Taxing questions over Scotland's economic growth

- Published

From a standing start two decades ago, Scotland's business organisations have shown themselves to be exceptionally adept at engaging with devolved politics - although a few individual business leaders still remain remarkably naïve about the democratic motive which drives political decisions.

Further, there can be different perspectives within business: for example, between those representing large firms and those speaking up for smaller outfits.

However, one thing tends to unite all sectors of the disparate business community. They would like our politicians to focus more upon economic growth. Less about the distribution of wealth and more about its creation in the first place.

Such was the clamour once more today as new GDP figures for Scotland were published. But there was also a revival of a controversy which seems set fair to be one of the defining characteristics of political discourse in coming years. Alongside, of course, the ever-present Brexit.

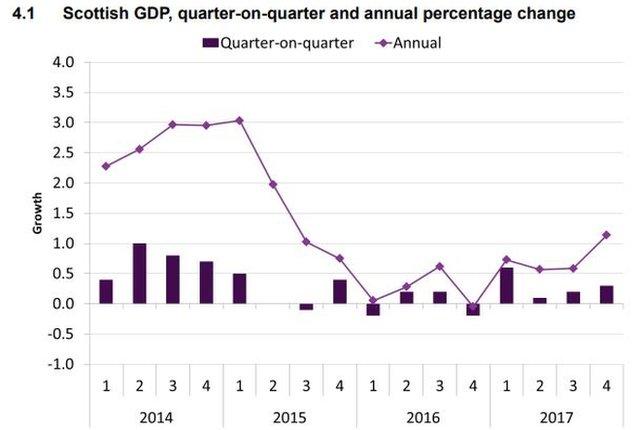

And those figures? Not disastrous by any means. A fourth consecutive quarter of economic growth, with the stats for the final phase of 2017 revealing an increase in GDP in Scotland of 0.3%.

Not bad, then. But by no means good, as business organisations and economic commentators have noted.

The Q4 figure for Scotland still lags slightly behind the figure for the UK as a whole. As does a comparison of the year as a whole, with the previous year. In that scenario, the Scottish economy grew by 0.8%, compared with 1.8% for the UK.

Looked at a different way, Q4 2017 compared with Q4 2016, the figure for Scotland is 1.1%. For the UK as a whole, it is 1.4%. However the sums are done, then, Scotland is lagging behind a UK performance which in itself is scarcely stellar.

Most observers note a particularly poor recent performance in the construction sector. As indicated earlier, all business organisations urge our politicians to co-operate and to concentrate upon policies and practices which enhance the economy.

Which brings us to that fundamental political discourse. The word today from the Tories, both in Holyrood opposition and in Westminster government, was "tax".

They argued, collectively and singly, that there are many remedies which could be essayed in an effort to improve Scotland's performance.

But they added that such efforts would only be hindered by the increase in the overall income tax burden which is about to kick in from the end of this week as a consequence of Scottish government decisions.

In response, Scottish ministers say that their tax decisions were moderate and responsible. That they were designed, further, to counter austerity - and thus stimulate the economy.

They outline measures they have put in place, including plans for a National Investment Bank. They cite the challenge of Brexit - countered by the Tories, who say Brexit will affect the whole UK. That it is up to Scotland as a whole to make the best of "opportunities" outside the EU.

In essence, there, you have the core contentions which will develop between the SNP and the Conservatives in the run-up to the next elections.

There are, of course, many other elements. There are counter offers from Labour, the Liberal Democrats and the Greens, with variations upon spending, tax and Brexit. But there remains one fundamental controversy. Given the wider economic context, Brexit and all, will those new tax plans help or hinder the Scottish economy?

- Published4 April 2018