Gers figures: Scottish public spending deficit falls as oil revenues rise

- Published

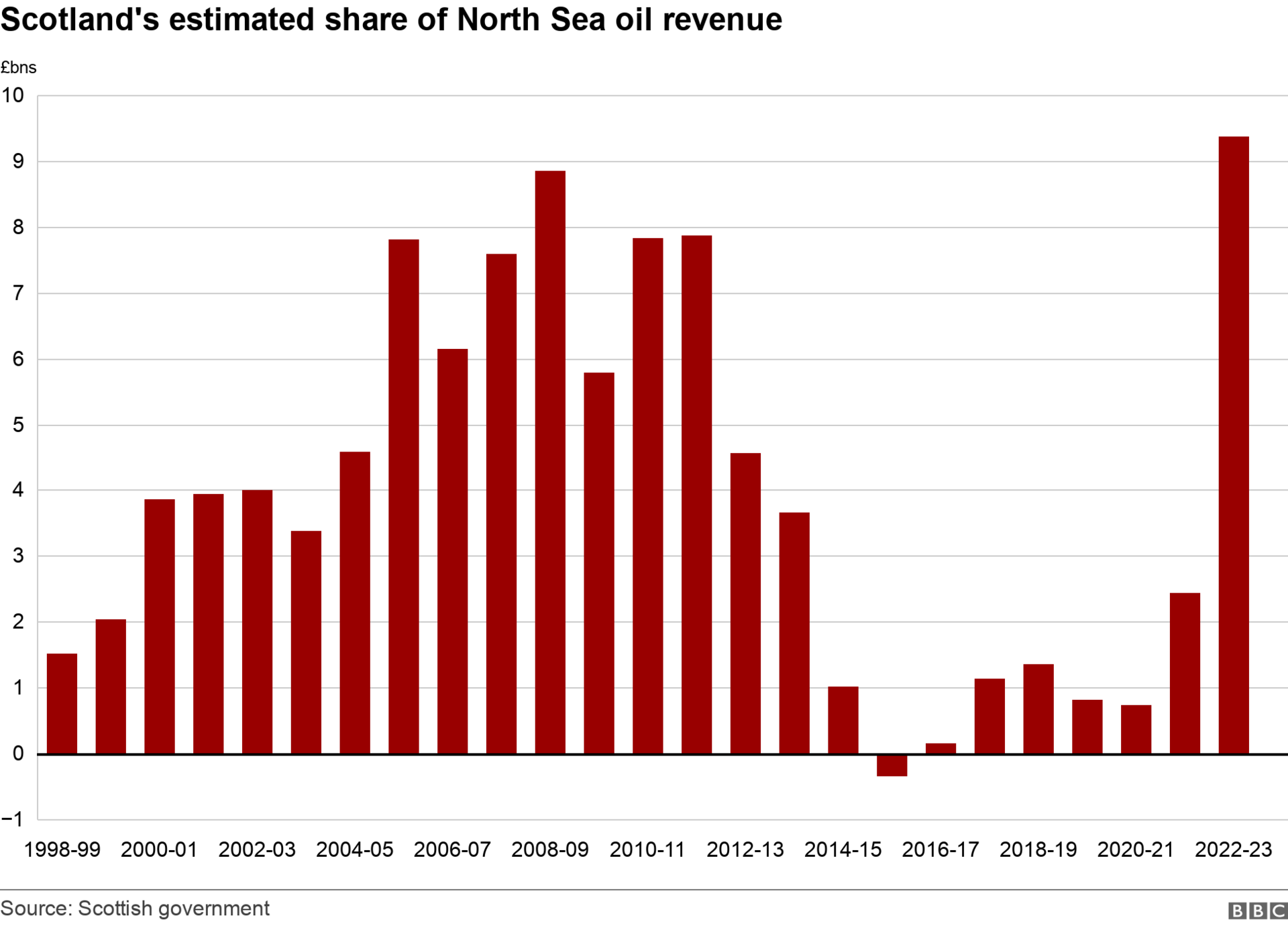

North Sea oil and gas revenues rose from £2.4bn to £9.4bn

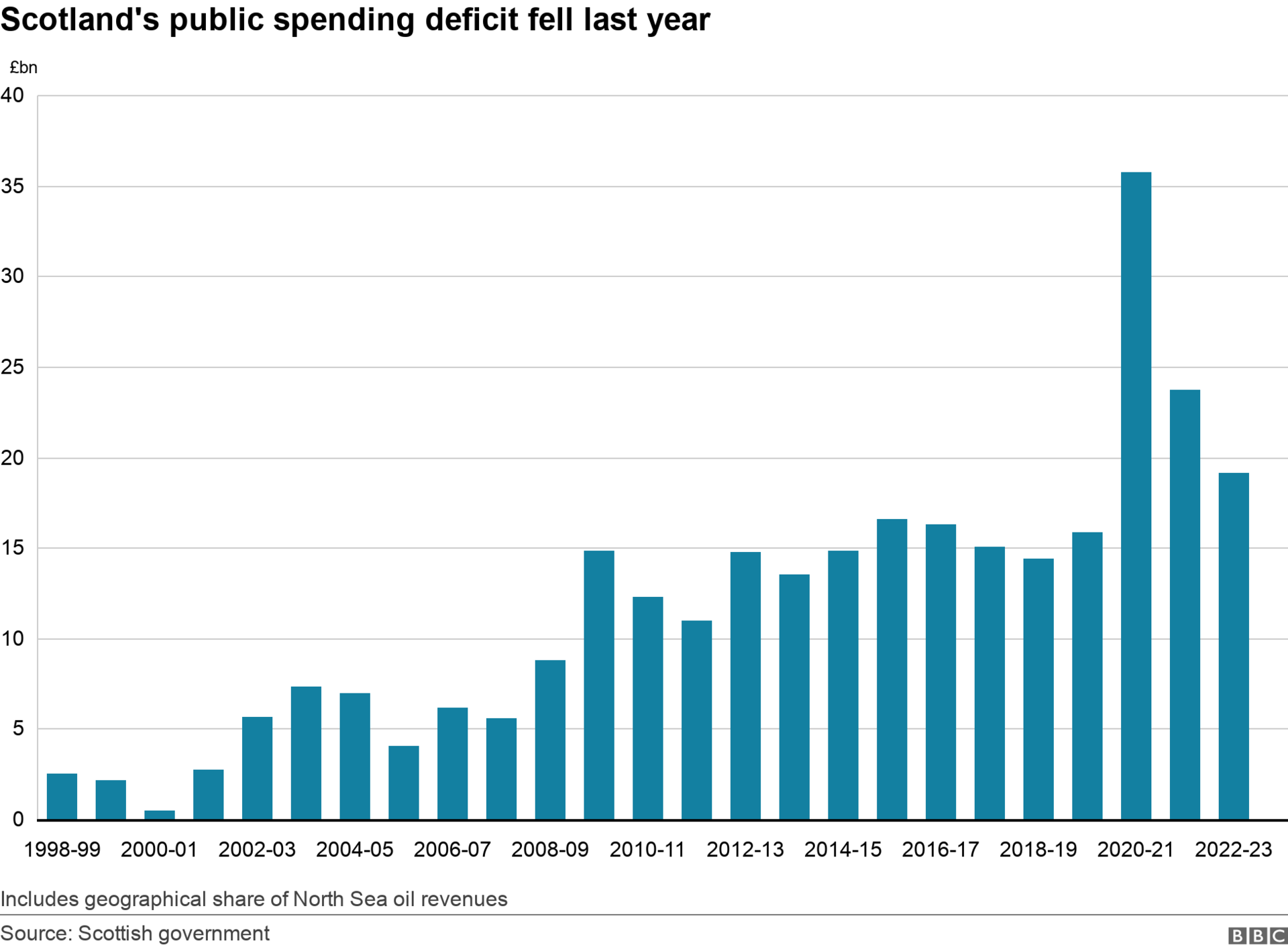

Scotland's public spending deficit fell to £19.1bn last year, largely due to higher oil and gas revenues.

The annual Government Expenditure and Revenue Scotland (Gers) report looks at taxes raised in Scotland and public spending for and on behalf of Scotland.

It estimated that the gap was lower than the previous year's £23.7bn but is still higher than before the pandemic.

The deficit represents 9.0% of Scotland's GDP - higher than the 5.2% for the UK as a whole.

The Gers report allocated Scotland a "geographical share" of North Sea oil and gas revenue for 2022-23.

It was valued at £9.4bn, following the introduction of the windfall tax - up from £2.4bn the previous year.

The report said that if North Sea revenue was not included the deficit would have been £28.5bn.

Gers is a National Statistics publication, which is prepared by Scottish government officials independently of ministers.

It sets out revenues raised in Scotland, both from devolved and reserved taxation and public spending on behalf of Scotland.

The difference is called the "net fiscal balance" and often referred to as the "deficit".

The statistics have formed a key battleground in the debate on the fiscal sustainability of an independent Scotland.

The economic research body The Fraser of Allander Institute said Gers relied on some estimation but that was part of all economic statistics and was not a reason to dismiss the figures as "made up".

The Gers figures for 2022-23 showed Scottish public sector revenue was estimated as £87.5bn.

Without North Sea revenue this was £78.1bn - up £8.1bn as income tax, national insurance contributions, VAT, and non-domestic rates grew strongly.

Total spending for the benefit of Scotland was £106.6bn.

It increased by £9.3bn, reflecting increases in debt interest payments at the UK level and the introduction of Cost of Living support.

