Key points: Smith Commission report

- Published

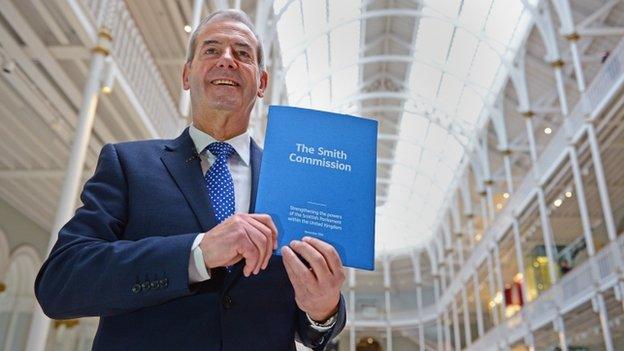

The cross-party Smith Commission on further devolution has recommended the Scottish Parliament be given new powers over some taxes and welfare payments.

The commission's chair, Lord Smith, said the changes would "deliver a stronger parliament, a more accountable parliament and a more autonomous parliament".

Here are some of the main points from the report, which can be read in full here, external.

Taxation

Income Tax

The report states that income tax will remain a shared tax and both the UK and Scottish Parliaments will share control of income tax. MPs representing constituencies across the whole of the UK will continue to decide the UK's Budget, including income tax.

But within this framework, the Scottish Parliament will have the power to set the rates of income tax and the thresholds at which these are paid for the non-savings and non-dividend income of Scottish taxpayers.

There will be no restrictions on the thresholds or rates the Scottish Parliament can set.

All other aspects of income tax will remain reserved to the UK Parliament, including the imposition of the annual charge to income tax, the personal allowance, the taxation of savings and dividend income, the ability to introduce and amend tax reliefs and the definition of income.

The Scottish government will receive all income tax paid by Scottish taxpayers on their non-savings and non-dividend income, with a corresponding adjustment in the block grant it receives from the UK Government.

Given that income tax will still apply on a UK-wide basis, albeit with different rates and thresholds in Scotland, it will continue to be collected and administered by HMRC.

The Scottish government will reimburse the UK government for any additional costs.

Value Added Tax (VAT)

The receipts raised in Scotland by the first 10 percentage points of the standard rate of VAT will be assigned to the Scottish government's budget.

These receipts will be calculated on a verified basis, to be agreed between the UK and Scottish governments, with a corresponding adjustment to the block grant received from the UK government.

Air Passenger Duty

The power to charge tax on air passengers leaving Scottish airports will be devolved to the Scottish Parliament. The Scottish government will be free to make its own arrangements with regard to the design and collection of any replacement tax, including consideration of the environmental impact.

Again, the Scottish government's block grant from Westminister will be adjusted accordingly.

Aggregates Levy

Once the current legal issues in relation to Aggregates Levy have been resolved, the power to charge tax on the commercial exploitation of aggregate in Scotland will be devolved to the Scottish Parliament. The Scottish government will be free to make its own arrangements with regard to the design and collection of any replacement tax

Other Taxes

All aspects of National Insurance Contributions, Inheritance Tax and Capital Gains Tax, Corporation Tax, Fuel Duty and Excise Duties will remain reserved, as will all aspects of the taxation of oil and gas receipts.

The commission has called on the UK and Scottish governments to work together to avoid double taxation and make administration as simple as possible for taxpayers.

Barnett Formula

The report says the devolution of further responsibility for taxation and public spending, including elements of the welfare system, should be accompanied by an updated fiscal framework for Scotland.

It says the Barnett Formula should continue, but the revised funding framework should result in the devolved Scottish budget benefiting in full from policy decisions by the Scottish government that increase revenues or reduce expenditure, and the devolved Scottish budget bearing the full costs of policy decisions that reduce revenues or increase expenditure.

Borrowing Powers

Additional borrowing powers should be provided to "ensure budgetary stability and provide safeguards to smooth Scottish public spending in the event of economic shocks", the commission said.

The Scottish government should also have sufficient borrowing powers to support capital investment.

Benefits, welfare and pensions

State pension

All aspects of the state pension will remain shared across the United Kingdom and reserved to the UK Parliament. This includes the new single-tier pension, any entitlements to legacy state pensions whether in payment or deferred, pension credit and the rules on state pension age.

Universal Credit

Universal Credit (UC) will remain a reserved benefit administered and delivered by the Department for Work and Pensions (DWP).

However, the Scottish government will be given the power to change the frequency of UC payments, vary the existing plans for single household payments, and pay landlords direct for housing costs in Scotland.

The Scottish Parliament will also have the power to vary the housing cost elements of UC, including varying the under-occupancy charge and local housing allowance rates, eligible rent, and deductions for non-dependents.

