Turmoil making investment harder, says bank chief

- Published

- comments

The Scottish National Investment Bank's Willie Watt with Nicola Sturgeon

Scots business leaders need more confidence to build up companies to scale, according to the chair of the Scottish National Investment Bank.

Willie Watt said the economic strategy has been more successful in encouraging people to start up businesses, which has been a weakness of the Scottish economy.

But he said only by growing those start-ups will Scotland tackle its weakness in productivity growth.

The financier was commenting on the publication of the first full-year set of accounts by the publicly-owned lender.

He said it had invested more than £129m in the year to March, in partnership with other investors bringing £440m to the deals. In the previous year, with only four months of operation, it invested £22m.

Mr Watt, 63, who was previously chief executive and chair of Martin Currie, the Edinburgh-based fund manager - said last year's investment total was less than he wanted, and that he hoped the public investment bank would get close to the £200m of Scottish government funding allocated for investment this year.

Ministers are funding the investment bank with £2bn over ten years, to invest in projects where private sector investors are reluctant to commit funds without a public sector partner taking a leading role.

It is focused on projects aimed at reducing carbon emissions, innovation and regeneration of places that help reduce inequalities.

Market turmoil in recent days and weeks - unlike anything Willie Watt has seen in 40 years as an investment manager, he says - were making it more difficult to get investors to commit. He said it would mean the Scottish National Investment Bank (SNIB) could expect to become busier, as projects might need more reassurance about risk.

"There was always a good case for a development bank in Scotland, and that case is underlined by the times in which we find ourselves," he said.

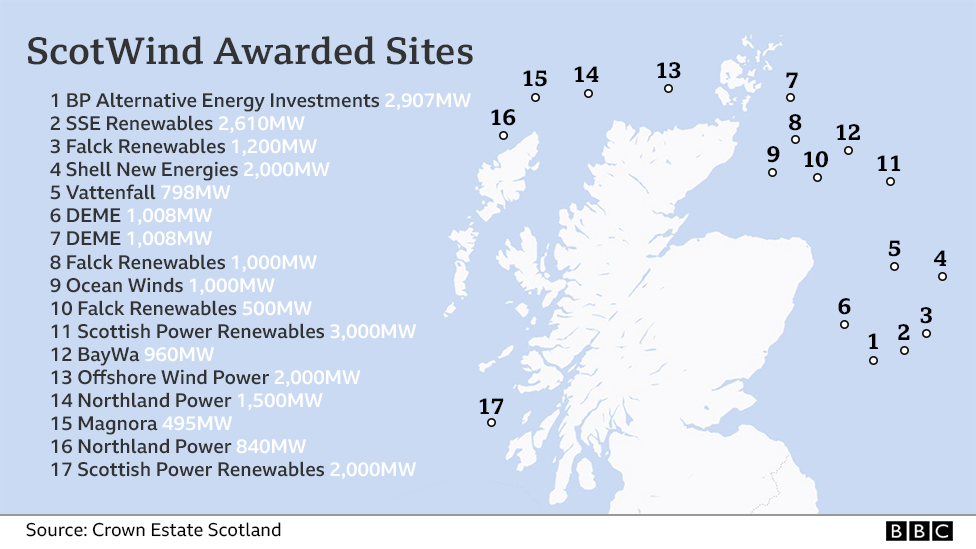

The opportunities that lie ahead in the next stage of offshore wind developments, known as ScotWind, require companies to build up to scale if they are to compete and seize worldwide opportunities.

The North Sea oil and gas service sector have successfully done that, said Mr Watt, winning contracts in offshore drilling around the world.

The energy developers that won bids to in the ScotWind auction were announced in January. They were required to set out how they intend to use local contractors to develop vast wind farms around Scotland's coast.

The bids showed a willingness to spend more than £23bn on 'local' content across the 17 projects, but the potential will not be reached if Scottish companies are not able to bid for that work.

"The ScotWind developers needed to make significant commitments to local content in their submissions for the ScotWind funding round," the SNIB chief told BBC Scotland.

"What concerns the bank is whether the supply chain is in shape to capitalise on those commitments. So we are trying to work with the business community and government to make sure that opportunity can be exploited in the private sector.

"We want the bank's capital to be used to help develop globally competitive companies in the ScotWind supply chain."

A £30m "keystone" investment in the extension to Aberdeen Harbour is part of that process.

He added: "We may make other infrastructure investments in that area. We're also interested in investing in innovative service-led companies that can invest in ScotWind, and potentially to support the work Scottish Enterprise does in attracting further investment into Scotland."

He said the challenge of growing companies was not so much about ambition or a lack of funding, as it was about confidence: "We think that scale-up is one of the biggest challenges that the sector faces.

"There's been a big focus on early stage entrepreneurship, and there's nothing wrong with that. Scotland is reasonably good at early stage entrepreneurship.

"I would like to see more companies become much larger, employ more people, generate more economic value. That would make a far bigger impact on the productivity problems Scotland has. Productivity is a problem for all developed western economies, but Scotland's position is not good."

The bank has invested in companies developing electric car charging points

The Investment Bank has invested in two tidal turbine projects, where it found private investors needed further reassurance that it was turning into a commercially viable technology. The technology behind electric vehicle charging points is also getting some investment support, along with loft insulation and Lothian Broadband, a company aiming to lay cables that support roll-out of high-speed broadband to the smaller towns that are not in near-term Openreach plans.

During the first year of operation, the 30 staff at SNIB more than doubled, at an administrative cost of £10m.

Its first chief executive, Eilidh Mactaggart, resigned "for personal reasons" in January, and secured more than £100,000 in severance pay.

Nine months later, she has not been replaced, while finance director Sarah Roughead has been interim chief executive.