Climate change: UK risks losing investment in net-zero race, MPs warn

- Published

- comments

The UK is at risk of losing jobs and investment in the "net-zero race", senior cross-party MPs have warned.

The government is set to announce its revised energy strategy on Thursday.

It argues the UK is a "world-leader" in working towards net-zero.

But cross-party MPs fear investors - and jobs - could move elsewhere if the strategy is not ambitious enough.

A Department for Business and Trade official said the government was having "almost daily" conversations with companies so they know the UK is committed to supporting green technology.

Why is the government outlining yet another energy and net-zero strategy, when it had one last year?

In part, it's out of necessity.

In July 2022, the High Court ruled its existing net-zero strategy "unlawful" for not showing how the UK will hit legally binding carbon targets.

Ministers also want to produce a plan for how UK net-zero policies can help grow the economy - one of the prime minister's priorities, even if net-zero is not.

They also need to respond to a government-commissioned net-zero review by Conservative MP Chris Skidmore.

It said the UK was "falling behind" on some climate targets, needed to be more ambitious, and should speed up the rollout of renewable energy, heat pumps, and insulation among other recommendations.

Race for net-zero

It's not though, I'm told by government insiders, meant to be the UK's response to a huge green subsidies programme in the US yet - that'll come later - which is concerning some climate-watchers in Westminster.

Reaching net-zero is often dubbed a "race".

Not just against time - with the impacts of climate change becoming more apparent - but economically too.

In the US, President Biden has introduced a multi-billion dollar package - the Inflation Reduction Act - to speed up the production of green technology such as solar panels and wind turbines and to subsidise people to make environmentally friendly purchases like electric cars.

Billions of dollars are being given to communities who have suffered most from fossil fuel production.

Extra tax incentives are also on offer for businesses investing in green jobs and technology in low-income areas.

The EU has responded with plans for a Net Zero Industry Act to increase subsidies for green industry.

Risk of jobs moving

The US's move has vocal critics in the UK government.

Business and Trade Secretary Kemi Badenoch has described it as "protectionist", Energy Secretary Grant Shapps as "dangerous".

Some fear it's given the US an unfair competitive advantage, and that it's an attempt to lure high-tech manufacturing companies to the US.

Some electric car and wind turbine manufacturers, among others, are already looking to relocate - taking good jobs with them, from areas of the UK that need them.

The government claims its existing plans to invest in renewable and nuclear technologies will support up to 480,000 green jobs and secure up to £100bn of private investment by 2030.

A Department of Business and Trade official told the BBC Ms Badenoch will bring forward an "Advanced Manufacturing Plan" in the coming months to make the UK a more competitive place for green industries to do business and "one of the best places in the world to manufacture electric vehicles and develop critical supply chain technologies".

They added that the government was having daily conversations with companies in this space.

The chancellor also said at the budget he'd use his Autumn Statement to "complete our response to the challenges created by the US Inflation Reduction Act".

Business 'could go elsewhere from Thursday'

But opposition parties, as well as some business leaders, green groups and Conservatives, fear time is running out to respond to the US's ambition.

The independent climate think tank E3G said the government's decision not to announce any new public investment or tax breaks for green industry in the Budget was a "disappointment" to UK business.

Labour's shadow climate change and net-zero secretary Ed Miliband has argued for a British equivalent of the Inflation Reduction Act (IRA) and a national wealth fund to invest in green technology alongside the private sector.

"We need to stop moaning about the IRA and start matching its ambition," he said.

Mr Shapps has accused Labour of having a "£28bn plan for borrowing, nothing more".

More concerning for the government may be some of the critics in its own ranks.

Mr Skidmore, who authored the government's net-zero review, told the BBC: "We have a vanishingly small window to act. There is a net-zero race, there are net-zero markets that will go elsewhere."

He added that the "real risk" on Thursday is that if the government does not provide certainty that "demonstrates that this is a place to invest" then "investors will say this doesn't deliver".

"From Thursday they will begin to take strategic decision to go elsewhere."

Not just about money

Thursday is not a "fiscal event" or Budget, so it's not expected new investment will be announced.

But Mr Skidmore said this is not just about money, but also demonstrating how welcoming the UK's planning and regulation systems are to green infrastructure.

For example, current planning rules make it very hard to build new onshore wind turbines and there are concerns the UK's national grid - electricity network - needs more capacity to accommodate further renewable energy.

"Ultimately," he said, "investors will look at what is being proposed and say 'yes this is a country we can do business' or move elsewhere."

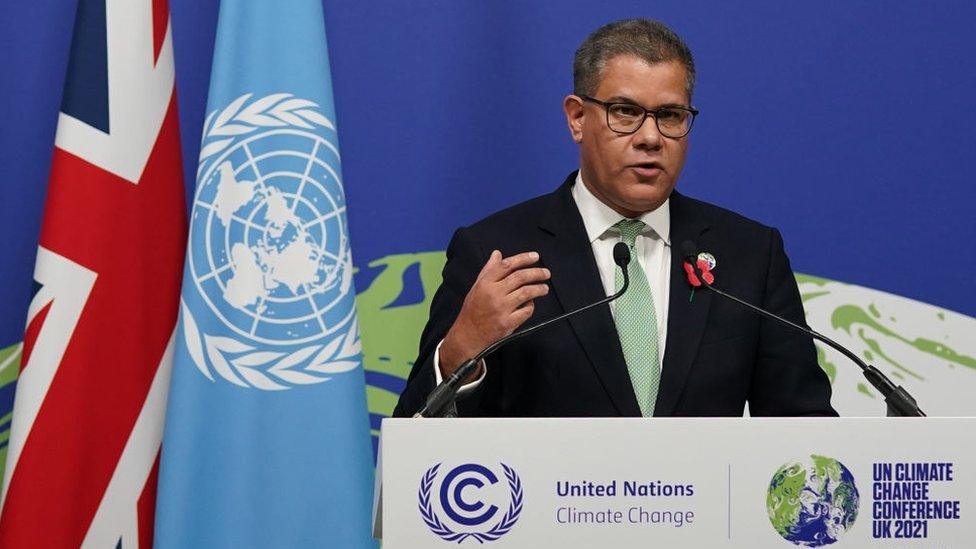

It's a sentiment echoed by the UK's former COP26 President Alok Sharma, who said: "We are fast approaching a crossroads."

