Tax and spend: What are experts saying about Scottish figures?

- Published

Economic experts have their assessment of the latest Scottish figures on taxation and spending. The statistics appear in the annual report of Government Expenditure and Revenue Scotland (GERS), external, which is seen as a guide to the health of Scotland's public finances.

John McLaren, Centre for Public Policy for Regions (CPPR)

'Good, but not definitive'

"The latest information contained within the report was much as had been suspected.

"Scotland's fiscal balance worsened considerably between 2011-12 and the latest year 2012-13, going from a deficit of £4.6 billion to one of £8.6 billion.

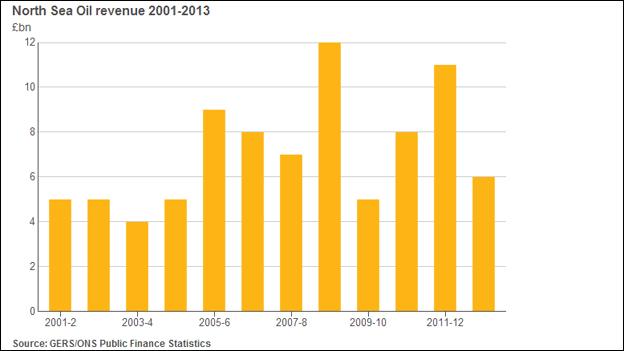

"This was due in the main to a large decline in North Sea tax revenues, which fell by over 40%.

"As around 90% of UK North Sea revenues are allotted to Scotland, based on a geographic share, this means that Scotland's fiscal balance relative to the UK has also worsened. In 2011-12, Scotland had a relatively better fiscal balance than the UK, when measured as a percentage of GDP and in terms of per head of population. In 2012-13, that position has reversed and the UK is in a slightly better position. Over the last five years, the two countries have averaged similar fiscal balances.

"While Gers gives as good a picture as we have of Scotland's finances, it is not definitive. On North Sea tax revenues in particular the waters are muddied by a lack of certainty.

"For example, Her Majesty's Revenues and Custom, HMRC, have estimated a different tax share from the North Sea for Scotland. HMRC and Scottish Government statisticians are currently liaising to try and rectify this variance.

"GERS gives us a useful insight into past fiscal balances but is not of great use for understanding the future position.

"North Sea revenues are highly erratic, caused by price and production fluctuations; Scotland's geographic share of North Sea tax revenues fell from £7.5bn in 2010-11, rose to £10 bn in 2011-12, but fell again to £5.6 bn in 2012-13. So, whilst GERS 2014 offers an insight, far more analysis of the future is needed given the erratic nature of this key income stream."

Alex Kemp, University of Aberdeen

'Investment activity linked to Scottish sector'

"The oil and gas estimates for the Scottish shares of oil and gas production and tax revenues reflect modelling undertaken by myself and Linda Stephen at the University of Aberdeen.

"The UK Continental Shelf was divided between the Scottish sector and the rest of the UK on the basis of the median line principle. A large financial model incorporating all the complex tax terms currently in place was applied to a large field database incorporating all the currently producing fields and those sanctioned but not yet in production.

"The figures for production of oil, gas, and total hydrocarbon production (including NGLs), and field development, operating and decommissioning costs were then calculated for the Scottish and rest of UK sectors. To estimate tax revenues allowance has also to be made for exploration and appraisal costs, loan interest, R&D costs and non-field specific (but deductible) overheads.

"Total exploration and appraisal costs for the UKCS were allocated between Scotland and the rest of the UK on the respective numbers of wells in the two sectors, and the wells in the Scottish sector were calculated to be much more expensive than those in the rest of the UK sector. The allocation of loan interest and R&D costs was based on the percentage of total field development costs in the Scottish sector compared to the rest of the UK. Overhead costs were allocated according to the percentage of total operating costs in the Scottish sector compared to the rest of the UK sector. All the modelling was undertaken on a calendar year basis.

"The results for aggregate production, expenditures, and tax revenues were checked and confirmed for consistency with published data for the UKCS.

"The results indicate that the Scottish share of total oil production has been in the range 96%-97% over the past few years. The Scottish share of gas production has fallen from 61% in 2009 to 48% in 2012.

"The significant downtime in some fields in the Scottish sector in 2012 was a key factor. The consequence is that the Scottish share of total hydrocarbon production has fallen from 82% in 2009 to 76% in 2012.

"As a further consequence of this, plus the higher cost inflation in the Scottish sector compared to the rest of the UK, the Scottish share of tax revenues has fallen from its historic peak of 96% in 2009 to 84% in 2012.

