Warning issued over oil industry cuts

- Published

Oil and gas firms have been warned not to cut costs too harshly, as they could "throw the baby out with the bathwater".

A leading consultancy also said they should move into other energy sources as they adapt to a "new normal".

PwC's energy team argues that the sector may soon face governments' cuts to oil production if new emission targets are to be met.

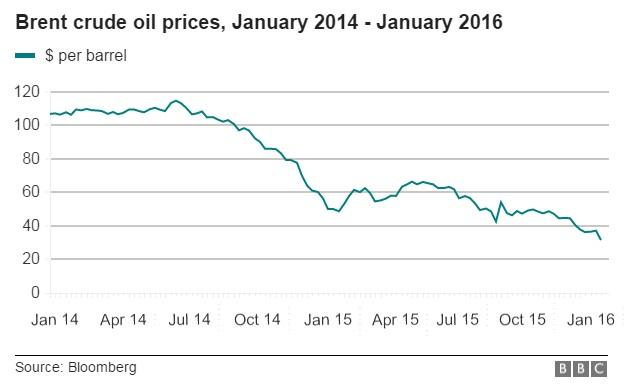

The advice follows a sharp fall in the global price of oil.

The Brent crude benchmark price has fallen from US$115 per barrel to less than $28 in 20 months.

Industry analysts expected it to be rising by the end of 2015, but the price has continued to fall this month, and there is now an adjustment to expectations of being "lower for longer".

Going under

Some industry advisers have warned that options are running out for some cash-strapped companies, and that there could soon be more acquisitions by financially-stronger rivals, with assets now priced low.

The Association of Chartered Certified Accountants (ACCA) has issued a report saying "the risk of going under is a very real one for many oil and gas companies", due to low cash-flow, large debts and senior executives nearing retirement, leaving a leadership vacuum.

PwC's report, published on Thursday, warned on industry moves to cut costs.

It said: "Oil companies are negotiating aggressively for 10% to 30% discounts from oil-field service providers."

It cites industry announcements that total more than 200,000 job losses around the world.

"Massive cost cutting may offer some short-term breathing space, but it is a myopic, panicky response that could leave businesses unequipped for the next turn of the business cycle," said the consultancy's advice to executives.

"No matter how difficult things get, avoid arbitrary cost cutting, which can leave your organisation ill-prepared for an uncertain future."

The drive to cut costs has been particularly strong in the UK North Sea, where costs per barrel have risen sharply in recent years as production has fallen.

Babies, bathwater

The advisers say company executives should channel funds into areas of individual company strength, which have the best prospects for growth.

There is a call for innovation to control oilfields remotely, with more extensive use of sensors. That would mean far lower staffing costs offshore.

The ACCA report warns executives "not to throw the baby out with the bathwater" when they are cutting costs.

"Where redundancies are inevitable, manage them carefully to account for skills-gap impact, and ensure readiness for future growth when the oil price rebounds," it said.

"The inevitable short-term fire-fighting should not come at the expense of the long view."

The PwC reports also warned firms with spending power against buying up too many oil reserves, as they could be "unburnable" if governments act to cut carbon emissions.

Last year saw movement towards such constraints being placed on the industry, notably at the Paris climate change talks in December.

The advice being offered to industry bosses is that they should diversify into low-carbon forms of energy.

For some, that could be a move into gas production, as it emits less carbon than oil. It could be more investment in renewable energy.

There is also advice to produce oil and gas more cleanly, meaning less by-product of harmful emissions.

The business consultancy argued: "The oil and gas landscape is being significantly reshaped by a potent emerging trend: the fear of climate change and a powerful, concerted effort to reduce carbon dioxide emissions and minimise fossil fuels.

"If you are a business leader in this industry, your most important task this year is to address or at least face up to a vital existential issue: how to successfully do business in an increasingly carbon-constrained world."

Viren Doshi, leader of the PwC energy strategy team, commented: "Managing uncertainties requires a plan that not only takes advantage of current conditions but simultaneously enables the company to create scenarios that will help drive success with this 'new normal'."