If you don't shop, retailers drop

- Published

Sluggish, disappointing and rather pallid: three ways of describing Scotland's latest retail figures. And they were from the retail industry people trying to look on the bright side.

With inflation just into negative territory - that is, consumer prices have dropped over the past year - it's not a disaster for retailers to have flat takings.

But with recovery under way, and average earnings growth now clearly above inflation, the nation's shopkeepers might hope for something that looks more like growth.

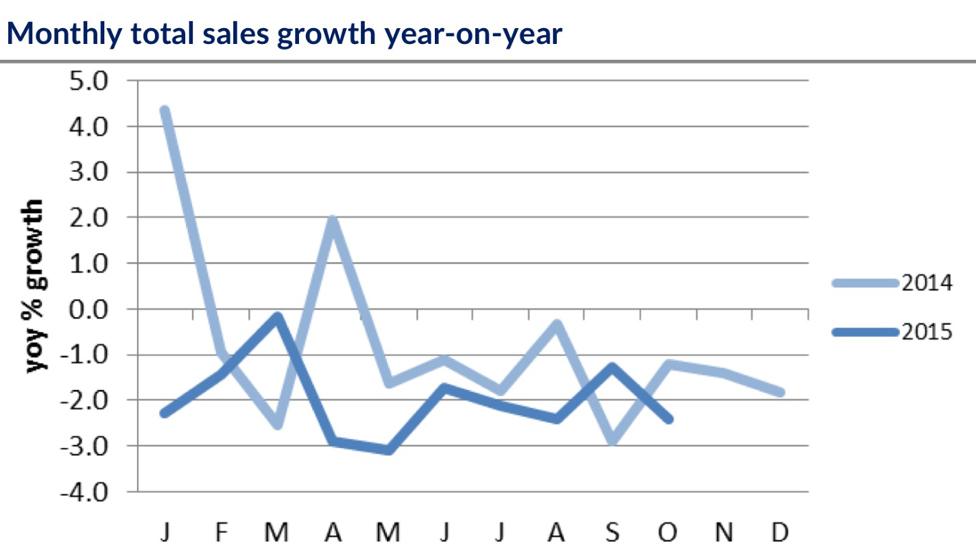

The trend from 2014 into 2015 has been downward, and this year, 'growth' has been negative every month

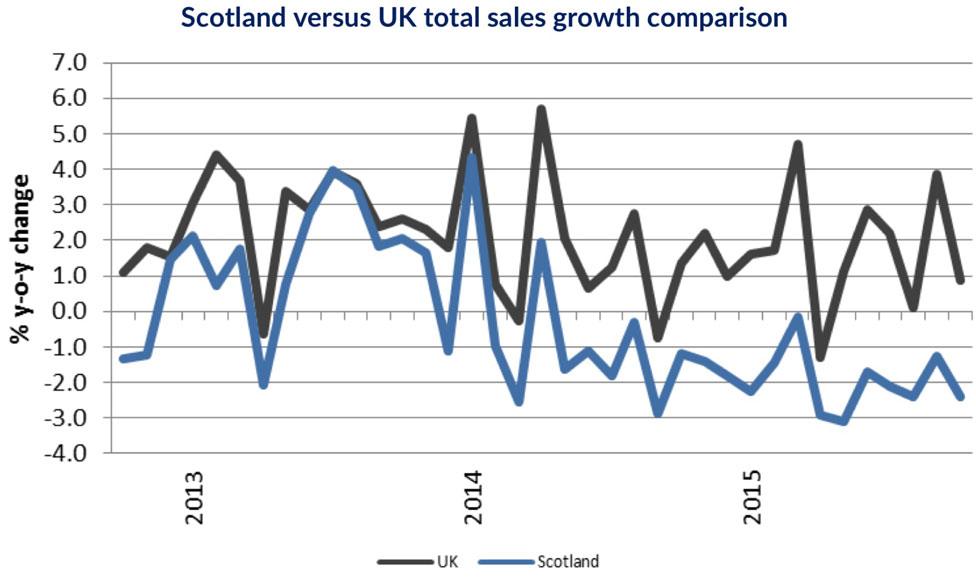

They're not seeing it, and they haven't for quite a while. Yet in similar economic circumstances, retailers are doing so in the rest of the UK.

Take, for instance, total shop sales, as counted by the Scottish Retail Consortium, external - the average of the past 12 months of monthly figures is down by 1.9%. For the UK as a whole, it's up 1.9%.

Retail growth in Scotland was almost matching the UK figures until early 2014, when a clear gap emerged, and Scotland has since seen falling total sales

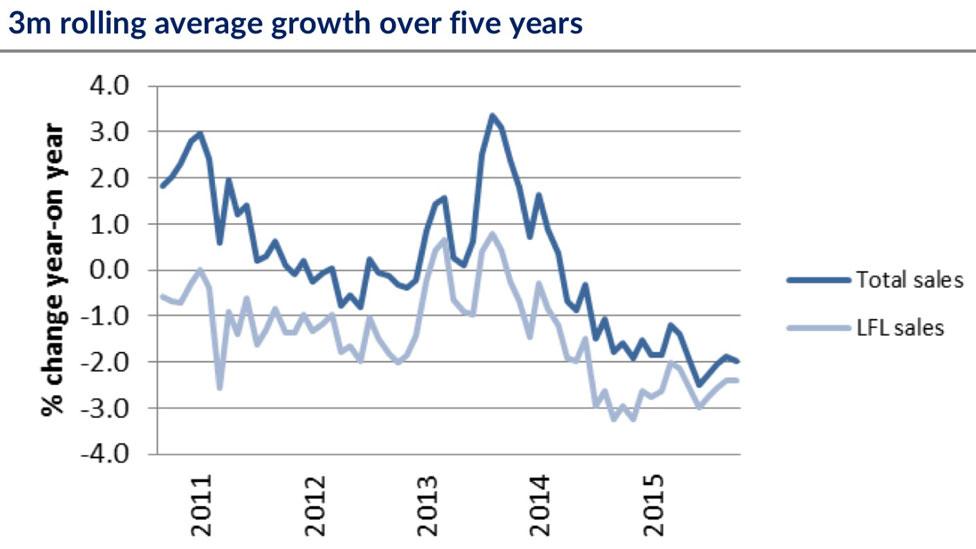

The industry looks more closely at like-for-like sales. That measures how shops are faring which have been trading throughout the year. In Scotland, an average for the past 12 months of -2.5%. Throughout the UK: up 0.6%.