But the power to vary the remaining elements of UC and the earnings taper will remain reserved. Conditionality and sanctions within UC will also remain reserved.

Benefits devolved outside Universal Credit

Powers over the following benefits in Scotland will be devolved to the Scottish Parliament:

Benefits for carers, disabled people and those who are ill: Attendance Allowance, Carer's Allowance, Disability Living Allowance (DLA), Personal Independence Payment (PIP), Industrial Injuries Disablement Allowance and Severe Disablement Allowance.

Benefits which currently comprise the Regulated Social Fund: Cold Weather Payment, Funeral Payment, Sure Start Maternity Grant and Winter Fuel Payment.

Discretionary Housing Payments.

The Scottish Parliament will have complete autonomy in determining the structure and value of these benefits or any new benefits or services which might replace them.

Benefits reserved outside Universal Credit

Responsibility for the following benefits will remain reserved to Westminster

Bereavement Allowance,

Bereavement Payment,

Child Benefit,

Guardian's Allowance,

Maternity Allowance,

Statutory Maternity Pay,

Statutory Sick Pay,

Widowed Parent's Allowance.

Powers to create new benefits

The Scottish Parliament will have new powers to create new benefits in areas of devolved responsibility, as well as new powers to make discretionary payments in any area of welfare without the need to obtain prior permission from the Department of Work and Pensions at Westminster.

Employment provision

The Scottish Parliament will have all powers over support for unemployed people through the employment programmes currently contracted by the Department of Work and Pensions, such as the Work Programme and Work Choice, when the current commercial arrangements expire.

The Scottish Parliament will have the power to decide how it operates these core employment support services.

Jobcentre Plus will remain reserved.

Minimum Wage

The National Minimum Wage will remain fully reserved to Westminster

The Constitution and other areas

Permanence of the Scottish Parliament

UK legislation will state that the Scottish Parliament and Scottish government are permanent institutions.

Elections

The Scottish Parliament will have full powers over elections to the Scottish Parliament and local government elections in Scotland.

The parties on the commission have called on the UK parliament to devolve the relevant powers in sufficient time to allow the Scottish Parliament to extend the franchise to 16 and 17-year-olds for the 2016 Scottish Parliamentary elections, should the Scottish Parliament wish to do so.

Holyrood will also be given powers to make decisions about "all matters relating to the arrangements and operations of the Scottish Parliament and Scottish government", including:

Powers over the overall number of MSPs or the number of constituency and list MSPs.

Powers over the the disqualification of MSPs from membership and the circumstances in which a sitting MSP can be removed.

However, any legislation to change the franchise, the electoral system or the number of constituency and regional members for the Scottish Parliament will require to be passed by a two-thirds majority of the Scottish Parliament.

Crown Estate

Responsibility for the management of the Crown Estate's economic assets in Scotland, and the revenue generated from these assets, will be transferred to the Scottish Parliament.

This will include the Crown Estate's seabed, urban assets, rural estates, mineral and fishing rights, and the Scottish foreshore for which it is responsible.

Following this transfer, responsibility for the management of those assets will be further devolved to local authority areas such as Orkney, Shetland, Na h-Eilean Siar or other areas who seek such responsibilities.

The Scottish and UK governments will draw up and agree a Memorandum of Understanding to ensure that such devolution is not detrimental to critical UK-wide matters such as defence, oil and gas and energy.

Broadcasting

There will be a formal consultative role for the Scottish government and the Scottish Parliament in the process of reviewing the BBC's Charter.

The BBC will lay its annual report and accounts before the Scottish Parliament and submit reports to, and appear before, committees of the Scottish Parliament in relation to matters relating to Scotland in the same way as it does in the UK Parliament.

Abortion

The parties called for "serious consideration" to be given to laws over abortion being devolved to Holyrood, and said a process should be established immediately to consider the matter further.

Additional issues for consideration

The parties raised a number of additional policy matters which do not involve the devolution of a power to the Scottish Parliament. Among these, they agreed that the Scottish and UK governments should work together to:

with respect to food labelling, to agree changes to the European country of origin rules so that a 'made in Scotland' brand is recognised under EU law

explore the possibility of allowing students graduating from Scottish further and higher education institutions to remain in Scotland for a defined period of time

explore the possibility of extending the temporary right to remain in Scotland for someone who is identified as a victim of human trafficking

explore different powers being in place in Scotland for asylum seekers to access accommodation and financial support and advice and be able to lodge from within Scotland an asylum claim to the Home Office

ensure that fines, forfeitures, fixed penalties imposed by courts and tribunals in Scotland, as well as sums recovered under Proceeds of Crime legislation, are retained by the Scottish government

review the functions and operations of the Health and Safety Executive in Scotland.

- Published26 November 2014