The Tory MP added that the US Inflation Reduction Act was attracting billions of dollars of private sector investment in green industries and that the government must set out a meaningful response like financial incentives on Thursday or "we can allow others to win this critical race".

He said mixed signals of delayed delivery of policies will "not cut the mustard" for businesses.

As COP26 president, Alok Sharma led the UK delegation at the climate summit in Glasgow in November 2021

The government insists it is committed to net-zero, making it easier for supportive communities to host onshore wind farms, growing solar capacity and doubling hydrogen production.

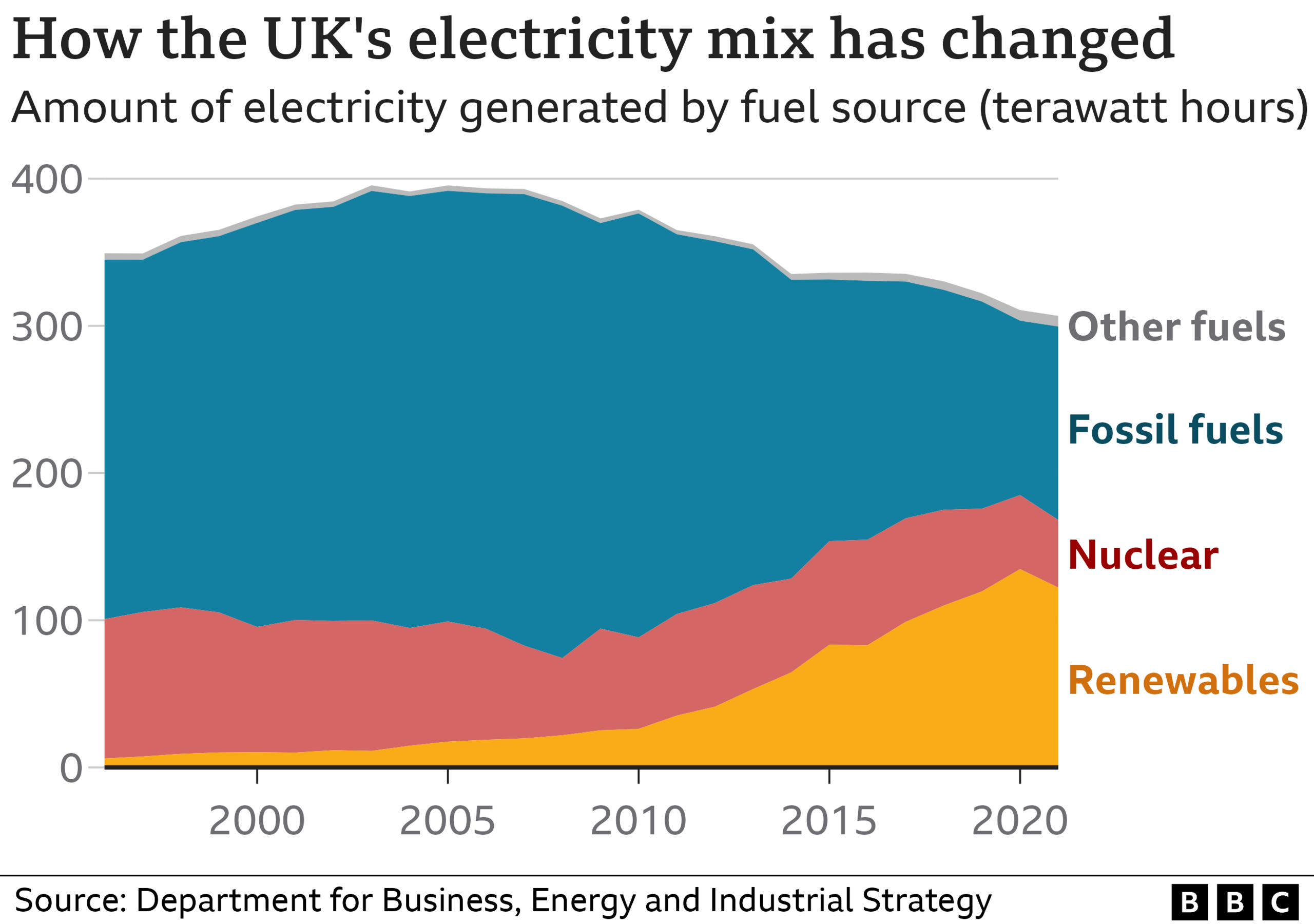

But it has said the government will seek to make use of North Sea oil and gas reserves as the UK transitions to cleaner energy.

A decision on whether to approve the new Rosebank oil and gas field in the North Sea may be made on Thursday - along with announcements on hydrogen, energy efficiency, electric cars and moving from gas boilers to heat pumps.

Green groups and MPs critical, and supportive, of net-zero alike will pour over the detail.

But some argue the key political judgement for the government will come from the business community.

If any decide it doesn't go far enough, get impatient, and up sticks, it could prove difficult to claw them back - and MPs warn that could have environmental and economic consequences for years to come.

- Published13 January 2023

- Published23 February 2022

- Published3 May 2024