Scottish council tax 2022-23: How much will your bill be?

- Published

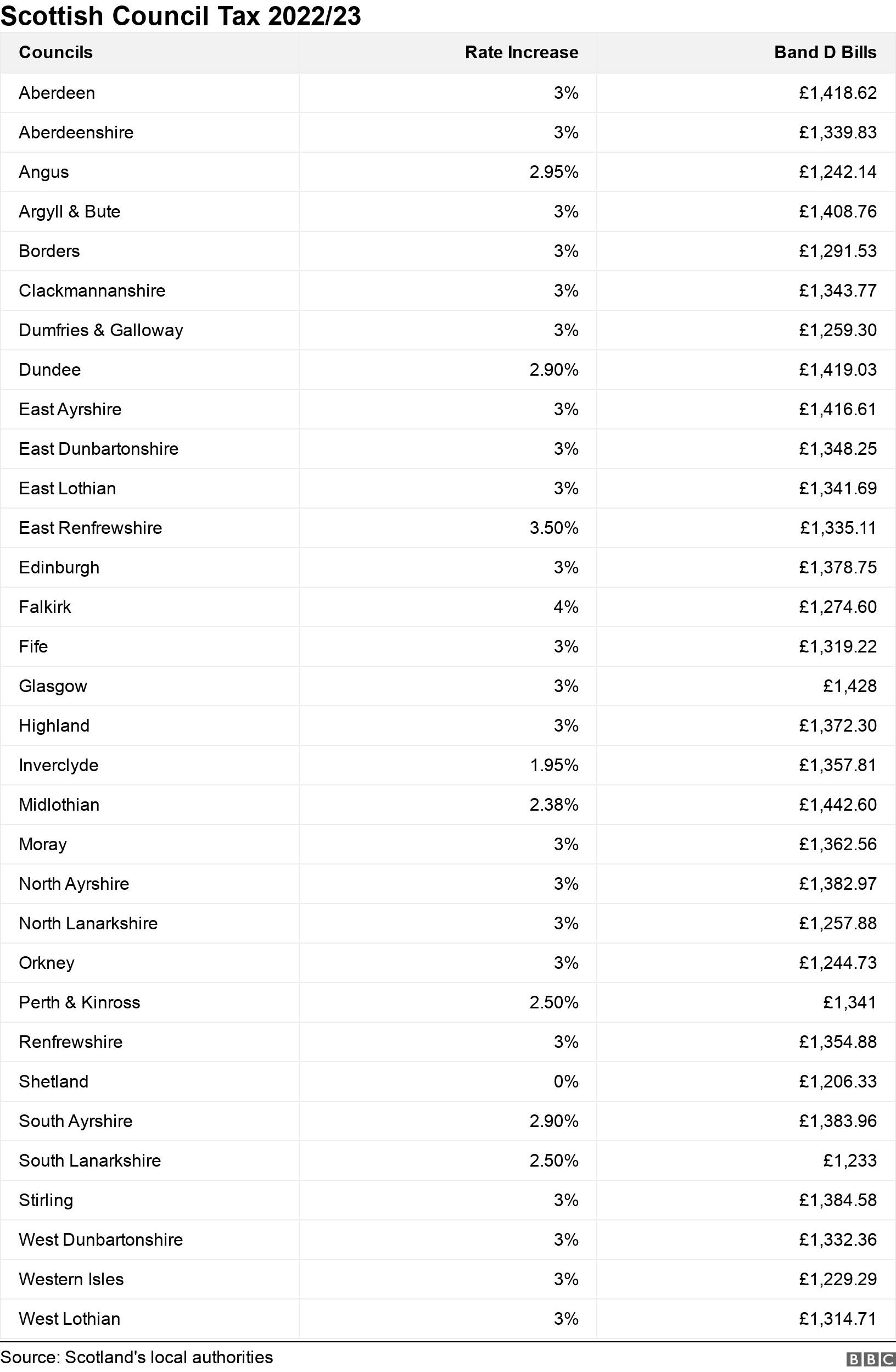

All 32 local authorities in Scotland have now set their council tax rates for the coming year - with 22 opting for a 3% rise.

Shetland Islands Council froze its rate; a proposed 7.7% rise in Orkney was rejected in favour of a 3% increase and Inverclyde Council agreed 1.95%.

Just two went above 3% - East Renfrewshire (3.5%) and Falkirk (4%).

It is the first time councils have been given complete freedom to set rates since the SNP came to power in 2007.

The final local authority to agree its 2022-23 budget and a rates rise of 3% was West Dunbartonshire.

The government announced at the end of January it would be giving an additional £120m to local authorities in a bid to ward off big increases in council tax bills.

A £150 discount will also be applied to householders in Bands A to D properties to ease the impact of the cost-of-living crisis and rising energy bills.

The bill you receive from your council will also include a figure for your water and waste water services. That element is rising by 4.2%, external with Band D householders paying £478.44 in 2022-23.

Here is a list of what each council has agreed.

Band D is highlighted as the average council tax bill for householders in Scotland. The Band D figures do not include water and sewerage charges, so the final household bill will be bigger.

For the first time since the SNP took power at Holyrood, councils have the ability to raise the council tax by as much as they deem appropriate.

Council tax was frozen for many years then increases were capped - either at 3% in absolute or real terms.

In the past some councils argued strongly that they should have the right to set the council tax at whatever level they deemed necessary without carrots and sticks from central government.

There were predictions some councils might raise bills substantially this year but most are no higher than 3% with just one, Falkirk, agreeing 4%.

With the council elections only two months away, some councillors inevitably fear a large rise could be unpopular and damaging at the ballot box.

Similarly no council has so far exercised its power to charge employers for workplace parking spaces.

This is the distinction between having the right to do something and actually doing it

But there is a risk to councils. Although a large chunk of their money is from the Scottish government, it is harder for them to blame Holyrood for unpopular local cuts and savings if they do not fully use the financial powers at their disposal.

Related topics

- Published23 February 2022

- Published22 February 2022

- Published10 December 2021

- Published9 December 2021