BP selling part of Magnus field and Sullom Voe stakes to EnQuest

- Published

The deal will see EnQuest secure a 25% stake in the BP-owned Magnus oil field

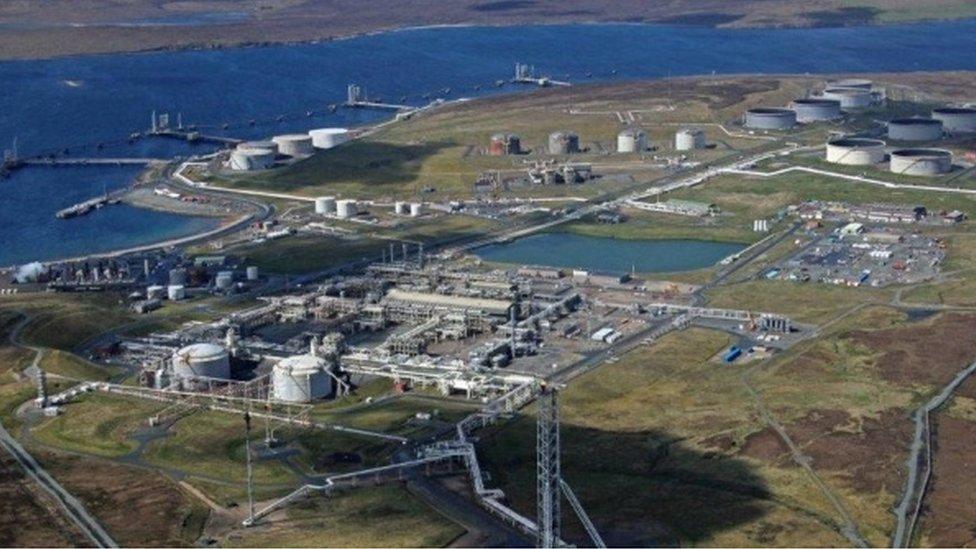

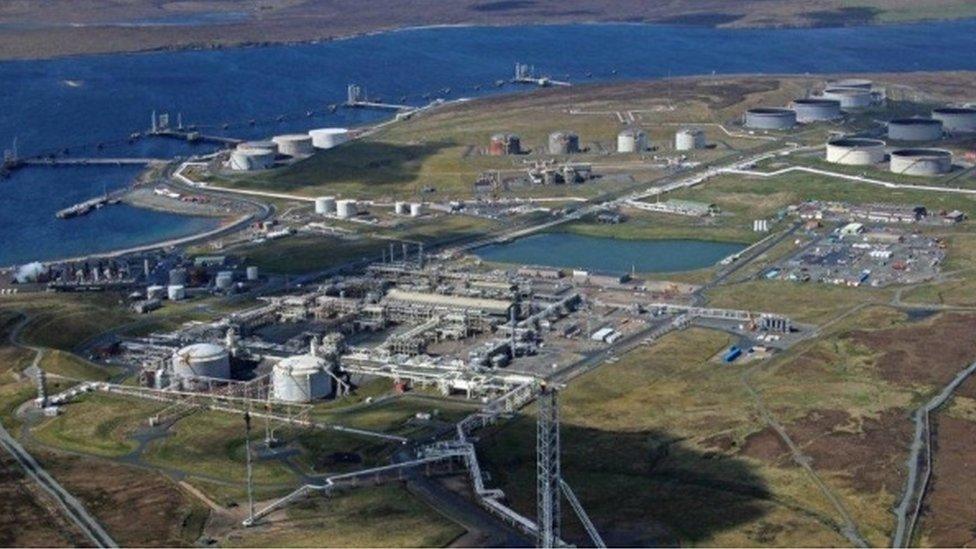

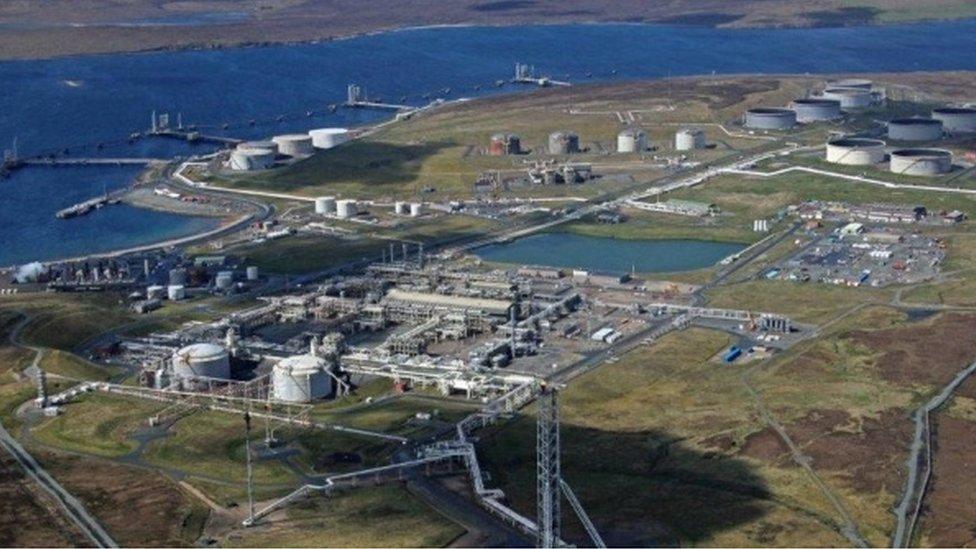

BP is to sell part of its interests in the Magnus oil field and Sullom Voe terminal in Shetland for £68m ($85m).

EnQuest will secure 25% of BP's Magnus stake, and a 3% share of the Shetland facility.

It is expected that about 100 BP staff linked with Magnus, and about 240 at Sullom Voe, will also transfer to EnQuest.

The company will have future options to take full ownership of Magnus and a larger Sullom Voe stake.

The deal also includes 25% of BP's interests in several associated pipeline systems.

Magnus is the UK's most northerly field, located 160km (100 miles) north east of the Shetland Islands.

The sale price of $85m is expected to be met from Enquest's share of future cash flows from the assets. The agreement will not include any upfront payment to BP.

The deal includes EnQuest buying a 3% share of the Sullom Voe terminal in Shetland

BP said EnQuest's record of extending the life of mature assets made them a natural operator for the interests.

BP North Sea regional president Mark Thomas said: "Sullom Voe and Magnus have been great businesses for BP, but to maximise the economic life of these important assets, we believe this deal will offer them a better long-term future."

The union Unite said there should be no change to the terms and conditions of any worker moving over to EnQuest.

Regional officer John Boland said: "When transfers like this happen, there is often a concern about potential job losses.

"We strongly hope that is not the case here, and we will be talking with BP and EnQuest to get a clear idea of their plans for the future so our members are fully informed."

'Positive signal'

Industry body Oil and Gas UK welcomed the deal, which is still subject to regulatory approval.

Chief executive Deirdre Michie said: "This is an innovative deal which will open a new chapter in the life of Sullom Voe and the productive life of Magnus, an iconic North Sea oil field.

"It also sends a very positive signal on the opportunities available in the North Sea and is an indication of confidence that, even after producing oil for more than 30 years, this mature field still has more to give."

She added: "The transfer of assets and infrastructure builds on a long-term trend to see 'the right mature assets' move into the right hands of established UK mature field operators and sees a fresh commitment to exciting development opportunities by established incumbent companies."

- Published10 June 2016

- Published31 March 2016