How does the Westminster Budget affect Scots?

- Published

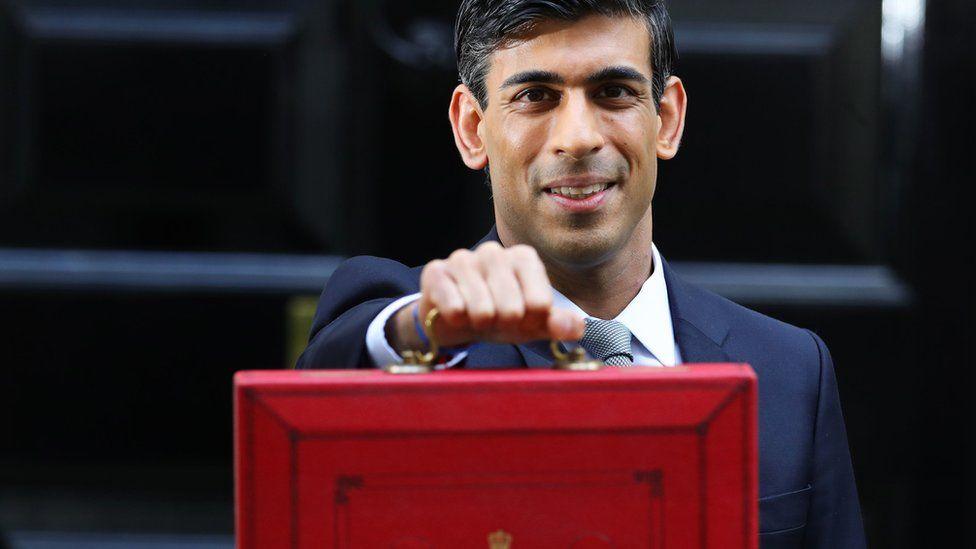

How much of Rishi Sunak's Budget applies to Scots? What of business incentives?

What policy choices don't cross the border, and mean more funds for Holyrood?

What is the politics of direct spend in Scotland, and of Brand Rishi? Some questions answered.

It's felt like a festival of budgeting, as the Holyrood version goes in search of a majority of MSPs - more on that next week - and as Rishi Sunak extends a one-hour speech into a week-long extravaganza of pre-announcements and post-match analysis.

Instead of hiding in Whitehall with his bean-counters, which is the convention, the chancellor has been managing expectations with broadcast and newspaper interviews. The Treasury is even branding the budget with its own logo.

The Rishi brand is being strongly promoted, with little evidence that links are being made to the Boris brand or, indeed, the Brexit one.

With so much in advance, the wholly-new bit on Budget day didn't come from the Treasury at all, but from the Office for Budget Responsibility. It costs the policy choices and forecasts for growth, on which the chancellor then has to base his arithmetic.

And it came up with some chunky numbers: £355bn being borrowed this year (less than it thought before): £243bn forecast for borrowing next financial year (a lot more than expected): 4% growth this year and 7.3% in 2022 (assuming a powerfully elasticated rebound after lockdown).

The other crucial number is the extremely low rate at which the UK government can borrow, so this splurge of borrowing and spending looks cost-free. That's unless borrowing costs go up, which is what they did last week in the USA, as the market expressed alarm at the scale of debt being issued.

Enough of the big picture. For Scots who wonder how much this affects them, here are some questions, and some answers:

Which bits of the Budget affect Scots?

A lot of it is UK-wide, but not all. That includes extension of the furlough scheme until September, along with its partner scheme for self-employed income support. Both are run through the IT systems for HM Revenue and Customs.

Most of the welfare system, though not all, is controlled from the Department for Work and Pensions, based in London. The £20 weekly uplift in Universal Credit is being continued for six months, and applies across the UK.

VAT on hospitality has been at 5% for nearly a year, down from 20%. That continues until September, and then goes up to 12.5% until April 2022. The sector finds that very welcome, but would have preferred it to extend to alcohol.

