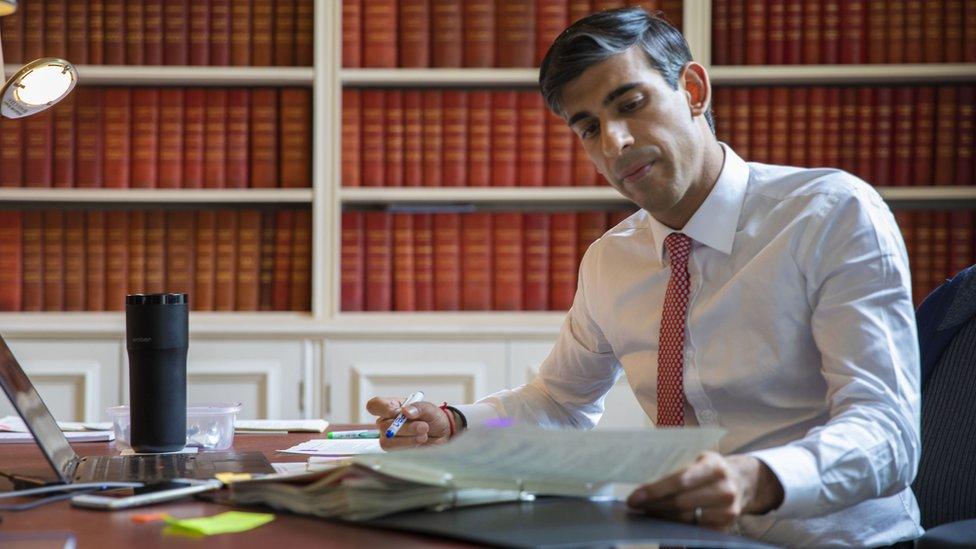

What does Chancellor Rishi Sunak's statement mean for Scotland?

- Published

UK government Chancellor Rishi Sunak has made a Summer statement mini-budget announcement aimed at minimising the economic impact in the wake of the coronavirus pandemic. Some of the measures directly affect Scotland while others will result in about £800m more for the Scottish government to distribute as they choose.

VAT

The VAT cut from 20% to 5% runs from next Wednesday to 12 January. It covers food, accommodation and attractions, including cinemas.

This applies across the UK.

Don't assume that it will reduce the cost of going to the pub or restaurant. It's more likely to be seen by businesses as a boost to their finances. They get to keep more of your bill.

The point is not to entice people into eating or drinking by lowering prices, or at least that's not seen as the main problem: the challenge is the caution people feel about going out, and the lower capacity while social distancing remains in place.

Eat out to help out

This scheme is intended to entice people back into restaurants and pubs serving food, with the government paying half your bill, up to £10 per person, on a Monday to Wednesday.

Restaurants have to register, and can claim back the funds, with the promise of funds in their bank accounts within five days of filing a claim.

Furlough 'bonus' scheme

The chancellor rejected calls to extend the furlough scheme beyond the end of October, saying it had to be wound down, and was bad for the economy to have people kept off work for any longer.

But he sugared that bitter prospect with a commitment that could cost up to £9bn.

For everyone furloughed, who remains in employment from November to January, subject to a minimum earnings level of £520 per month (about 90% of those furloughed), there will be a £1,000 bonus for employers.

This scheme, like the current furlough scheme, applies to Scotland.

Kickstart jobs for young people

We already knew about the £2.1bn Kickstarter scheme to create more jobs for those under 25.

The fund will subsidise six-month work placements for young people on Universal Credit who are at risk of long-term unemployment.

There are conditions to ensure the system is not gamed, so there has to be proof that these are new jobs.

The measures that don't apply in Scotland

UK Chancellor Rishi Sunak also announced a range of measures that do not apply directly in Scotland due to devolution.

These will result in funds being available through the formula which calculates how much UK expenditure Scotland receives.

A home buyer in England, for up to £500,000, won't have any stamp duty (transaction tax) to pay, as of today. This is to stimulate transactions in the property market. There's funding in lieu of doing something similar in Scotland, but is that a priority for Holyrood, with Land and Buildings Transaction Tax, or simply a way of boosting house prices?

There are vouchers of £5,000, rising to £10,000 on those on low income, to make energy-efficient home improvements to homes in England, available to home owners and to landlords. Money should be heading north as a result. Could the system be designed differently to tackle different housing issues in Scotland?

Employers get £1,000 extra to take on young apprentices and £1,500 for those aged over 24. The apprenticeship system is different in Scotland. It is popular as a focus for spending, but are these grants, and at that level, the best way to spend extra money becoming available? Any changes may have to mesh with measures being taken by the Department for Work and Pensions (DWP). With an extra £1bn to help jobseekers, the DWP has a wide remit in Scotland, but shares some powers and responsibilities with Holyrood.

- Published8 July 2020

- Published8 July 2020