EU exit could add two years to austerity, IFS says

- Published

The UK could face an extra two years of austerity measures if it votes to leave the EU, the Institute for Fiscal Studies has said.

The consensus of economists was that the UK economy would shrink after an EU exit, the think tank said.

It warned ministers could react to a post-Brexit GDP fall with either deeper cuts, or by extending them.

But UKIP leader Nigel Farage said the IFS was biased because it was part-funded by the EU.

He told BBC News: "They take direct funding from the European Union.

"So, once again, it's the same old game. It's taxpayers money being used to tell us what we should think and what we should do. And frankly the scale of this now is outrageous.

"The government and all their friends - taxpayer-funded friends - are frankly cheating in this referendum by selling this constant negative message."

IFS director Paul Johnson told BBC Radio 4's Today programme, his organisation got "about 10% of our income from something called the European Research Council, which is an independent arms-length body which funds world-class academic research".

But he added: "For the last 30 years, the IFS has really built its reputation on the independence and integrity of our work, and actually there is no sum of money from anywhere in the world which would influence what we said".

'Further austerity'

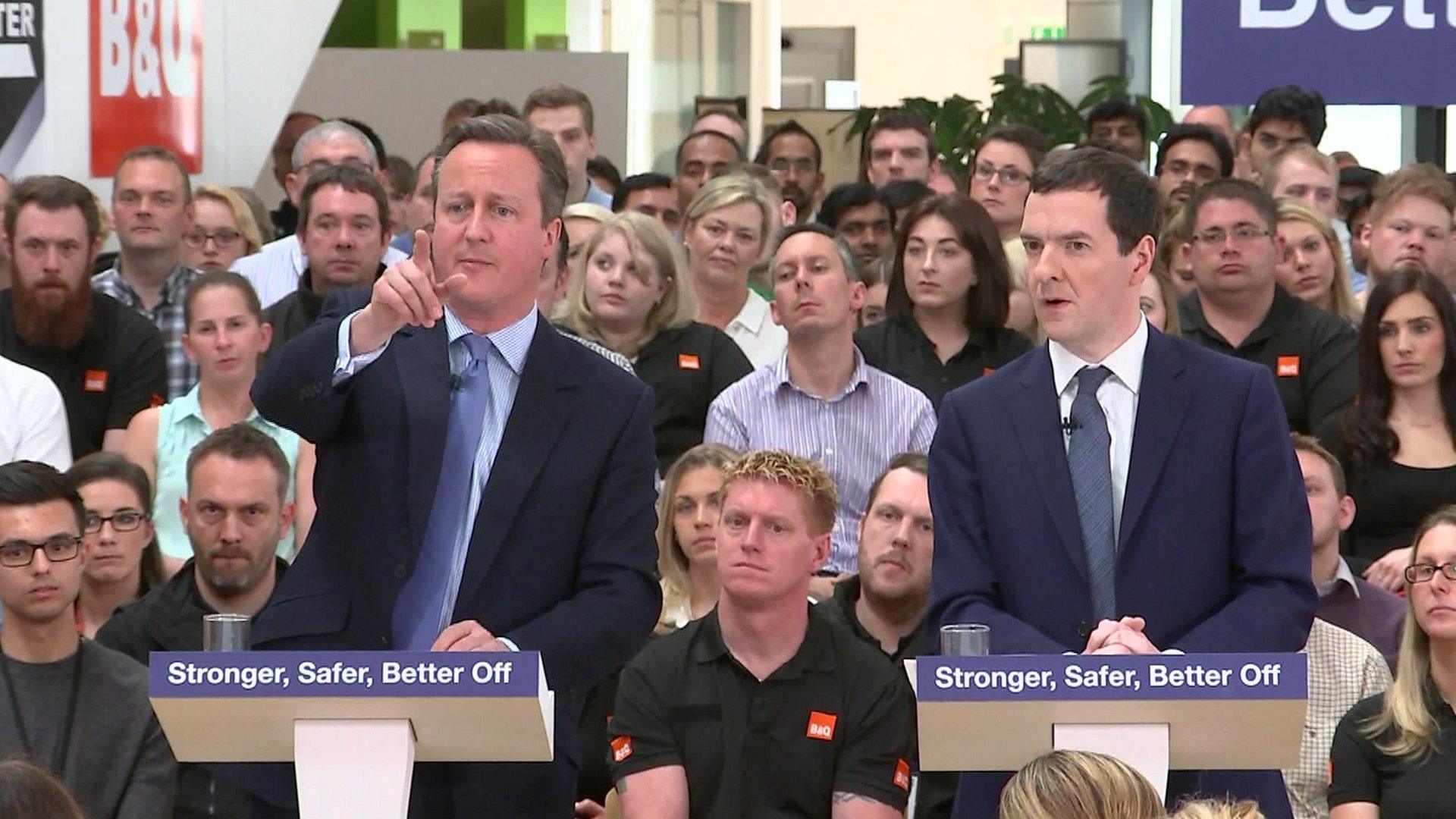

Prime Minister David Cameron said the IFS was the "the gold standard in independent, impartial economic forecasting and commentary in our country".

The IFS assessment comes as a dozen former senior military officers have warned that the EU's policies are undermining the UK's combat effectiveness.

Speaking out in favour of Britain leaving the EU, they said Nato, and not the EU, should remain the cornerstone of Europe's defence.

More than 300 historians, meanwhile, have written, external to The Guardian saying Britain has an "irreplaceable role to play in Europe" and warning against "condemning ourselves to irrelevance" by leaving.

The IFS said a vote to leave could result in a £20bn to £40bn hit to the public finances in 2019/20, if GDP was 2.1% to 3.5% lower over the period, as predicted by the National Institute of Economic and Social Research (NIESR).

Paul Johnson, IFS director and an author of the report, said: "Getting to budget balance from there, as the government desires, would require an additional year or two of austerity at current rates of spending cuts."

The IFS said the UK could use its contribution to the EU - estimated at £8bn a year - to help shore up its finances if it voted for Brexit.

However, it said this could be overshadowed by the negative impact on the UK economy, with a 0.6% fall in national income offsetting the benefits.

