Budget 2023: Pensions tax cut for all is wrong, Labour leader says

- Published

- comments

Sir Keir Starmer: 'Easy to bring in tailor-made' pensions to help retain doctors.

Pension tax breaks aimed at keeping doctors in work should not have been given to all, Sir Keir Starmer has said.

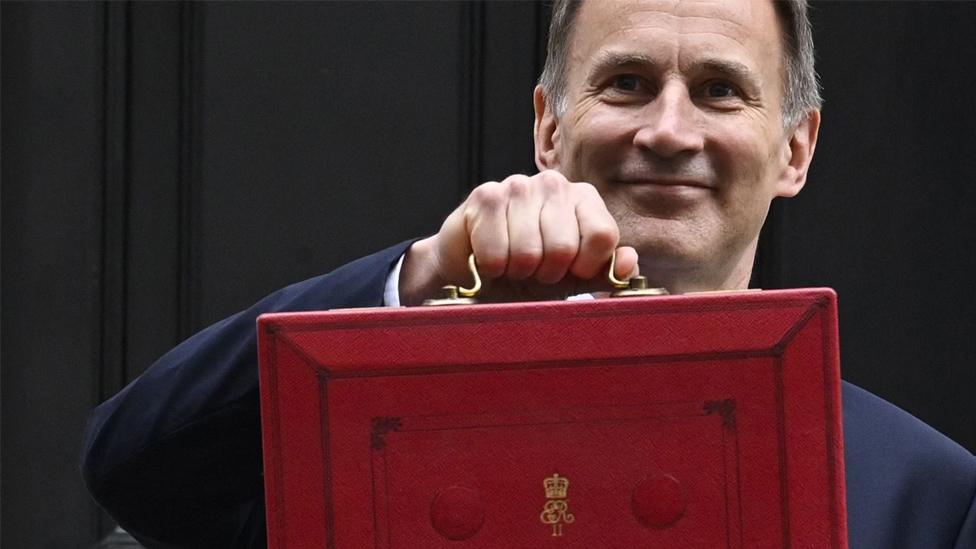

It comes after Chancellor Jeremy Hunt scrapped the overall £1m lifetime limit on tax-free pensions savings in Wednesday's Budget.

The Labour leader branded the move a tax break for "the richest 1%" that showed the "wrong priorities".

He added that any pensions tweak should be "tailor-made" for doctors.

Doctors have said the current tax-free pension allowances are pushing some of them into declining overtime shifts or into early retirement.

Mr Hunt, a former health secretary, says the changes to the pension pot rules are a "very important measure to get the NHS working".

At the Budget, he announced he was abolishing the current £1.07m cap on how much individuals can build up in their private pension pots over their career without having to pay additional tax.

The annual tax-free allowance on pensions will also increase from £40,000 to £60,000.

The chancellor said the changes would stop doctors retiring early - but would also contribute to the government's wider drive to persuade retirees back into work.

"I have realised the issue goes wider than doctors. No one should be pushed out of the workforce for tax reasons," he told MPs.

The financial watchdog, the Office for Budget Responsibility, estimated the changes to the allowance would increase overall employment by 15,000 workers.

The combined cost will be more than £1.1bn a year by 2027/8, according to official estimates.

'Billion pound giveaway'

However, the decision to opt for a wider change to pension rules has been criticised by Labour, which branded it a "one billion pound pensions bung" for the wealthy.

The party has committed to overturning the government's changes if it wins power at the next general election, and replacing it with an alternative scheme just for doctors.

It has not yet offered details of its alternative approach, but has suggested it could be based on a scheme for judges introduced in 2022, under which the tax allowances are disapplied.

Shadow health secretary Wes Streeting has previously told the Telegraph in September, external he favoured "doing away with" the savings cap.

Speaking earlier, Mr Hunt said it suggested Mr Streeting had previously advocated the government's approach.

But Mr Streeting insisted his previous comments were about how the allowance affected doctors - and he had "consistently argued" they should have their own carve-out from the rules.

He told BBC News this would cost "a fraction" of the blanket change proposed by ministers, which he called "a sledgehammer to crack a nut".

Watch: Pints, power and parents: Budget info in 64 seconds

Mr Hunt defended making a rule change across the board, arguing it was the "simplest and quickest way" to resolve the issues facing doctors.

He added that the change could be introduced in two weeks, delivering help to the NHS when it "most needs support".

He pointed to Royal College of Surgeons statistics, saying the organisation had found that 69% of their members had reduced their hours because of the "way pension taxes work".

On Wednesday, Treasury Minister John Glen said a targeted scheme risked legal challenges from other highly-paid public sector workers, such as senior civil servants.

Speaking to BBC2's Politics Live, he added that a wider change to the rules would also have a "positive effect on the economy as a whole".

The announcement was welcomed by NHS Providers, which represents hospitals in England.

'Poor value'

Chief executive Sir Julian Hartley said it would help "stem the flow of senior NHS staff either taking early retirement or not taking on extra work for fear of punitive tax bills".

But the independent Institute for Fiscal Studies said the change would "encourage a relatively small number of better-off workers to stay in the workforce a bit longer" and was "unlikely to have a big effect on overall employment".

The Resolution Foundation think tank, which focuses on people on low to middle incomes, described the policy as "hugely regressive and wasteful".

Chief executive Torsten Bell said: "It's a big victory for NHS consultants but poor value for money for Britain."

Related topics

- Published17 March 2023

- Published16 March 2023

- Published15 March 2023