"Future production and tax revenues in the two sectors will reflect the fruits of the current investment boom and future oil and gas prices. A very high proportion of current investment activity relates to the Scottish sector."

Tony Mackay, Mackay Consultants

'Scottish budget deficit will worsen'

"The annual Gers publication is always of great interest to economists like me because it contains a lot of very interesting and useful statistics which I use frequently throughout the year. Unfortunately it has become increasingly politicised in recent years, to the annoyance of my economist friends in the Scottish government. This latest Gers report is no exception, not surprisingly given the independence referendum in September.

"It estimates total public sector spending in Scotland in the 2012-13 financial year at £65.2bn. Public sector revenue, excluding North Sea oil and gas, is estimated at £47.6bn, implying a deficit of £17.6bn.

"If North Sea revenues are included on the assumption that about 90% are from oil and gas fields in Scottish waters, they rise to about £53.1bn. However, that still leaves a deficit of about £12bn in 2012-13. That is obviously very embarrassing for the SNP government.

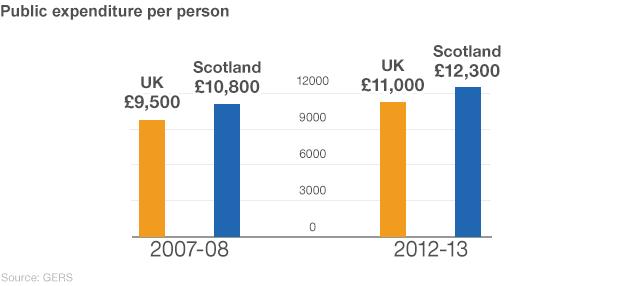

"There can be no doubt that public sector spending per person is higher in Scotland than the UK average and that has long been the case. There are two main reasons for that. Firstly, the large geographical area means that the costs of providing schools, roads and many other public services are more expensive, particularly in rural areas like the Highlands and Islands.

"Secondly, the historical dominance of the Labour Party of many local authorities resulted in higher-than-average public spending. That trend has continued at the Scottish level under the current SNP government.

"The critical issue is clearly the North Sea oil and gas tax revenues. These have been very high in recent years because of high oil prices, with Brent crude trading at over $100 per barrel. However, the Gers report states that these fell by -41.5% between 2011-12 and 2012-13.

"I am very surprised at the magnitude of that fall. However, UK oil production is currently declining at about -10% per year, although there may be a temporary increase until about 2017 because of new fields being developed in the West of Shetland area. The long term trend is undoubtedly downwards.

"Further, operating and development costs in the North Sea have risen substantially, which implies lower tax revenues, and there is the added complication of the costs of decommissioning fields such as Brent and Murchison when they cease production. Those costs can be set against the oil industry's tax bills.

"The obvious conclusion from the latest Gers report for any objective economist is that the Scottish budget deficit will worsen over the next decade."

Roger Cook, The Scotland Institute

'Expenditure broadly similar to last year'

"Overall, revenues in Scotland are similar to last year. If North Sea oil is excluded, Scotland accounts for 8.2% of the UK total, and is estimated to be £47.6bn compared to £46.3bn in 2011/12. However, if oil is included (on a geographical basis), then estimated revenues in Scotland have fallen from £56.9bn (9.9% of the UK total) to £53.1bn (9.1% of UK total), a significant drop of £3.8bn.

"Expenditure is also broadly similar to last year having increased from £64.5bn (9.3%) to £65.2bn (9.3%).

"The estimated Scottish share of the budget deficit can be calculated in three ways: as a share of GDP without oil; as a share of GDP with oil allocated on a per capita basis; or, as a geographical share. Each of these gives different answers:

•Deficit (no oil) has increased slightly from£14.0bn to £14.2bn (11.2% of GDP)

•Deficit (per capita oil allocation) has increased from £13bn to £13.6bn (10.6%)

•Deficit (geographical oil allocation) has increased substantially from £3.4bn to £8.6bn (5.9%)

"The overall UK deficit has worsened from -£88.6bn to -£91.9bn.

"The obvious change, compared to 2012/13, is in terms of estimated revenues from North Sea oil especially as the geographic basis is the best estimate of the financial situation of an independent Scotland. The drop in income is related to "a combination of unplanned production stoppages at several large gas fields and higher levels of maintenance activity in the North Sea.

"Secondly, capital investment in the North Sea has risen in recent years."

Analysis compiled by Martin Currie, BBC news online

- Published12 March 2014

- Published12 March 2014

- Published12 March 2014