Reality Check: Would small cut to growth wipe out Brexit ‘gains’?

- Published

The claim: The saving of EU budget contributions would be dwarfed by the losses to the exchequer if leaving the EU reduced economic growth.

Reality Check verdict: The UK's contribution to the EU budget would indeed be dwarfed by relatively small effects on economic growth.

The International Monetary Fund (IMF) released the concluding statement from its assessment of the state of the UK economy on Friday.

Having promised to evaluate its forecasts when the full details were released, it is a bit disappointing that we will not be getting the figures behind the IMF's Brexit concerns until the week before the referendum.

In the event, the statement from the IMF only summarised other organisations' research, saying: "Most assessments point to sizeable long-run losses... from 1.5% to as much as 9.5% of GDP."

There have been assessments such as that from Economists for Brexit that predicted a small increase in growth if the UK were to leave, but these are not mainstream economic views.

But an interesting point made by the IMF was: "Any output losses in excess of 1% of GDP would result in net fiscal losses for the UK, as reduced revenue because of lower output would more than offset any gains from eliminating the UK's net EU budget contribution of 1/3% of GDP."

That's a slightly low figure for the UK's net contribution - the figure in 2014 was closer to 0.5% of GDP.

The net contribution is the amount the UK contributes minus the amount returned for specifically UK projects.

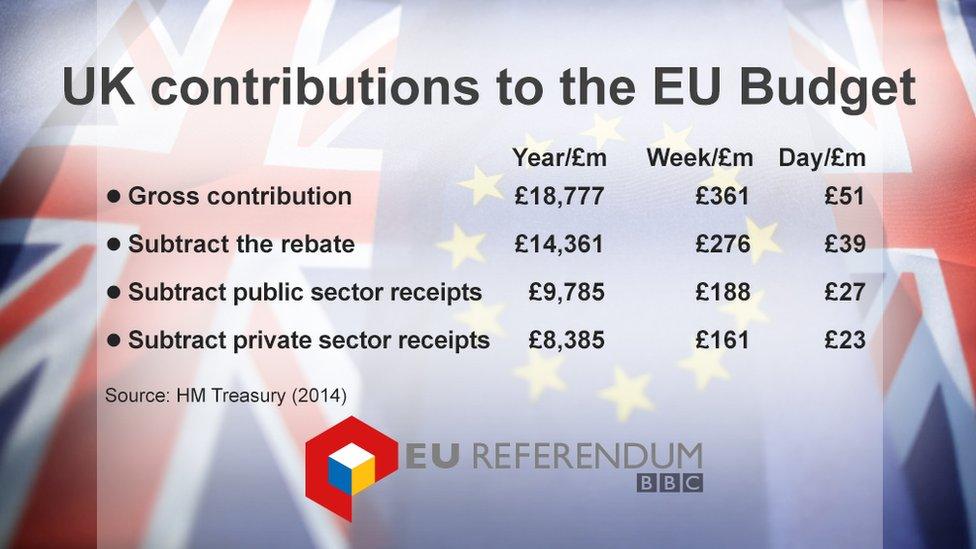

So it's what you have left if you take the gross contribution of £18.8bn and subtract the rebate - the amount spent on UK projects such as regional development in the UK, supporting UK farmers and research and development carried out in the UK. In 2014, the net contribution was £8.4bn.

The net contribution is the amount that would be available to spend on other things if the UK left the EU, unless we had to continue paying into the EU budget as part of a deal to get better access to the single market.

The IMF's warning is similar to one from the Institute for Fiscal Studies that any benefits in savings from the UK's contribution to the EU budget would be dwarfed by the impact of leaving the European Union on the economy.

It's easy to see why this would be the case. GDP, the total amount produced by the UK's economy, is around £1.8 trillion.

The government's total tax take is around 38%, external of GDP.

If GDP grew 1% less it would mean the economy was smaller than it would have been by £18bn. The government's tax take would be smaller by 38% of that - about £7bn.

That's certainly in the same ballpark as the UK's net contribution to the EU (remember, that was £8.4bn in 2014, but it changes from year to year).

This is not to say that the IMF is definitely right to say that the economy would grow less following a Brexit - if the economy grew an extra 1% that would also dwarf the budget contribution.

The point is that the contribution to the EU budget is relatively small compared with the size of the UK economy.

This table is a guide to numbers you may hear quoted. The figure in the second line, for example, is not the value of the rebate, it's how much is left after you subtract it.

- Published13 May 2016

- Published15 April 2016

- Published22 February 2016