Scottish manufactured exports fall by 0.4%

- Published

Scottish manufactured exports fell by 0.4% in the third quarter of last year despite a strong performance from the food sector, according to new figures.

Scottish government statisticians said food and drink export volumes were up by 3.6%, with food sales up by 17.3%.

But sales of metals and metal products slumped by 15.7%.

There was also a substantial fall in exports from the sector covering non-metallic products, other manufacturing and repair.

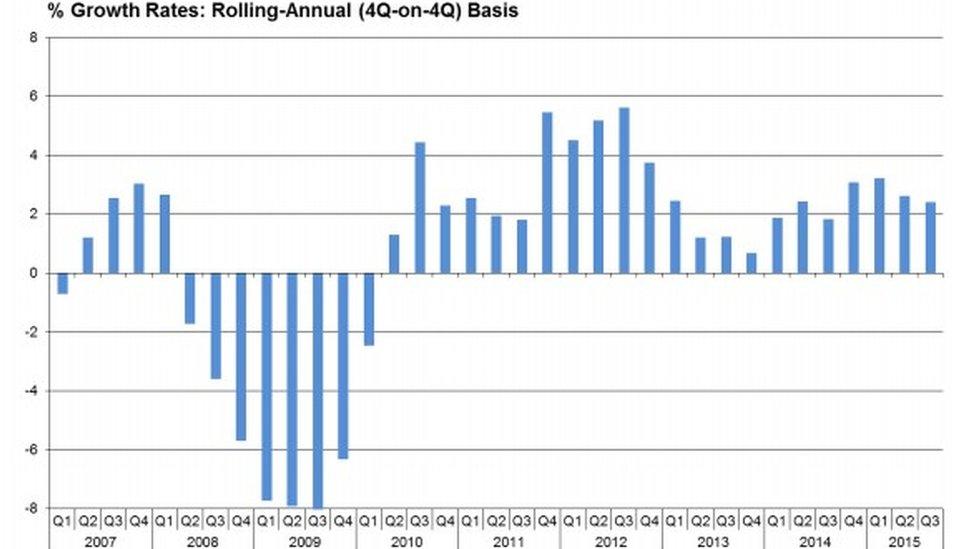

Despite the quarterly fall, the overall volume of manufactured goods sales to overseas markets grew by 2.4% over the year.

The latest Scottish Index of Manufactured Exports, external recorded growth in food, beverages and tobacco (+3.6%) and refined petroleum, chemical and pharmaceutical products (+0.9%).

The engineering and allied industries sector saw sales rise by 2.4% - its first recorded positive growth of the year.

While the food sector showed strong growth, drink exports were flat at 0%.

Source: Scottish government

Comparing average growth in the latest four quarters with the previous four quarters, there were contractions in wood, paper and printing (-4.7%) and non-metallic products, other manufacturing and repair (-1.8%).

Annual growth was positive in all other sectors including food and drink (+2.6%), refined petroleum, chemical and pharmaceutical products (+10.8%), textiles, clothing and leather (+1.8%), engineering and allied industries (+1.7%) and metals and fabricated metal products (+4.6%).

Deputy First Minister John Swinney said: "Today's figures continue the recent trend of export growth, which is consistent with the wider picture that has materialised for the Scottish manufacturing sector from the recent Q3 2015 GDP figures and business surveys over this period.

"It is encouraging to see strong quarterly growth in food, beverages and tobacco and engineering and allied industries sectors, and export growth of 2.4% during the year.

"These statistics show, however, that the Scottish economy, like that of the UK, is continuing to feel the effect of significant global headwinds that are being driven by muted global growth alongside the strong value of sterling and current oil prices."

- Published13 January 2016