Of course, there's a big move towards online shopping. The Retail Consortium is trying to take account of that as well. And that doesn't look so bad.

But it's still very flat. Over the past year, the average of the preceding three months of non-food sales, including online, has been 0.5% growth in Scotland. Across the UK: 2.9%. That gap has been consistent for at least a year.

Food has been particularly tough-going, driven by price competition and particularly between the supermarkets. The average fall in Scottish food sales over the past three months of figures: down 3.3%. In the UK: up 0.5%.

Fancy dress

The October reports are downbeat on non-food as well. Hallowe'en fancy dress gear sparkled some magic dust. But relatively good autumn weather meant that winter coats and boots went unsold.

The trend for sales figures is down over five years, and during that time, established, like-for-like (LFL) stores have rarely seen positive growth figures

While retailers are hoping for an autumn statement from George Osborne next week that peps up consumer confidence, we're told their customers have spent autumn holding out for better deals towards the end of the year.

That was the explanation also this week for the SRC's footfall figures, which again showed a decline in the number of people out on shopping streets and shopping centres. Out-of-town retail parks were doing better.

Again, these figures were down when much of Britain was up, though the Scottish figures were clearly better than northern England. And Scots shop vacancy rates looked better than elsewhere.

Black Friday

Customer expectations that there are sales ahead, and therefore no need to shop until then, is likely to be a major cause of sleepless nights for retailers.

The 'tradition' of having a Black Friday sale the day after Thanksgiving - the final Thursday in November - has been built up over time in the US.

In Britain, it's a recent import, driven by Amazon. And its rapidly established success in driving sales has upended conventional thinking and planning for the vital Christmas season.

Last year saw traffic and crowd pressure, and an estimated £1m spent every three seconds.

For this, retailers have to take a guess at how much more of a phenomenon it could be next week - ensuring they've got enough stock, adequate home delivery capacity, and enough fire-power and customer appeal left to get some margin out of the subsequent four pre-Christmas weeks.

Asda has taken the bold move of shifting away from Black Friday deals to spread its discounting effort over a longer period. It joins John Lewis, Primark and Argos, which is having several discount Fridays in November.

It seems Black Friday is already under way, 10 days early. Amazon is offering short-term deals at regular intervals, and expects to offer the biggest deals on Thanksgiving Thursday itself.

It's reported in America that one of the main outdoor sports equipment chains, REI, is retreating from the market pressure, and promoting the Thanksgiving holiday as an opportunity for quality family time.

The market analysts at Fitch have also been looking at Black Friday trends in Britain, and reckon it's already peaked.

It simply doesn't work for most conventional retailers, and the few who have backed away already can expect to be joined by others before next week is over.

Battling Germans

Asda has a bigger, longer-term battle on its hands, to fight off the challenge from the new, German-based discount stores. Lidl and Aldi have together just reached 10% of British grocery sales.

It is only three years since they had half that share, and nine years before that, they were on 2.5%.

Through its US parent company, Walmart, Asda has just released figures showing sales down 4.5% in the year to July-September - only slightly better than its worst ever fall, of 4.7%, in the previous quarter.

On Tuesday, data firm Kantar Worldpanel issued the figures watched closely by the industry, showing grocery market figures and share.

In the 12 weeks to 8 November, Asda slipped most, by 3.5% to £4.1bn. It lost second position to J Sainsbury's, with 16.4% and 16.6% of the market respectively.

Retreating Tesco

Tesco, in retreat from its rapid, all-fronts expansion and with its problems well documented, saw sales down 2.5% to below £7bn, with its grocery share falling below 28%.

Morrison's is still in a bad place, having tried to catch up with a convenience store format but quickly giving up and selling up.

It has also moved away from heavy dependence on coupons at the check-out. Sales fell 1.7%, with its market share just ahead of Aldi and Lidl combined.

While the Co-op and Waitrose edged their sales upwards (with 6.3% and 5.2% of the market), Lidl was up 19% to more than £1bn sales in the 12 weeks. It had 4.4% of the market. Aldi was up 16% to £1.4bn, with 5.6% of the market.

In the past year, these two gained a million more customers. Kantar reports that Lidl's average checkout basket has risen in value to £18.85, which is 78p ahead of the industry average.

Price points

J Sainsbury may be getting something right, judging by these figures.

An interesting insight into its response to the German discounters was revealed in an industry analyst's note this week.

This suggests the big orange store reckons that only around 20% of its grocery volumes are being undercut by the discounters. If it can match them on those items, it could try to gain margin on others, where it does not compete.

And if it successfully does that, the Jefferies note reports the Sainsbury view that it can remove the oxygen from the price competition which is Aldi's and Lidl's only significant market proposition.

Without that, the Germans will be constrained in how much they can fulfil their expansion plans, and thus, their rapid growth could be held in check.

It might work. But even if the big four can assert themselves, this looks like remaining a highly dynamic market-place, and a particularly challenging one for the big players in it.

- Published18 November 2015