PMQs: Starmer attacks Sunak over 'collapse' in housebuilding

- Published

- comments

Both front benches accuse the other of giving different messages on house building and protecting the Green Belt

Sir Keir Starmer has accused the prime minister of overseeing a "collapse" in housebuilding.

The Labour leader said Rishi Sunak was "shattering the dream" of those who "desperately" want to own a home.

But Mr Sunak defended the government's record, saying housing supply was up 10% in the last year.

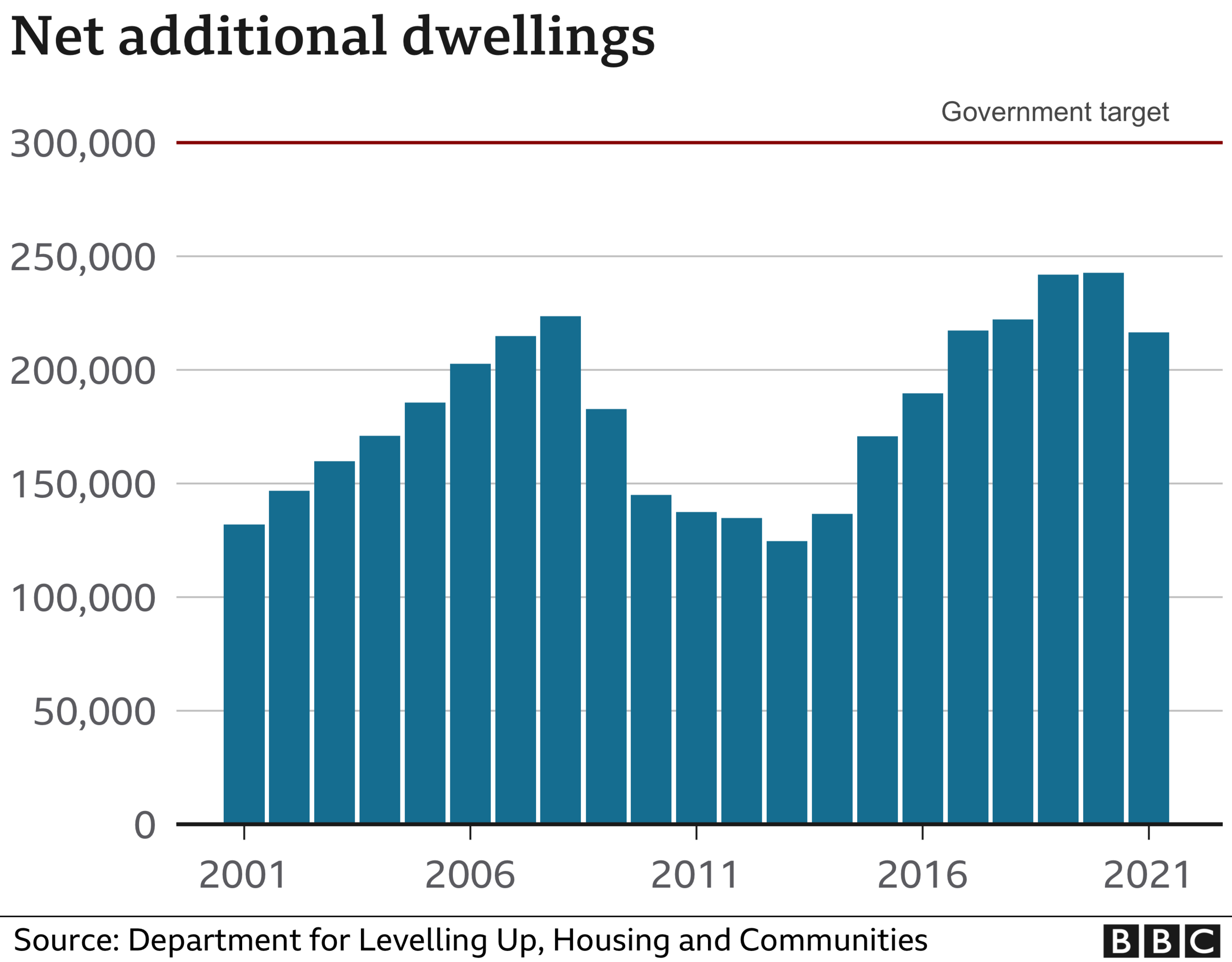

The government is set to miss its target of building 300,000 new homes a year in England by the mid-2020s, a figure it has never achieved.

Last year Mr Sunak was accused of watering down local housing targets, following a rebellion by some Conservative MPs.

The government has said it remains committed to the 300,000 figure but has given councils more flexibility in meeting centrally-set targets.

During Prime Minister's Questions, Sir Keir said "housebuilding has collapsed" since Mr Sunak "crumbled to his backbenches and scrapped mandatory targets".

He said the prime minister's "failure" was "shattering the dream of those who desperately want to own their own home".

"How can they ever look the British people in the eye again, and claim to be the party of homeownership?" he asked.

Mr Sunak said the government had delivered almost record numbers of new homes in each of the past three years, while the number of first-time buyers was at a 20-year high.

"He talks about targets, so let's be clear, I promised to put local people in control of new housing, I delivered on that policy within weeks of becoming prime minister," he said.

Earlier this year Housing Secretary Michael Gove said the UK housing model was "broken" and more homes were "desperately" needed.

Labour has sought to make housing central to its pitch to voters ahead of the next general election, which is expected next year.

Sir Keir also accused the Conservatives of being responsible for a "mortgage bombshell", after interest rates rose for the 13th consecutive time to 5% last week.

The Bank of England has been increasing interest rates since the end of 2021 in an attempt to tame rising prices.

This makes it more expensive to borrow money and theoretically encourages people to borrow less and spend less, meaning price rises should ease.

However, it also means homeowners are facing big increases in mortgage payments.

Sir Keir criticised the government's "softly, softly approach" of asking banks to offer more flexibility to struggling mortgage-holders, rather than making this mandatory.

Mr Sunak said it was right to provide support for mortgages and the "vast majority" of the market was now covered by the measures.

Related topics

- Published6 December 2022

- Published17 May 2023

- Published28 June 2023

- Published2 August 2024