The starting rate for paying income tax goes up for the whole UK to £12,570 - a rise of £70, and that's where it will stay until 2026.

That is the only part of income tax that is not devolved to Holyrood, so the freeze on all other thresholds and on the rates at each level will not affect Scottish income tax payers.

That policy does, however, feed through to the block grant formula for Holyrood, meaning more money should flow north, and make it easier for Holyrood also to freeze its thresholds and collect more as a result of people moving up to higher bands.

Also affecting household finances, fuel duty is avoiding a scheduled increase throughout the UK, while increases are afoot for farmyard use of 'red diesel'.

Alcohol duty is also frozen, meaning a standard bottle of Scotch whisky avoids a 30p price rise.

What about business incentives?

Corporation tax isn't a direct concern of many, but the reversal of policy from cutting it over the past decade to raising it sharply from 2023 - up from 19% of profits to 25%, at least for larger companies - applies throughout the UK.

It is more of an indirect concern for those whose pension funds depend on those profits, or for workers who expect a share of the post-tax pie in their salaries.

Until 2023, there's a big incentive to business to invest, with an eye-catching 130% tax break on investment, and that also applies throughout the four nations.

To help business improve productivity, a UK fund for buying software and for management training will be available to small and medium-scale enterprises.

The Scottish government is offering a business rates holiday for the same retail, hospitality, leisure, tourism and aviation firms that have had it for the past year. Rishi Sunak is not being as generous to these sectors for England: they get a three-month rates holiday, and then a partial cut for the rest of the year.

What doesn't apply to Scots?

When you hear Rishi Sunak talk about apprenticeships, they're probably not in Scotland. There should be funding, however, linked to that announcement, which can be applied to Scotland's different training regime.

Likewise, continued transactions tax reductions to help home buyers. The Scottish government is not treating that as a priority, so a share of the money allocated to that cut can be applied to policies that Scotland has but England does not, such as the council tax freeze.

The chancellor is allocating £5bn to provide restart grants of up to £18,000 for firms that have been forced to close by the pandemic lockdown.

A share of that, about £400m, goes to Holyrood, where ministers can choose to spend it as they wish. It would be surprising if they don't offer something similar.

Money has been found to add to an emergency fund for arts. The policy doesn't cross the border into Scotland, but a £40m share will do so.

If you're wondering why the budget announcement of eight freeports is all English, it's because a Scottish one has not been chosen yet, nor Welsh or Northern Irish. The Treasury is working with the Scottish government on options for adapting the low-tax, deregulated enterprise zones, with an environment slant. The Cromarty Firth looks well placed.

Why is the Treasury spending on specific Scottish projects, and not Holyrood?

The Westminster government has new, legislated powers to ensure it can spend in devolved areas of policy. It was already working alongside the Scottish government to co-fund city and region growth deals.

The Chancellor announced these will be accelerated in Falkirk, Ayrshire and Argyll and Bute, so the total will be spent over 10 years instead of 15.

He also said £27m is going to the Aberdeen area for a transition zone to help the area's economy move from dependence on oil and gas to green energy. A smaller sum is being put into an underwater technology centre in the city.

The Budget includes funding for grassroots sport, which will be available to clubs and councils around the UK.

A £150m fund has been established to help communities buy pubs and other local assets. Again, this is for the four nations.

A "levelling up" fund is a £4.8bn project encouraging local councils to improve infrastructure in parts of the UK that have been left behind by economic development. Much of the talk of levelling up has been about northern England, but this fund applies elsewhere too.

By-passing Holyrood, to have a direct impact on Scotland, is one way Downing Street hopes to find traction with Scottish voters, as a reminder that it is not only the Scottish government providing for them.

The Scotland Office and Treasury like to highlight how much is being spent in Scotland on income support schemes, and in additional funds going to Holyrood through the past year. However, treading where devolved powers have been for 22 years may also become a subject of controversy at the election campaign this spring.

- Published4 March 2021