Oil firms cut payroll costs as optimism slumps further

- Published

Payroll costs have been cut by three-quarters of offshore oil and gas operators as optimism levels plunged further in the first three months of the year.

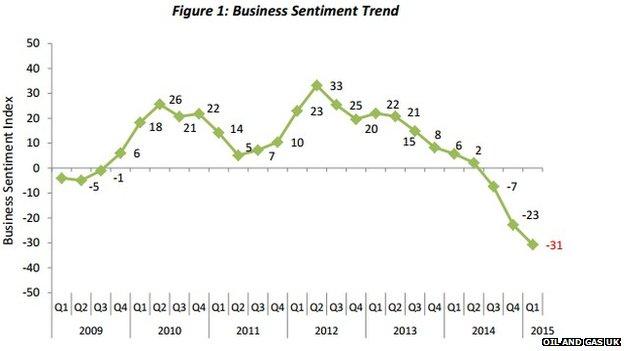

The latest Business Sentiment Index from Oil and Gas UK showed "overwhelmingly negative" results.

Comparing the positive with negative outlooks, there was a 31 percentage point gap.

This was worse than the 23-point gap at the end of 2014.

The figures have worsened considerably since the oil price began to fall, but the declining optimism began two years earlier.

Oil and Gas UK claimed this reflected "the challenges of operating in a high-cost, mature basin".

There have been eight consecutive quarters of declining optimism, and the three most recent quarters have been in pessimistic territory.

Of those companies responding to the survey, 31% said operating and running costs were lower than in the previous quarter, and only 3% said they were higher.

Among offshore operators, 43% said operating costs had been cut, and 76% said staffing costs and day rates for contractors were down.

In the first three months of this year, 40% of companies cut research and development spending, and 46% have reduced training budgets.

Cost-cutting measures include changes to rotas, onshore travel time, with simplification programmes and better project planning.

Companies have also cut discretionary spending and re-tendered key contracts. There have been redundancies as well as freezes on recruitment, staff salaries and contractor day rates.

'Challenging circumstances'

Oonagh Werngren, operations director at Oil and Gas UK, said: "Contractor companies have begun to feel the full impact of operators pruning back budgets and commissioning fewer projects in response to rising operating costs.

"Contractor company respondents are adjusting to these challenging circumstances by re-evaluating their own resources. They are identifying opportunities for introducing more cost-efficient practices.

"Bold and behavioural change is needed, both on an individual company basis and collaboratively across the sector, to help improve production and production efficiency in the UKCS. This work has clearly started."

Assessing the global extent of cost-cutting in the oil and gas industry, Edinburgh consultants Wood Mackenzie recently reported that companies have cut costs so aggressively that the level at which firms cease to be cash flow negative has fallen by $20 to $72.

New Oil and Gas UK chief executive Deirdre Michie says the sector "has a tough journey ahead"

Tom Ellacott, head of corporate upstream analysis for Wood Mackenzie explains: "Capital cost-cutting has been both rapid and in some cases dramatic.

"Individual companies have had one, two and sometimes three bites at the cherry, and industry has for the time being settled on a 24% or $126bn fall year-on-year.

"Dividends and share buyback programmes have also been targeted, while companies have turned to both the debt and equity markets to boost liquidity."

In a separate development, Deirdre Michie has taken up the post of chief executive at Oil and Gas UK.

She replaces Malcolm Webb, who formally retires at the end of May.

Ms Michie, who will be based in Aberdeen with an office in London, said: "Our industry has a tough journey ahead, but I hope by working together, this sector will become stronger, safer and have a brighter future with a thriving supply chain, for decades to come."

- Published30 April 2015

- Published28 April 2015