Scotch's trade winds turn stormy

- Published

The mast and sails haven't been ripped off the good ship Scotch Whisky amid stormy trade winds, but after a decade of sterling export performance, she looks ready for a major overhaul.

The fall in total exports last year, published by the Scotch Whisky Association, won't come as a surprise to anyone who has been watching the big distillers publish their financial figures in recent months.

As I explained when Diageo put out its numbers for the back end of last year, the market leader has done exceptionally well out of clever marketing, hitting the sweet spot of aspirational middle class consumers in emerging economies who want to buy international luxury goods.

But progress is proving bumpy and tricky. The seemingly endless India-EU trade talks still protect the world's largest whisky market behind a 150% tariff barrier.

China offered so much potential, and it still does. But for now, Scotch has got on the wrong side of official disapproval of extravagant gifting, particularly if it looks like corruption.

Brazil's economy has stalled. Venezuela is in crisis. Likewise, Spain's young club scene had a thirst for Scotland's amber nectar, but the country has been through a well-documented economic downturn.

The Scotch Whisky Association explains some new markets are consolidating, and newer ones are doing well. It's a mixed picture. Some importers of Scotch may also be running through old stock. But there's got to be more to it than that.

To find out more about the competitive world of selling spirits, it's worth a look at the United States of America. By value, it's the biggest national export market for Scotch, and by quite a long way.

Last year, exports to the US were at £750m. That was down 9%, but was still £300m ahead of France, the next biggest market. By volume, US exports were down 7% to 119 million bottles, with only France importing more.

Spirit of St Louis

So what's going on? Well, the US spirits market is quite healthy. Since 1999, its drinks market share has risen from 28% to 35%, while beer has fallen from 56% to 48%.

(And within that, the US beer giants have been humbled by, among other things, craft beer. Budweiser was selling 45 million barrels in 1988. I lived in the US back then, and it seemed the market consisted of three or four giant brands. By 2011, Budweiser was down to 17 million barrels.)

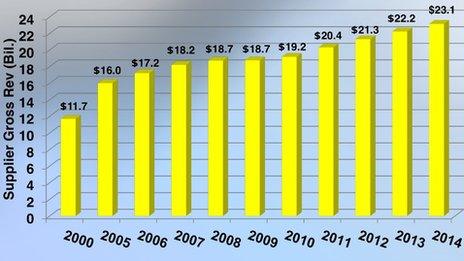

Whiskies do well within the spirits market. While the industry body, the Distilled Spirits Council of the US (Discus), reported $7.5bn of supplier gross value from whiskies, out of $23bn for spirits. More than half last year's growth was from whiskies.

Source: Distilled Spirits Council of the US

Drill down into those figures, and you find that Scotch is not performing that well.

Of 57 million cases sold, 9.4 million were Scotch.

While blended US whiskey added 41% of sales, and bourbon and Tennessee whiskies grew 7%, blended Scotch was down 3% by volume, and 2% by value.

The brighter export prospect is fast becoming Scotch single malt. Volume was up 6.4% in exports to the USA, and 9% by value, as US sophisticates switch to premium brands, such as Glenlivet, Glenmorangie and Macallan.

By volume, Scotch blends are still way out in front: 7.6 million cases sold in the US last year, to 1.9 million of single malts. By value, however, the ratio is 2:1.

Flavoured whiskey

This is an increasingly crowded market. Tennessee and bourbon were up 11% by volume, Irish whiskey by 9% (11% by value to $550m) and cognac by 11%.

American blends are up most sharply, and the big growth area, according to US distillers, is in flavoured whiskies. Last year, 24 million cases of flavoured spirits were sold - more than half vodka, more than quarter of that whiskey. The flavoured whiskey segment was up more than 40% last year. (Whisky buffs should pause here to splutter with indignation.)

First into the market was Jim Beam Tennessee Honey. There's now a cider-based Winter Jack variety. It was followed by Dewar's Highlander Honey. To stick to Scotch whisky rules, it has to be described as a "spirit drink". Ballantyne's and J&B also launched their own honey versions, carefully re-labelled.

Then came Beam's cherry-infused, cinnamon spice, honey tea, and cider-vanilla Red Stag bourbons. Pernod Ricard has branded its Irish whiskey "Paddy", with honey and apple options.

While craft beers have taken off on both sides of the Atlantic, the growth in small-scale craft distilling is far faster in the US. There were 92 small-scale distillers in 2010. By last year, there were more than 700.

And that's the point. Scotch distillers have marketed hard to give themselves an edge in international markets. But others are doing the same.

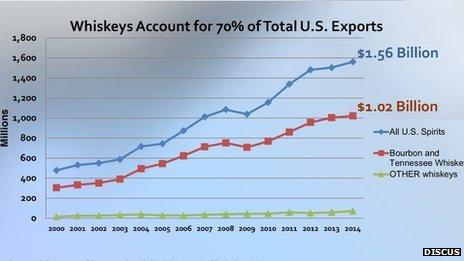

US spirits exports were strong last year, up 4% to a record high for the fifth year. After Canada, the UK is the second biggest market at $178m-worth of bourbon, whiskey and tequila. UK sales of US spirits were up 10% last year, and 48% since 2004.

That's the slowest growth of the top ten markets. Canada was up 114% in a decade, France by 298% and Singapore - gateway to the Chinese market - by 543%.

And while they are still small export markets, there's rapid growth also into central and Latin America, and the UAE hub.

The message from US whiskey is similar to what you can see from sales of premium brandy and cognac.

Scotch whisky can't afford to rest on its recent growth, its unique provenance, or its laurels.

- Published1 April 2015