Before the Covid pandemic Scotland's public deficit figure stood at £15.1bn - 8.6% of GDP - but more than doubled to £36.3bn, or 22.4% of GDP, in 2020.

It has reduced over the past two years but remains higher than before the pandemic.

The latest report estimates annual government spending per person for Scotland at £19,459, which is £2,217 higher than the figure for the UK.

While spending is more in Scotland, the revenue per person was also higher last year because of the windfall tax.

Including North Sea revenue, Scotland raised an estimated £15,967 per person, which was £696 more than the UK figure.

Without the North Sea cash the UK figure would have been £859 higher.

The Scottish government's Wellbeing Economy Secretary Neil Gray claimed a "full £1bn" of the deficit in Scotland was "the direct result of the UK government's mismanagement of the public finances".

He said: "I am pleased that Scotland's finances are improving at a faster rate than the UK as a whole, with revenue driven by Scotland's progressive approach to income tax and our vibrant energy sector."

Scottish Conservative finance spokeswoman Liz Smith said the figures highlighted the benefits Scots get from being part of a strong United Kingdom and that the SNP had squandered its record funding settlement.

"The figures also wholly reaffirm the case for ensuring our oil and gas sector continuing to play a key role in Scotland's economy for years to come," she said.

"That is why it is astonishing that every other political party - including the SNP-Green coalition and Keir Starmer's Labour Party - have turned their backs on the industry."

Scottish Labour finance spokesman Michael Marra said the statistics showed the economic benefit that Scots receive as part of the UK.

"With Scots individually benefitting to the tune of some £2,217 from higher spending in Scotland despite the larger negative balance in Scotland's public finances, the potential harsh financial cost of leaving the union is laid bare for all to see," he said.

"It is Humza Yousaf's duty to explain exactly what he would cut, when and how deeply to make up this huge deficit in his independence plans."