Coronavirus: More Scots could live for longer on their savings

- Published

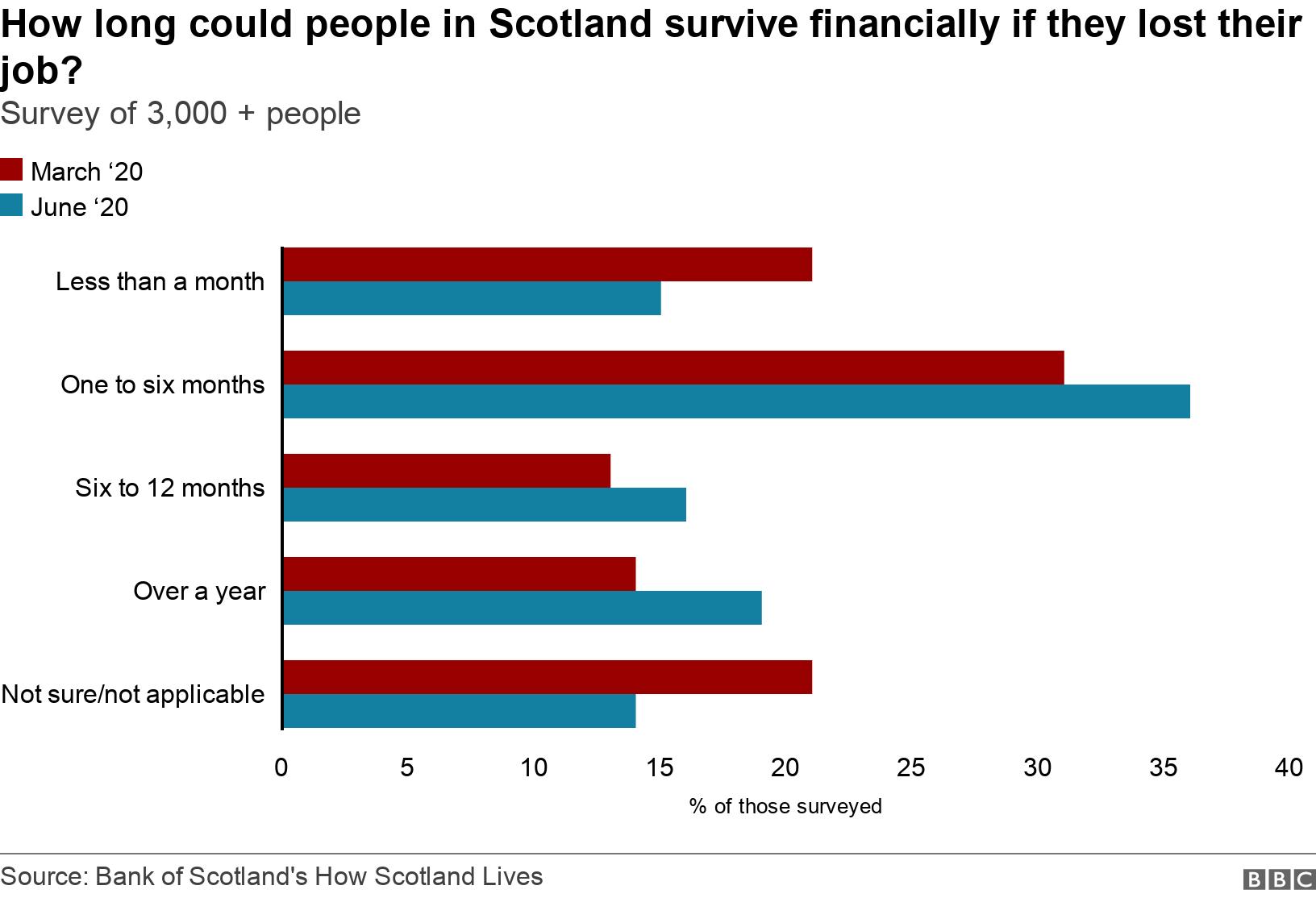

People in Scotland are more confident now about how they could cope with unemployment than they were before lockdown, a survey has suggested.

Research by the Bank of Scotland found more people felt they could survive for up to a year on their savings.

With holidays cancelled and socialising curtailed by the pandemic, more people put away money and paid down debts.

And those on lower incomes appeared to have taken the greatest steps to increase financial stability.

Before lockdown 21% of Scots asked said they would not be able to cover outgoings for a month if they lost their job.

Five months after the UK was locked down to prevent the spread of coronavirus, that figure has fallen to 15%.

Citizens Advice Scotland warned that households without any savings tended to be the most vulnerable, with low and often unstable incomes.

They included people on social security or those who were working on short-term contracts.

'Financial anchor'

The Bank of Scotland report also found that:

More than a third of those asked (36%) could survive for between one and six months (up from 31% in March)

A total of 16% could make ends meet for six to 12 months (up from 13%)

Almost one in five (19%) said they could make ends meet for more than a year (up from 14%)

The findings come from two surveys conducted by You Gov for the Bank of Scotland's How Scotland Lives research.

The bank said more than 3,000 people living in Scotland were interviewed for each survey.

Other findings include:

Of those on a very low income (£10,000 - £14,999), 20% said they could make ends meet for just a few weeks, down from 30% in March

About a quarter of people (26%) with a household income of between £15,000 and £19,999 could not last a month if they lost their jobs, down from 30%

And people in the Highlands were the most likely to be able to survive longer than a year on their savings

Ricky Diggins, of the Bank of Scotland, said: "We often find that during periods of economic uncertainty, people choose to put more money away, pay down their debts, to try and anchor themselves financially."

He said during lockdown there had been a "concerted effort" by many Scots to save where possible.

"There is no doubt that empty social calendars and reduced travel costs gave some families an opportunity to save more money each month, but it is also clear that while low income households have improved their financial position somewhat, they are still more exposed to the impact of a financial shock."

Citizens Advice Scotland spokesman Myles Fitt said there were "significant numbers" of people who did not have any savings at all.

"Our expert advisers are always willing to help people maximize their income and manage their finances, so we would urge anyone in this situation to contact us. Our advice is free, confidential and impartial," he said.