Liz Truss-backed group sets out alternative 'growth budget'

- Published

Liz Truss attended the launch of the "growth budget"

Economists assembled by Liz Truss have proposed measures including slashing taxes and toughening up benefits requirements to boost economic growth.

The commission, set up by the former prime minister after she left No 10, said its "growth budget" would reverse the "stagnation" in the economy.

Rishi Sunak is also facing pressure from other Tory MPs to cut taxes.

It comes ahead of next week's Autumn Statement, when the government announces its tax and spending plans.

Ms Truss was in office for 49 days in Downing Street, and her so-called mini-budget - which included £45bn of tax cuts - sparked economic turmoil.

The former prime minister was among those who attended the launch of the "growth budget" earlier, alongside close supporters Jacob Rees-Mogg, who served as her business secretary, and former Brexit Minister Lord Frost.

However, she did not speak at the event.

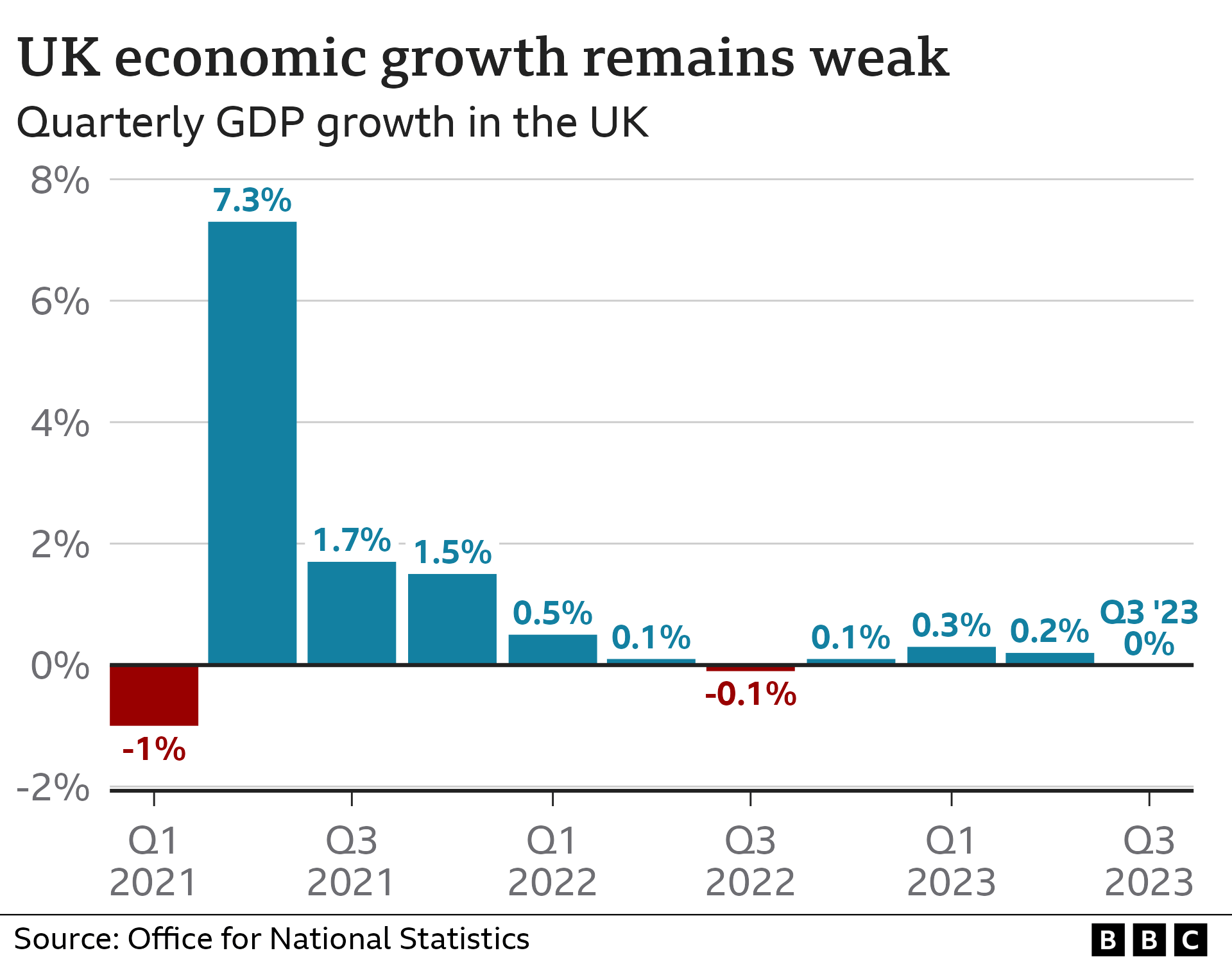

Ms Truss's successor as PM, Mr Sunak, has pledged to get the economy growing by the end of the year but progress has proved sluggish in recent months.

The Bank of England has said the country is likely to see zero growth until 2025, although it is expected to avoid a recession.

Conservative MPs on the right of the party have already been calling for Mr Sunak to cut taxes to boost growth.

The prime minister is facing renewed pressure from this wing after sacking Suella Braverman, who was a popular figure on the right, as home secretary.

Cutting corporation tax from 25% to 15% and unfreezing tax allowances are among the measures proposed by the commission's "growth budget".

The government's policy is to keep income tax thresholds frozen until 2028, with millions likely to see a greater proportion of their salaries taxed due to wage increases.

The commission also said the government should consider abolishing inheritance tax and stamp duty, paid when buying a property.

On welfare and employment, it proposed imposing more stringent requirements for benefits and freezing the minimum wage, as well as providing more support to help people back into work.

To encourage building, it suggests "use it or lose it" time limits on planning permission and cutting the time taken to approve big transport and energy projects by 75%.

Meanwhile, it said the ban on fracking should end and net zero levies should be scrapped.

The group said its proposals would boost GDP - a measure of economic activity - by 23%, and household incomes by £26,000 by 2044.

However, Labour's shadow chief secretary to the Treasury Darren Jones said: "Liz Truss and her backers in the Conservative Party are once again pushing the policies that crashed the economy last year and left working people worse off, with higher prices and mortgage bills."

The Treasury declined to comment on the proposals, with a government spokesman saying: "Next week, the chancellor will set out plans in the Autumn Statement to unlock investment, get people back into work and reform our public sector so that we can boost supply and deliver growth."

Related topics

- Published18 September 2023

- Published5 February 2023

- Published22 November 2023