Scottish budget 2022-23: At a glance

- Published

Finance Secretary Kate Forbes has detailed her tax and spending proposals, external against the continuing backdrop of the Covid-19 pandemic, the SNP government's partnership agreement with the Greens, and the election pledges set out earlier this year. Here are the key points from her speech to MSPs.

Tax rates

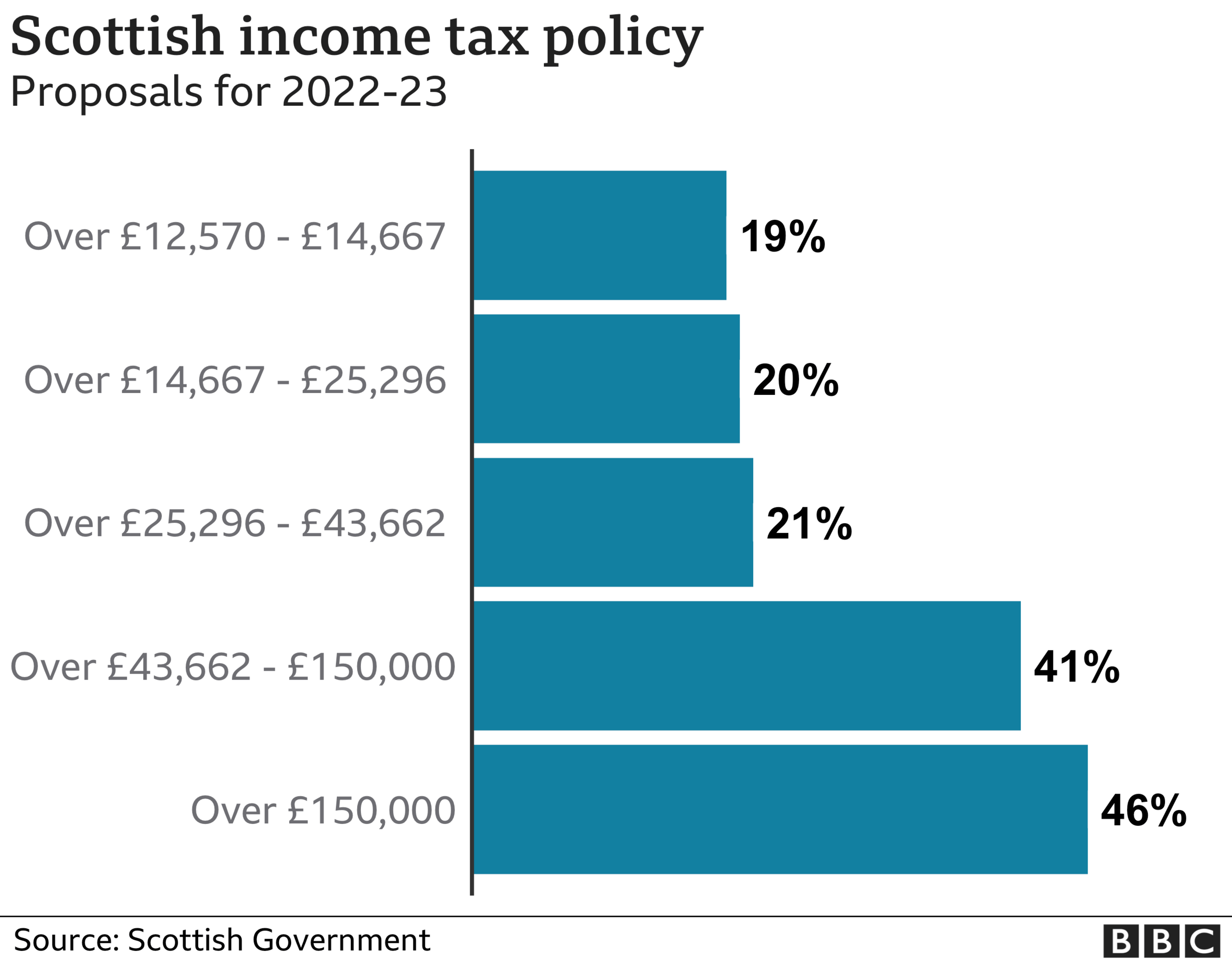

Income tax rates will remain unchanged next year but the thresholds at which it is paid will increase for lower earners.

The Starter and Basic rate income thresholds will increase in line with CPI inflation (3.1%).

The Higher Rate threshold will be frozen in 2022-23. It remains at 41% for earnings between £43,662 and£150,000.

The Top Rate tax (46%) threshold will also be frozen at £150,000

The land and buildings transaction tax rates and bands will be maintained at their current level

Scottish landfill tax - standard and lower rates will be increased

Public sector pay

Minimum wage rises to £10.50 an hour for social care staff and all people covered by the Public Sector pay policy.

The pay policy for next year focuses on those on low incomes, guaranteeing an inflationary uplift of at least £775 to those earning up to £25,000, £700 to those earning between £25,000 and £40,000, and £500 to those earning above £40,000.

Council tax freeze ends

Last year's freeze on council tax rises will not continue

For 2022-23, councils will have complete flexibility to set the rate they want for the first time since the SNP came to power in 2007.

NHS and social care

In total, the Budget provides funding of £18bn for Health and Social Care, including £12.9bn for health boards.

The overall package provides £1.2bn for mental health. There is a commitment that 10% of all front-line NHS spend goes to mental health by the end of the parliament in 2026.

Business and economy

Over the past two years the retail, hospitality, leisure and aviation sectors have had 100% rates relief to deal with effects of the Covid pandemic

This ended in July for businesses in England but will continue until April next year in Scotland.

There will be 50% rates relief for the first three months of 2022-23, capped at £27,500 per ratepayer, to prevent a "cliff edge".

The Non-Domestic Rates poundage will be 49.8p, a below inflation rise.

Tackling child poverty

More than £4bn will paid out in Scottish social security and welfare payments, including £1.95bn to start delivery of the Adult Disability Payment in 2022-23

It also includes £197m to double the Scottish Child Payment to £20 from April 2022 for families in poverty with children under six - and extend it to under 16s by the end of 2022.

A Green budget?

The Budget sets cash for the decarbonisation of homes and buildings, transport and industry.

It includes: the first £20 million of a 10-year £500 million Just Transition Fund for the North East and Moray

£336 million for energy efficiency, and low carbon and renewable heat

£150m for infrastructure to make walking, wheeling and cycling safer;

£1.4 billion to maintain, improve and decarbonise Scotland's rail network

Economic forecasts

Supply chain bottlenecks, labour market shortages, inflationary pressures and rising energy prices are all placing extra pressure on businesses and households trying to recover from the impact of the pandemic

The Scottish Fiscal Commission forecasts a level of long-term economic damage to the Scottish economy from Covid-19 is about 2%, similar to the OBR's forecast for the UK.

This means the long-term impact of Brexit on the economy will be worse than that caused by Covid-19.

The Fiscal Commission forecasts the economy will recover to pre-pandemic levels by April-June 2022, almost two years earlier than forecast at the previous Scottish Budget in January.