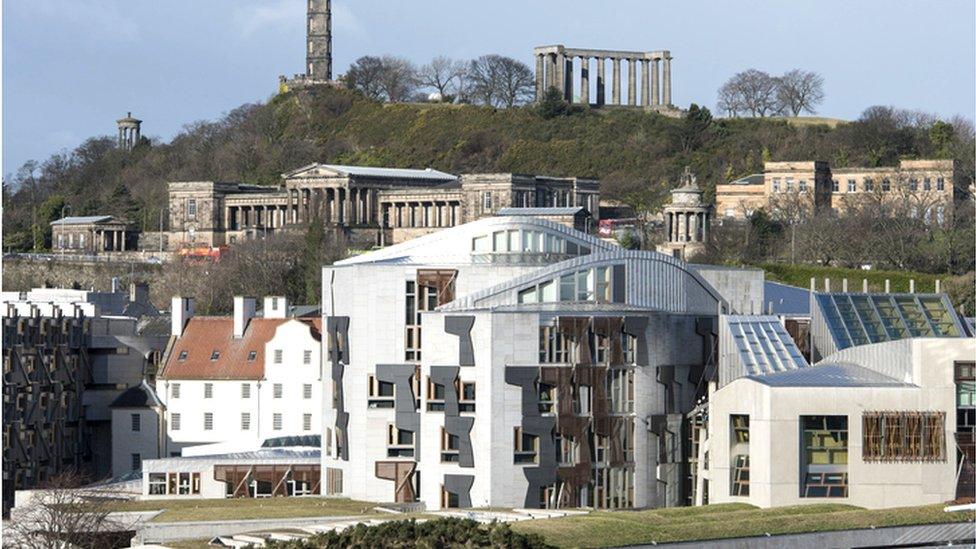

Scottish election 2021: Taxing questions for the campaign

- Published

Holyrood elections used to be about spending promises. They still are. But since the last one, a big, new, dynamic dimension has been added - of tax.

You may not have noticed it.

At the first Scottish Parliament election 22 years ago, the campaign turned on a pledge from the SNP to reverse a Labour government cut of 1p per £1, external in the basic rate of income tax.

Tax powers then were limited and blunt.

Eight years later, the most prominent promise of the incoming SNP administration was to abolish the "unfair" council tax, external.

That did not happen. It was complicated.

Including business rates, air passenger tax and the option of new taxes on tourists, parking or road use, tax options have widened a lot since 1999.

The case for Scottish independence is built on Holyrood taking control of all its spending and taxes (subject, perhaps, to some constraints by the European Union).

It's less clear what might then happen to them, and whether Holyrood's choices would help or hinder the economy.

A poll conducted last month for the Chartered Institute of Taxation pointed to 83% of Scots agreeing that they needed better information on the way taxes were decided in Scotland.

A third of those surveyed were not aware of major changes to control of income tax in the past six years, and a quarter were not aware Holyrood could alter income tax, or reform council tax and business rates.

So if you need to know more, here are some of the tax issues that could affect you and the election campaign.

How will Holyrood balance spending pledges with tax?

Put simply, spending pledges have to be paid for. If not through tax, they are financed by borrowing, particularly in the current crisis. That defers paying to the future, and perhaps to another generation.

But the Scottish Parliament does not have such a straight-forward transaction.

It has limited borrowing powers, much of its finance comes in a block grant from the Treasury in London (two-thirds of non-capital budget in 2020-21) and it's required to balance its budget.

Since 2016, Holyrood has held almost all the powers over income tax in Scotland, so candidates can say which levers they intend to pull to pay for their wish list of election pledges.

Or they can cut taxes, with a high risk that there would then be less to spend on public services or welfare.

These powers have given more flexibility to budgeting, and also brought more uncertainty and risk.

There are only limited borrowing powers to adjust spending if that revenue is not achieved. And these are unpredictable times for public finances.

SCOTLAND'S ELECTION: THE BASICS

What elections are happening? On 6 May, people across Scotland will vote to elect 129 Members of the Scottish Parliament (MSPs). The party that wins the most seats will form the Scottish government. Find out more here.

What powers does the Scottish Parliament have? MSPs pass laws on most aspects of day-to-day life in Scotland, such as health, education and transport. They also have control over some taxes and welfare benefits. Defence, foreign policy and immigration are decided by the UK Parliament.

How do I vote? Anyone who lives in Scotland and is registered to vote is eligible, so long as they are aged 16 or over on the day of the election. You can register to vote online, external.

How does Scottish income tax work differently?

Income tax currently accounts for two-thirds of all the tax revenue under the control of Holyrood. In the new financial year, it is forecast that this will bring in £12,263,000,000.

With the new powers, the tax bands have been changed from three tranches to five, and the basic and higher rates have gone up, to 1p per pound higher than the Westminster rates.

The starting threshold of £12,570 is set at Westminster - the only element that is. Nearly 45% of Scottish adults don't earn that much, so they don't pay income tax.

The lowest Scottish 19% rate means that some people pay £21 less per year than they would on the same pay in the rest of the UK.

Those earning more than £27,393 in Scotland pay more than they would on that pay in England. Earning £50,000, they pay £1,500 more.

