SSE buys stake in North Sea gas field from Total for £565m

- Published

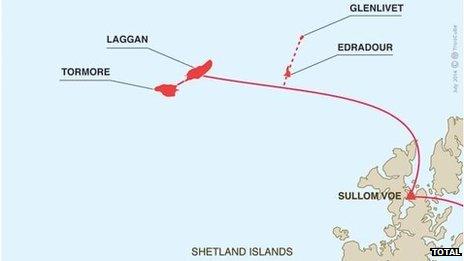

The Greater Laggan Area development includes four gas fields

Energy firm SSE has announced it is buying a minority stake in French oil and gas giant Total's West of Shetland operations for £565m.

Under the deal, Perth-based SSE will take a 20% stake in the Greater Laggan Area development, which includes the Glenlivet, Laggan, Tormore and Edradour gas fields.

It will also hold a 20% share in the Shetland Gas Plant at Sullom Voe.

Greater Laggan is located about 125km north west of the Shetland Islands.

Under the agreement, Total will continue as operator and own 60% of the assets. The remaining 20% will continue to be owned by Dong Energy.

The deal is expected to be completed later in the financial year but requires regulatory approval.

SSE said the fields it was acquiring were new and would have relatively low operating costs.

They are not yet producing gas, but the Greater Laggan Area development is expected to start production later this financial year.

Peak production of about five million therms of gas per day is expected to be reached next year.

The new Shetland Gas Plant will process and export gas and condensate from fields in the area to the St Fergus Gas Terminal in Aberdeenshire.

In March, the UK Department of Energy and Climate Change (DECC) approved field development plans for Edradour/Glenlivet.

SSE expects to invest a total of about £350m in further development of the Greater Laggan assets by 2018, including about £170m in the current calendar year.

'Natural next step'

In a blog, external, SSE chief executive Alistair Phillips-Davies described the agreement as "a natural next step forward" for SSE.

He also said in a statement: "Following extensive due diligence, we have agreed to acquire a series of very good assets and entered into a partnership with one of the world's leading gas and oil companies.

"The acquisition means we will be able to introduce further diversity across our investment programme.

"It comes following a period of relatively low wholesale gas prices and is therefore timely. It completes our portfolio of gas production assets for the foreseeable future.

"The acquisition, including the Shetland Gas Plant, represents further investment in the UK energy infrastructure that gives access to gas from northwest Europe to help secure energy for customers and to help meet the needs of our gas-fired power stations, which will have an important part to play in supporting security of electricity supply."

In a separate development, Total has confirmed it intends to follow companies, including BP and Shell, in moving to a three-weeks on rota pattern for its offshore workers. It's beginning a consultation with staff on a move to three on, three off, which is expected to take effect in the first quarter of next year.

- Published24 March 2015

- Published12 February 2015