Bank of Scotland to introduce plastic £5 and £10 notes

- Published

The existing banknote designs will be "adapted and modernised" so they are suitable for polymer

The Bank of Scotland has announced plans to introduce plastic £5 and £10 banknotes.

The bank said its next notes would be printed on polymer, replacing the cotton paper used for notes currently in issue.

The notes will be slightly smaller and will reuse the existing Bank of Scotland designs.

A one-off limited edition £5 note will be issued in November and auctioned to raise money for BBC Children in Need.

The circulation will be limited to just 50. They will feature designs from the winners of a children's competition which has just been launched.

The main replacement polymer banknotes will continue to feature Sir Walter Scott and The Mound on the front and the bridges theme on the back.

The images will be "adapted and modernised" so they are suitable for polymer.

'More durable'

The design of the polymer £5 note will be unveiled before the end of this year, with the notes due to be issued in the second half of 2016.

It will be followed about a year later by the polymer £10 note.

The announcement follows discussions with the Bank of England, which is due to bring plastic banknotes into circulation next year.

The Bank of Scotland is one of three in Scotland authorised to issue banknotes.

Managing director Robin Bulloch said: "Bank of Scotland has been issuing banknotes for over 300 years and we take seriously our responsibility to create good quality genuine banknotes that can be used with confidence.

"Polymer notes are cleaner, more secure, and more durable than paper notes.

"They will provide enhanced counterfeit resilience, and increase the quality of Bank of Scotland notes in circulation."

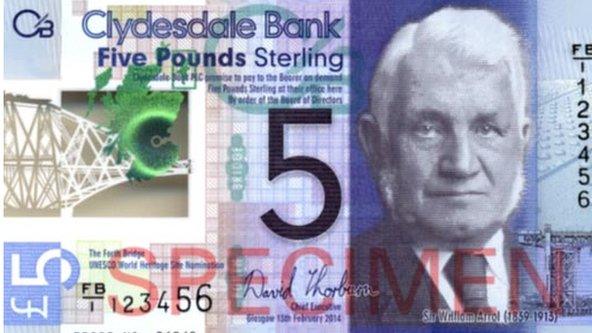

The new Clydesdale bank note features Sir William Arrol

In March, the Clydesdale Bank announced it was issuing two million polymer £5 notes.

The new note features an image of the Forth Bridge and has been issued to commemorate the bridge's 125th anniversary.

The note also features a portrait of Sir William Arrol, whose company constructed the bridge among many other landmarks in Scotland.

- Published23 March 2015

- Published18 December 2013