A new shape to the state

- Published

The season of mists and low-hanging fruitfulness is past. The autumn statement has a more wintry chill to it this year.

That is because it is accompanied by George Osborne's second spending review, setting out the path of public spending and departmental allocations until 2019-20.

And after those low-hanging fruits - the easier wins - have been picked and squeezed, the next five years look like presenting a tougher challenge.

This is more like taking a chain-saw to branches, and perhaps chopping down some of the trees of state.

What it is likely to signal is a fundamental re-shaping of the role of the state. And as the state is becoming politically and fiscally fractured, that puts strains on the re-shaping north and south of the border.

Health protection

There is lots to watch for at 12:30, when the Chancellor gets to his feet. Here are some pointers, based on the most recent, pre-statement numbers.

First, ring-fencing. The National Health Service, cash spending per school pupil and overseas aid are protected. The Treasury has pledged to throw a fence around them.

Mr Osborne is reported to be going further, with a £3.8bn injection of funds with which to see off a gathering financial crisis in the NHS. Even with real terms protection, funds have failed to match the demands on the NHS, and that's how it is expected to continue.

Other departments have done deals to protect parts of what they do, such as military equipment and anti-terrorist intelligence.

The Ministry of Defence has argued for military equipment spending to be maintained

It means that those without protection, which have already shrunk relative to the big-spending health, education and welfare departments, are going to take a much bigger chunk of the cuts to come.

Those that are weighted towards day-to-day, or revenue spending, such as policing and local government, look likely to face a much deeper cut over five years than transport, which is more about capital spending.

Capital is due to rise by 11% over this parliament. That's why George Osborne can be expected to make a big deal about housing, railways and northern English infrastructure.

Dramatic cuts

However, revenue spend, according to the Institute of Fiscal Studies (IFS), is due to fall by more than 3%. That sounds manageable to most organisations. But once the big protected ones have been taken into account, the smaller unprotected spending departments face real-term cuts averaging 27%.

Some of the pain is expected to be felt by a gradual, painful squeeze on social care, for instance, where need is rising. Elsewhere, subsidies for the arts will likely see a more dramatic use of the chainsaw.

Whereas many people saw only a limited impact from the past five years of cuts, there is now the question of when the majority will begin to feel the impact of the next five years, and when that will become a stronger part of the political narrative.

Library closures fire up the middle class. Local government funding in England will have fallen by nearly two-thirds over the decade, reckons the IFS.

Police numbers are symbolic of a commitment to fighting crime. The BBC could chop services because (bizarrely) it has taken on the welfare department's commitment to pay the licence fee for over-75s.

Bedroom tax

And welfare cuts will go deeper. The so-called bedroom tax was a relatively small cut to the total welfare budget. Most of the cuts achieved so far were from squeezing working age benefits in real terms - not uprating by as much as inflation. That's very significant, but not so obvious.

The next cuts look more likely to gather political opposition, as tax credit cuts already have. On them, George Osborne will have to find a way of softening the blow for low-paid "strivers", without losing face and without breaking a fiscal constraint of his own devising.

The latest cuts are likely to stoke up political opposition

The gap between working age welfare cuts and pensioner benefits continuing to rise is another of those slow burners worth watching.

The decade of austerity has protected pensioners while hitting younger people. The same younger people will have to live with the very large national debt that is their inheritance. Look out for strains between the generations.

Barnett fair?

And look out for more of those well-rehearsed strains between the nations. The block grant that comes to Holyrood (and similar to Cardiff and Stormont) is partly protected by decisions made by the Treasury, and partly not.

Of around £30bn spent by Holyrood, £12bn now goes on health. So if that part is being largely protected, then it should ease the strain on John Swinney's budget, when he presents the draft on December 16th.

Likewise for schools, though the 'cash spending per pupil' formula sounds like it's far from generous.

However, if justice, economic development, universities and local government are being fiercely squeezed in Whitehall, that has a proportionate squeeze through the Barnett allocation.

That doesn't mean the Scottish finance secretary has to squeeze each of these as hard. The block grant can be divided up in entirely different ways.

But politically, it will be hard not to protect the NHS and schooling at least as much as Whitehall is doing.

Manifestos

And he has other commitments to consider; a big uplift in childcare spending, a floor on college funding, free university tuition, and a rise in the building of affordable homes from 30,000 in the current Holyrood Parliament to 50,000 in the next one.

That's before we get to see the other pledges in next year's Holyrood election manifestos.

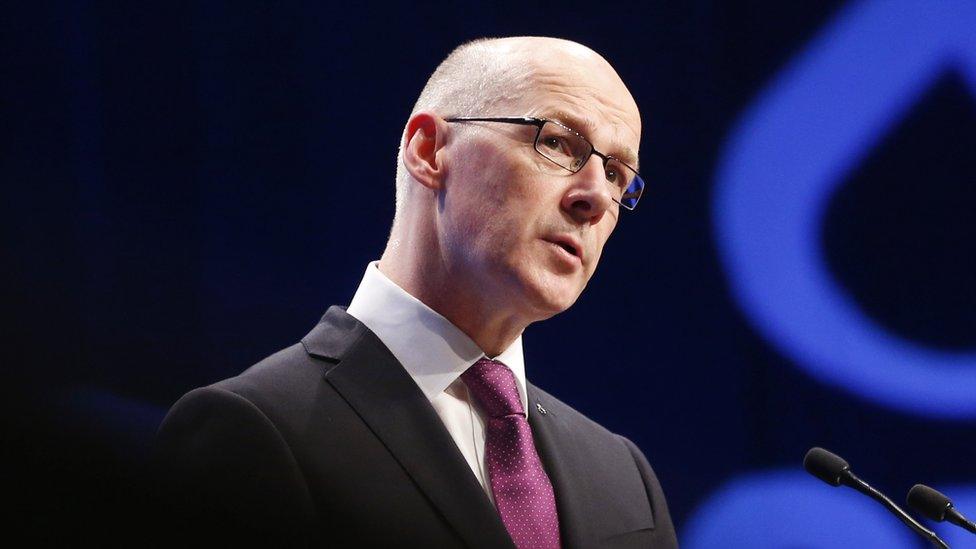

Scottish Finance Secretary will have to square the SNP's spending commitments with the new financial landscape

IPPR Scotland, a new offshoot of the London-based think tank, the Institute of Public Policy Research, reckons that the pluses and minuses of the Barnett formula should lead to a real terms squeeze of more than 11% in non-protected Scottish revenue spending by 2019-20, from £14.1bn to £12.5bn (in 2015-16 prices).

That is while capital spending could be up by nearly 12%, much of it on those affordable homes. And it depends on Mr Swinney making the most of limited borrowing powers

Squeezed Swinney

Given that Mr Swinney has an election to fight in May, he is unlikely to be as open about his spending intentions beyond next financial year as George Osborne can now afford to be. And the toughest of the squeeze on the Scottish budget looks like coming in 2017-19.

The novelty about the Holyrood block grant next year is that several billion pounds are going to be carved out, because from next April, MSPs set the Scottish Rate of Income Tax by which half of income tax will be raised.

For reasons of SNP politics, that's not likely to diverge from the UK rate next financial year. But with more powers due to follow, there will surely be pressure to use them for loosening the Whitehall squeeze over the rest of the decade.

By the start of the Twenties, the protection of priority areas and the weakening of the unprotected will likely leave the state in a markedly different shape - big on health and schooling, but in retreat from its other roles.

The season of mists and low-hanging fruitfulness is past. The autumn statement has a more wintry chill to it this year.

- Published25 November 2015

- Published24 November 2015