So you might expect Holyrood to have more money to spend. The different tax regime raised an estimated extra £456m more last year.

But there's a catch. The Institute for Fiscal Studies reckons, external that £456m more is raised, but because tax take per head is lower, it affects the block grant from Westminster. That way, Holyrood is only £117m better off.

Are taxes going to go up in the next five years?

The answer depends on who is in charge at Holyrood after 6 May, and also on choices made in Downing Street. The latter will decide the point at which the Covid spending taps are switched off, and a squeeze is applied to the deficit.

It looks unlikely there will be as tight a squeeze on public spending as the one applied from 2010 to 2018. There doesn't seem to be the political will for a return to austerity.

But as plans currently stand at the Treasury in London, support for the NHS and schools will be accompanied by a return to squeezing spending programmes that are not a priority.

The Institute for Fiscal Studies has warned that some spending commitments from the Scottish government are being funded by temporary funds to do with the Covid crisis. So retaining them will dig into core funds.

If taxes do go up, MSPs will have to be wary of unintended consequences: of high-earning taxpayers arranging their finances so as to move them out of the reach of Scottish income tax, or of Scotland being perceived as high tax and bad for inward investment.

One way of raising tax is by retaining thresholds for higher rate tax.

By keeping the higher rate at around £43,700, the Fraser of Allander economic institute reckons, external a further 100,000 people will be paying 41% tax over the next five years, taking the total beyond 550,000, or one in five Scottish workers.

When will council tax be replaced?

Council tax was introduced in a rush 30 years ago, to replace the notoriously unpopular poll tax. It is based on bandings of home valuations from 1991.

There should have been a revaluation to bring the system up to date, but politicians fear a backlash from those whose bills would rise.

The system is regressive: those on low incomes typically pay a higher share of their income on it than those on higher incomes.

Freezing it for 11 of the past 14 years has been politically popular, while the benefits of doing so have been skewed towards higher value home-owners.

The replacement promised by the SNP in 2007 was to be a local income tax. It turned out to be administratively difficult to introduce. Politically, it wasn't worth the hassle.

Labour also sought a replacement while it was in government pre-2007, but struggled to agree on one.

Greens have long wanted a local tax that reflects the valuation of land.

Modest changes have been introduced to council tax, increasing the share of revenue from more valuable homes. But movement towards a replacement has been glacial.

Are business rates fit for purpose?

Non-domestic rates, or business rates, are charged on commercial buildings and fixed assets, including offices, shops, factories and warehouses.

For every £1 of notional annual rental cost, nearly 50p is charged in rates each year. For many firms, it is their second biggest cost after payroll.

Those who run digital businesses, where their shopfront is online and overheads are lower, carry a much smaller share of the cost of funding government.

During the Covid crisis, retail, leisure and hospitality has had a business rates holiday. On a semi-permanent basis, there is also a Small Business Bonus Scheme.

But there is pressure to put digital rivals on an equal footing, also leading to a review in England.

If it leads to reform, it would not mean that Scotland has to follow, but it would add to pressure for reform.

A further Holyrood-controlled tax that is a revenue-raiser but a distortion of the market is Land and Buildings Transaction Tax.

That hits home-owners, but only when they buy, so it is a big disincentive for people to move out of homes that are too big or too small for them.

Why is Holyrood not using its power to cut tax on flying?

Air Passenger Tax has been devolved, but it has not changed. The SNP intended to cut it by half, but it was delayed by complex European Union rules and the protection of a hard-won tax exemption for Highlands and Islands take-offs.

SNP ministers then decided to abandon their plan for cutting it, on environmental grounds that it should not act to encourage more flying.

The Westminster government is consulting on a change that could mean tax cuts for internal UK flights, and a wider range of rates depending on length of international journey. At present, there are two rates below and over 2,000 miles.

The Holyrood administration after 6 May will have to decide if it goes along with those Westminster plans.

A further tax that was being partly devolved was VAT - not so that rates could be set by Holyrood, but the sums raised in Scotland could be assigned to Holyrood's budget.

Identifying transactions as in or out of Scotland, particularly when so many are now digital, is proving very difficult. So assignment of VAT is on hold. The Chartered Institute of Taxation warns against its implementation.

What could radical tax reform look like?

There are numerous proposals for simplified tax, most of them looking to Westminster reform.

The Oxford Economics report into the Scottish economy, external, published this week, suggested a system that would tax income, savings, dividends and capital gains at the same rates, to reduce distortions.

It argued that taxes currently fail to incentivise work, saving or investment, but do encourage corporate debt.

Tax could also be used more to discourage unwanted choices, such as greenhouse gas emissions.

The Institute for Fiscal Studies wants a vast simplification programme, abolition of buildings transactions tax and of council tax.

The Chartered Institute of Taxation and Institute of Chartered Accountants in Scotland want to see tax reform much better thought through, without late changes to budgets.

Among their challenges is one to MSPs elected on 6 May to get better at scrutinising both tax and spending.

POLICIES: Who should I vote for?

CANDIDATES: Who can I vote for in my area?

PODLITICAL: Updates from the campaign

- Published29 March 2021