Mr Johnson said: "Leaving the EU would give us an immediate £8bn boost to the public finances, but the overwhelming consensus is that the economy would be smaller than otherwise following Brexit.

"If the economy is just a few percentage points smaller than it otherwise would have been, we will be a bit worse off."

Analysis by Kamal Ahmed, BBC economics editor

The IFS's report on the impact on the public finances of Brexit is different from the myriad of economic reports flowing from organisations as diverse as the International Monetary Fund and Economists for Brexit.

Rather than do its own economic modelling, the IFS has taken the mid-point of most of the major reports on the possible referendum impact and built its analysis from that.

It judges that mid-point to be closest to the National Institute of Economic and Social Research study which suggested that Brexit could leave the UK economy between 2% and 3.5% smaller than under a remain scenario.

From that the IFS uses a simple economic model that suggests that for every 1% decline in GDP, the government needs to raise an extra £14bn due to lower tax receipts.

Of course, if the economic impact of Brexit is - in the long run - positive, as some economists argue, then the impact on the public finances would also be positive.

The UK "could perfectly reasonably decide that we are willing to pay a bit of a price for leaving the EU and regaining some sovereignty and control over immigration and so on", Mr Johnson said.

"That there would be some price though, I think is now almost beyond doubt."

But Vote Leave's John Redwood said the IFS was in the "cosy establishment" and the UK was better off out of the EU.

Speaking on BBC Radio 4's Today programme, he disputed the forecasts used in the report, and said savings made from quitting the EU would mean austerity would not be needed.

But on Twitter Andrew Lilico, the chairman of Vote Leave-affiliated Economists for Britain, distanced himself from the criticisms of what he called the Leave campaign's "propaganda arm", external.

Patrick Minford, co-chairman of a separate group, Economists for Brexit, said that the IFS analysis acknowledged that the free trade approach recommended by his organisation "would be the best option for the UK following an exit from the EU".

Gerard Lyons, his co-chairman, added: "The UK needs to break away from the short-termism and the groupthink that had dominated UK policy making and embrace Brexit as this is the best way to position the economy for longer-term future growth."

Subscribe to the BBC News EU referendum email newsletter and get a weekly round-up of news, features and analysis on the campaign sent straight to your inbox.

- Published25 May 2016

- Published25 May 2016

- Published25 May 2016

- Published24 May 2016

- Published23 May 2016

- Published22 May 2016