Highland council tax to rise by 4% in April

- Published

Council tax in the Highland Council area are poised to rise by 4%

Highland Council has set its new council tax rates and also agreed measures to tackle a gap of almost £50m in its 2023-24 budget.

A tax rise of 4% in April will see the annual bill for average band D properties increase from £1,372 to £1,426.

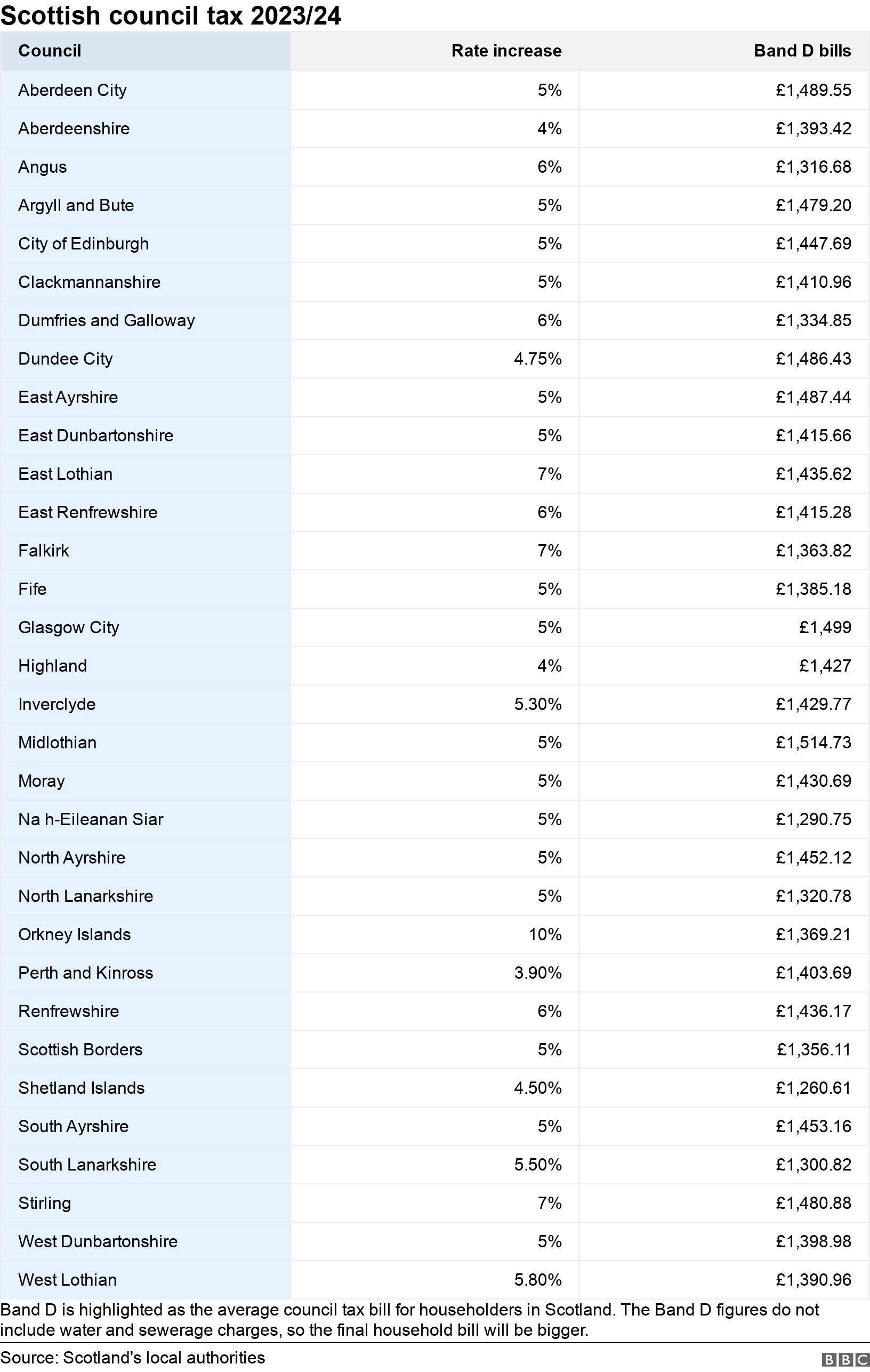

The council said it would be among the lowest increases in Scotland.

It has identified more than £22m of cuts - one of the highest single-year total savings it has ever considered.

The ruling SNP-independent administration plans to use some of its reserves to help reduce the gap further, but added that a mid-year budget would likely be needed to find more savings.

Ahead of Thursday's budget meeting, council leader Raymond Bremner said Highland's finances were extremely challenging.

He said: "We are faced with a perfect storm of circumstances which have led to a significant budget gap and ongoing pressures and risk impacting on future years.

"While it is imperative we make savings, we need to invest in transformation and that is why our approach is a balance of investment and plugging the gap for the coming year."

Highland Council said a plan for a green freeport on the Cromarty Firth was a reason to be optimistic about the region's future

Convener Bill Lobban said never before had the council's finances been under so much pressure.

But the local authority added that it remained optimistic about the region's future, with hopes a planned green freeport on the Cromarty Firth would create new jobs and boost the economy.

There have been concerns raised over the looming council cuts, including reductions in support for charities.

Inverness-based Special Needs Action Project (Snap) said it would lose 20% of its annual income.

The charity said: "The potential impact of this reduction in funding cannot be underestimated - the 50 children who currently benefit from this funding which supports our after school clubs, holiday leisure schemes and Saturday outings cannot access mainstream children's activities due to the levels of support they need.

"Their parents, who are also their carers, need regular, well-planned time off from their caring role, not to mention valued time with other members of their family.

"This funding helps us to keep our fees as close as possible to the charges levied for mainstream children's activity clubs."

Conservative councillor Isabel MacKenzie was one of several councillors who unsuccessfully made a plea for Snap's funding to be protected.