Reality Check: Would Brexit create a DIY recession?

- Published

The claim: Leaving the European Union would create a year-long recession.

Reality Check verdict: The Treasury analysis gives two scenarios, described as "shock" and "severe shock". Both point to a recession in the short term, but in the case of the lesser "shock" scenario, while there would be an impact on the economy, the predicted recession would be very mild and well within the bounds of forecasting uncertainty.

The Treasury has released its analysis of the short-term effects of a vote to leave the European Union - that's what would happen in the two years after 23 June.

And it's not pretty - the Treasury predicts, external that economic growth would decline, wages would be lower than if we'd stayed in and house prices would fall.

If you're prepared to be influenced by economic modelling (read our Reality Check on the subject here) then there is a simple message, which is that in the first two years, a vote to leave the EU would be a considerably bad thing for the economy.

If you want to go a bit further into the figures, there is more to say.

The Treasury no longer does economic forecasts - that job has now been given to the independent Office for Budget Responsibility (OBR).

What the Treasury is doing is what it calls scenario analysis, which is taking what would happen if we stayed in the EU as a base-line and then considering what the impact would be were we to leave.

So all the figures you see today are not how much worse things would be than they are today. They are how much worse things will be in two years if we leave the EU, than they would have been if we stayed in.

'That's a recession'

The Treasury has modelled two scenarios, the "shock" and the "severe shock" scenarios.

The shock scenario is what it reckons would happen if the country decided to negotiate a bilateral agreement to cover its relationship with the EU. The severe shock scenario is what would happen if we decided to trade as just another World Trade Organisation member, with no special relationship with the EU.

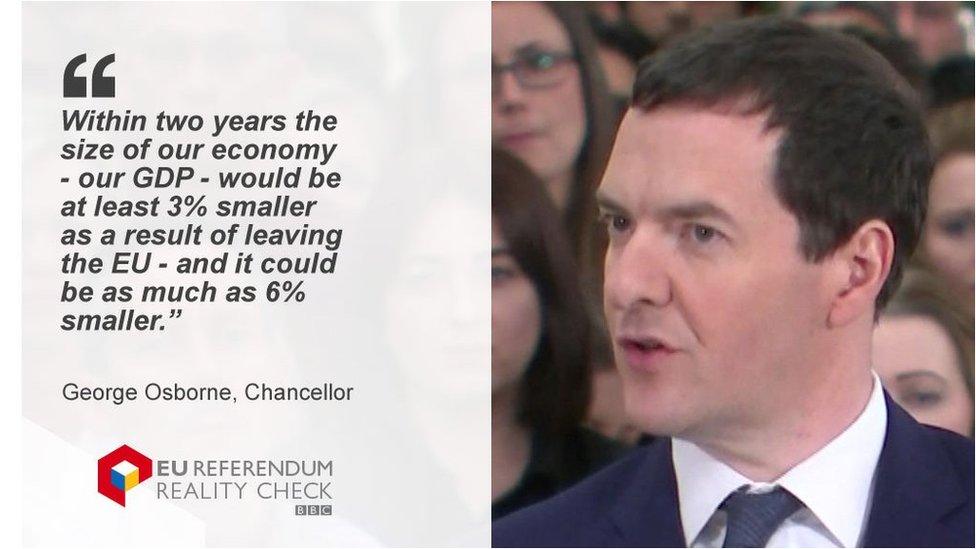

The Chancellor said in his speech: "Within two years the size of our economy - our GDP - would be at least 3% smaller as a result of leaving the EU - and it could be as much as 6% smaller."

"We'd have a year of negative growth - that's a recession."

But that doesn't mean it will be smaller than it is now, it means it will be smaller than it would have been had we stayed in.

If you compare that with the OBR's forecast for what will happen to the economy over the next couple of years (assuming we stay in) it turns out that under the shock scenario, in the first four quarters after the vote to leave, the economy would contract by 0.1% every quarter.

A recession is when you get at least two consecutive quarters (three month periods) in which the economy gets smaller. So that would be a recession, but not by very much. It would be well within the degree of uncertainty surrounding this sort of economic analysis.

Under the severe shock scenario, the expected contraction would be much more severe: - 1% in the first quarter and -0.4% in the following three quarters, before registering negligible growth in the following year.

The same may be done with other predictions in the report.

For example, the Treasury predicts house prices in two years would be between 10% and 18% lower than they would be if we had stayed in. The OBR forecasts house prices will rise by about 10% over that period, so if you put those predictions together for the two scenarios you get prices being either flat or falling by 8%.

- Published21 March 2016

- Published23 May 2016

- Published22 February 2016