Reality Check: Is pound weakness due to market errors?

- Published

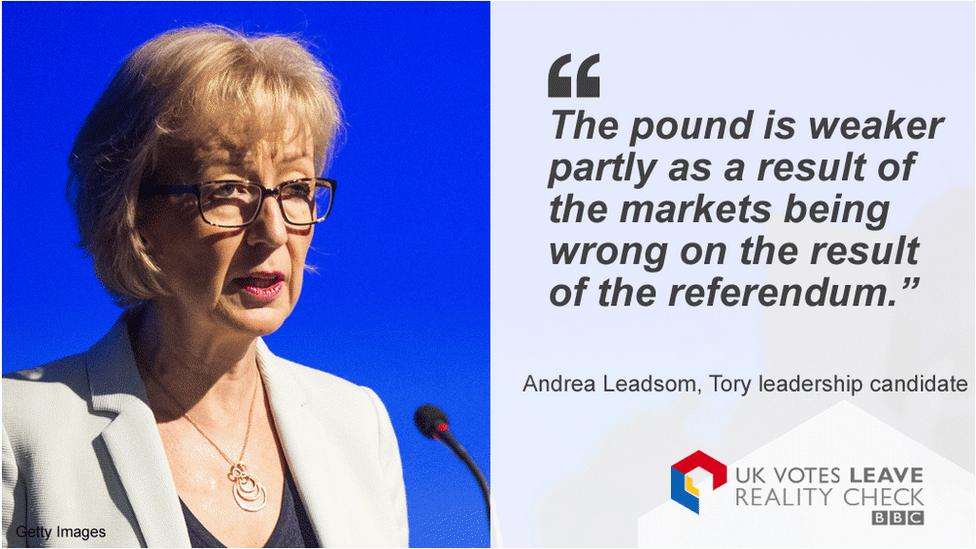

The claim: Part of the reason the pound is weaker is that the markets thought the UK would vote to stay in the EU.

Reality Check verdict: Currency market moves on the day of the referendum suggest that the markets did indeed predict the wrong result, but it is hard to argue that the pound would now be at a different level if they had predicted correctly.

Conservative Party leadership candidate Andrea Leadsom gave a very upbeat speech on Thursday morning, urging her followers to "banish the pessimists".

"Already we can see that the forecasts of a disaster for sterling, for equities and for interest rates have not been proven correct," she said.

"The pound is weaker, partly as a result of the markets being wrong on the result of the referendum and partly on the expectation of further interest rate easing."

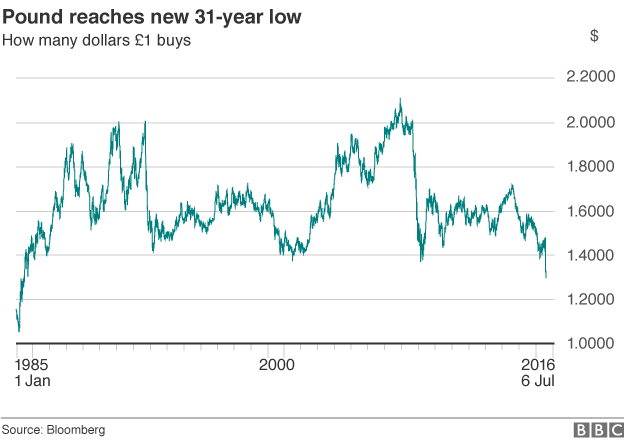

The pound is at its lowest rate against the US dollar since 1985 and it is hard to argue that that weakness is due to the markets getting their referendum predictions wrong.

You could argue that the pound would not have risen to $1.50 on the day of the referendum if investors had not been expecting a remain vote, but would that have made much difference to its current rate?

"It's come down and it's stayed down, so it seems hard to say this was about a short-term reaction," says Simon Derrick, head of currency research at Bank of New York Mellon.

Mr Derrick adds that much of the reason for the falling pound is that Bank of England governor Mark Carney had been talking about cutting interest rates from their already record low levels and the pound being at levels that make exporters more competitive.

- Published5 July 2016

- Published30 June 2016

- Published22 February 2016