister - 25 October last year.

At Prime Minister's Questions last week, Mr Sunak said Mr Zahawi had "already addressed this matter in full and there's nothing more that I can add".

But now Mr Sunak has changed his position.

On Monday, Mr Sunak asked his independent ethics adviser to look into whether Mr Zahawi had broken the ministerial code, saying there were "questions that need answering" over the case. Mr Zahawi says he is confident he behaved appropriately.

Watch: "Integrity and accountability are really important to me", says Rishi Sunak

Then, at PMQs this week, Labour leader Sir Keir Starmer asked Mr Sunak why he had changed his position on Mr Zahawi's tax affairs.

Mr Sunak said "the issues in question occurred before I was prime minister" and "the usual appointments process was followed" when Mr Zahawi became party chairman.

"No issues were raised with me when [Mr Zahawi] was appointed to this current role," Mr Sunak said.

"And since I commented on this matter last week, more information has come forward. And that is why I have asked the independent adviser to look into the matter."

That leaves questions for Boris Johnson, who appointed Mr Zahawi chancellor last year, when the matter had not been resolved.

If, as the BBC has been told, Mr Zahawi flagged the tax issue with the internal government ethics watchdog before his appointment as chancellor, Mr Johnson may have been aware.

5) What background checks were done before Mr Zahawi took on cabinet jobs?

Mr Zahawi has held several senior ministerial roles, including chancellor, since the start of July last year.

He was given those jobs by three different prime ministers, including Mr Johnson, Liz Truss and Mr Sunak.

The appointment of a cabinet minister is a matter for the prime minister of the day. Ultimately, it's their call.

But there is a process for vetting candidates. Remember the propriety and ethics team?

This is a vetting team made up of a small group of civil servants who gather information on candidates for government roles.

In considering potential appointments, the prime minister may receive advice from these civil servants on, for example, potential conflicts of interest. The civil service has no role in approving or vetoing appointments, though.

The BBC has spoken to people with knowledge of the process, who say that the team does not "start from scratch" every time a minister is appointed to a new role.

This raises the question: what were successive prime ministers told about Mr Zahawi's tax affairs during the vetting process?

And it brings into focus the role of the cabinet secretary, Simon Case, who has overall responsibility for advising the prime minister on ethical issues.

What did he know about Mr Zahawi's tax affairs?

Related topics

- Published29 January 2023

- Published23 January 2023

- Published23 January 2023

- Published21 January 2023