Rebooting the RBS brand

- Published

It's seven years, almost to the day, since Fred Goodwin and a hapless board of so-called directors took the Royal Bank of Scotland over the brink of collapse.

There was hardly any capital to back up a balance sheet then burgeoning beyond the two trillion pound mark. That's before we all came to the rescue.

There may be even less capital before too long, but this is of the typeface variety.

"RBS," it is reported, is becoming "rbs". You could call it typographical subversion. Or a symbolic expression of lowered case humility.

NatWest

We're told in the Guardian that it's disappearing from the frontages of the City of London offices which usually appear when its latest loss or mis-selling misdemeanour is on the telly.

In its place and in England and Wales, NatWest is taking on a much more prominent position.

As a high street brand south of the Border, we already knew that RBS is becoming Williams & Glyn - reviving a defunct brand before spinning it off to become a separate banking entity and competitor. (That's under instruction from the European Commission.)

In Scotland, the initialised bank is being un-initialised, returning to Royal Bank of Scotland (or perhaps "royal bank of scotland"?)

Interface

Observers of corporate verbiage won't be surprised to find that the bank's marketing and branding people have applied their imagination to both the re-brand and the explanation.

The RBS spokesman doesn't confirm or deny the report of going lower case, but says: "We are and always have been a bank of brands". It gets better.

"As part of our strategy to build a stronger, simpler, fairer bank we are directing our efforts to make each of our customer brands number one in their respective markets."

The best bit is coming up: "Our brands are our interface with our customers and through them we will be able to connect more deeply with customers and rebuild pride in the great things these brands do for our customers."

They have a point, though it may be a bit irritating for customers to be told they are interfacing with a brand, and indeed, connecting deeply with it, rather than applying for a loan or getting some cash out of a machine.

Toxicity

Brands matter and can be very valuable in building and retaining customers' trust.

The problem with RBS is that it's suffered seven years of toxicity.

And here's the evidence that NatWest has been much less damaged:

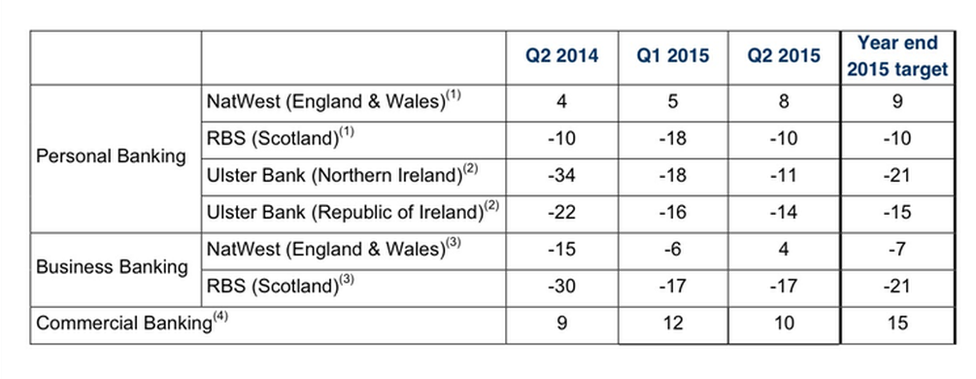

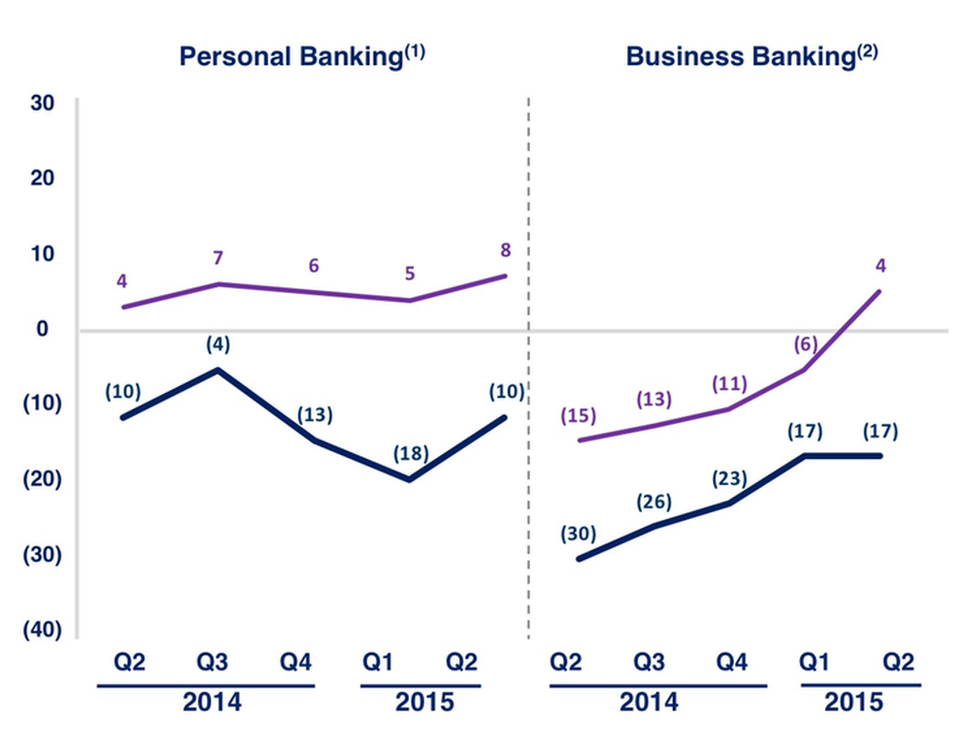

These figures show what happened when pollsters, on behalf of RBS, asked customers if they would recommend the bank to a friend or colleague.

The numbers (simplified a bit) show the difference between those who say they would, and those who would not. NatWest has more personal recommenders than detractors, but the reverse is true of RBS in Scotland.

In Ireland, the Ulster Bank brand is in even deeper trouble, following the property crash and an IT meltdown.

In business banking, NatWest has been seen more negatively than positively by its customers, though that has improved to a small net positive. The RBS deficit has been reducing, but it remains rather large.

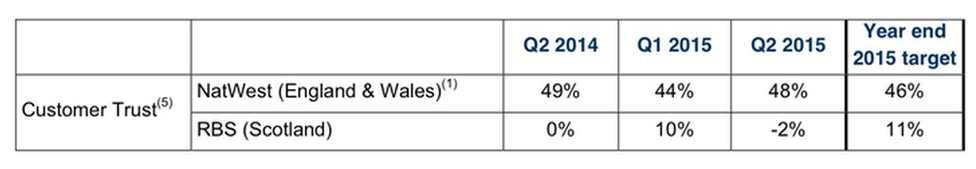

When asked if RBS and its brands can be trusted to "do the right thing", it's striking that more RBS customers think it does not than those who think it does. Trust levels in NatWest are far higher.

That ought to interest those who think we should be shopping around and switching banks more often. Even if they wouldn't recommend their banks or don't trust them, customers stick with what they know. Either loyalty, habit or inertia is strong, or they quite like to dislike their bank.

Calamity

Any branding expert will tell you that the key to a good rebrand after a reputational calamity is that the new look has to be accompanied by a genuine change.

That is, it's not enough to stick a new logo on the branches, vans and headed notepaper, and expect people to believe you've changed, if you haven't.

RBS chief executive Ross McEwan, with a background in retail banking, surely knows that.

He won't want to invest in an expensive rebrand - even if it's reducing capital letters to lower case ones - unless he is confident that he can back up the symbolic change with a real change when customers do that "deep interface" thing.

All this reminder of reputational catastrophe makes you wonder what the branding volks are up to at Volkswagen headquarters over in Wolfsburg. Anyone for Audi?