PMQs: Keir Starmer blames Tories for 'mortgage catastrophe'

- Published

- comments

Labour leader Sir Keir Starmer challenges Rishi Sunak over mortgage rate rises being faced by homeowners.

Labour leader Sir Keir Starmer has accused the Conservatives of being to blame for "the mortgage catastrophe".

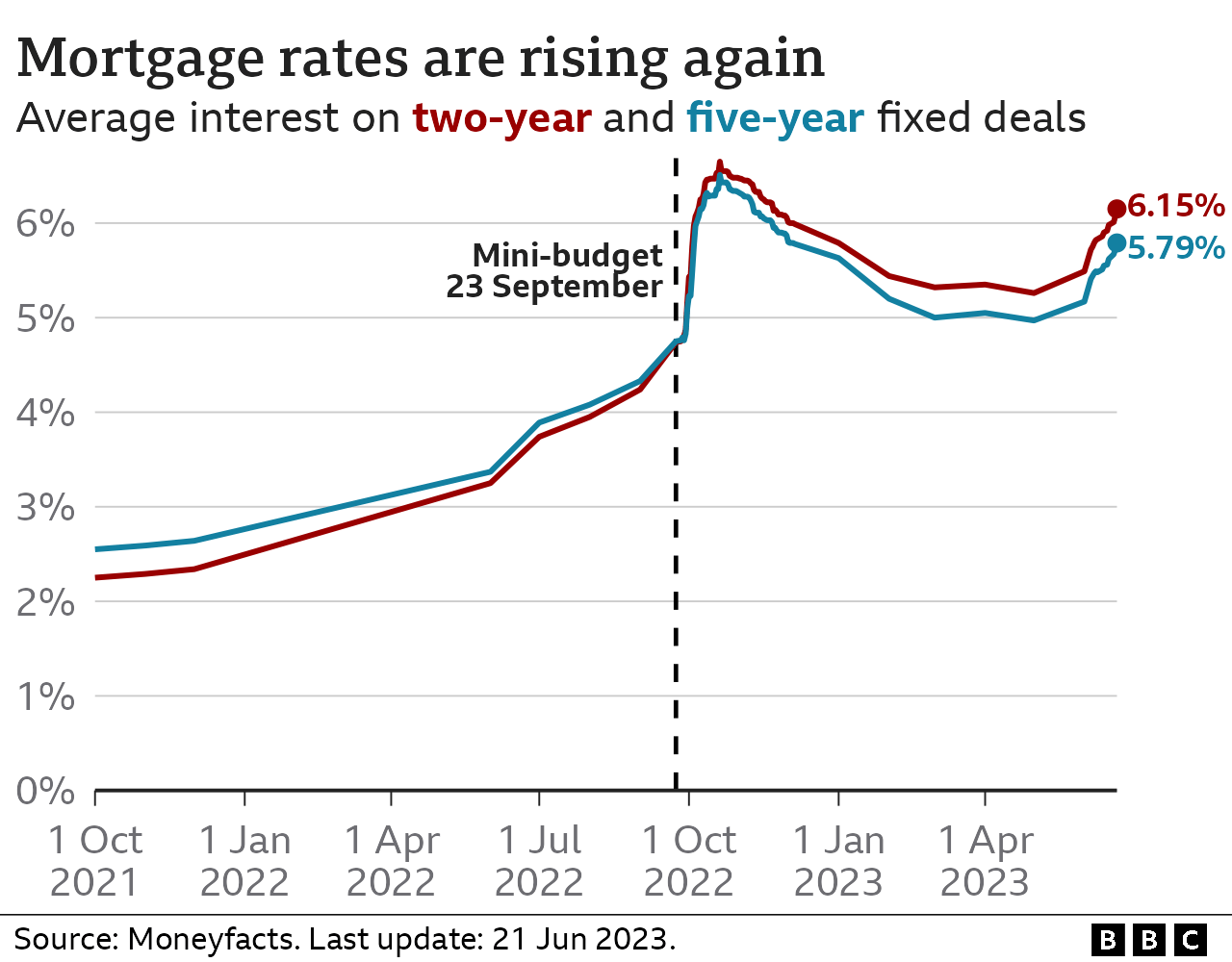

Rising interest rates mean homeowners are facing big increases in mortgage payments.

Prime Minister Rishi Sunak said this was due to global factors, with other countries also facing interest rate rises.

But Sir Keir said "13 years of economic failure and a Tory kamikaze budget... put mortgages through the roof".

The pair clashed over the issue during Prime Minister's Questions, after the latest figures showed inflation - the rate prices are rising - remains stubbornly high.

On Thursday, the Bank of England is expected to increase interest rates further in attempt to tame price rises.

It has led to concerns over loans, particularly mortgages, with homeowners - a third of adults in the UK - facing large increases in repayments when fixed-term mortgage deals come to an end.

Sir Keir said the prime minister was warned last autumn about the risk of soaring mortgage costs but "he either didn't get it, didn't believe it or didn't care because he certainly didn't do anything".

However, Mr Sunak said the government had increased support for the mortgage interest scheme, which offers help towards interest payments for some people on benefits, as well as spending tens of billions of pounds on cost-of-living payments.

He said the US, Canada, Australia and New Zealand were also seeing similar levels of interest rates, while in Europe they were the highest in two decades.

Mr Sunak added that rising prices were driving up interest rates and "this is why the absolute right economic priority is to halve inflation".

The prime minister made halving inflation this year one of his five priorities in January.

However, the latest figures for May showed inflation remained at 8.7% - the same rate it was in April.

He told the Commons the government "continue to be on track to keep reducing inflation".

The government is under pressure from some of its own MPs to offer more help to homeowners.

Last week, Tory MP for Telford Lucy Allen warned the country was facing a "mortgage catastrophe".

Meanwhile, on Monday former minister Sir Jake Berry said a "mortgage bomb" was about to go off and suggested the government should consider mortgage interest relief.

Chancellor Jeremy Hunt has ruled out major financial help for mortgage holders over fears this could fuel price rises further.

However, he said he would meet mortgage lenders to ask what help they could give to households struggling with payments.

The Bank of England has been steadily raising interest rates since the end of 2021. This makes it more expensive to borrow money and theoretically encourages people to borrow less and spend less, meaning price rises should ease.

- Published20 June 2023

- Published5 January 2024

- Published9 January 2024