Deal done: now the budget work starts

- Published

The deal is done - the 19th budget in the Scottish parliament, and it is utterly unlike anything we've seen at Holyrood before.

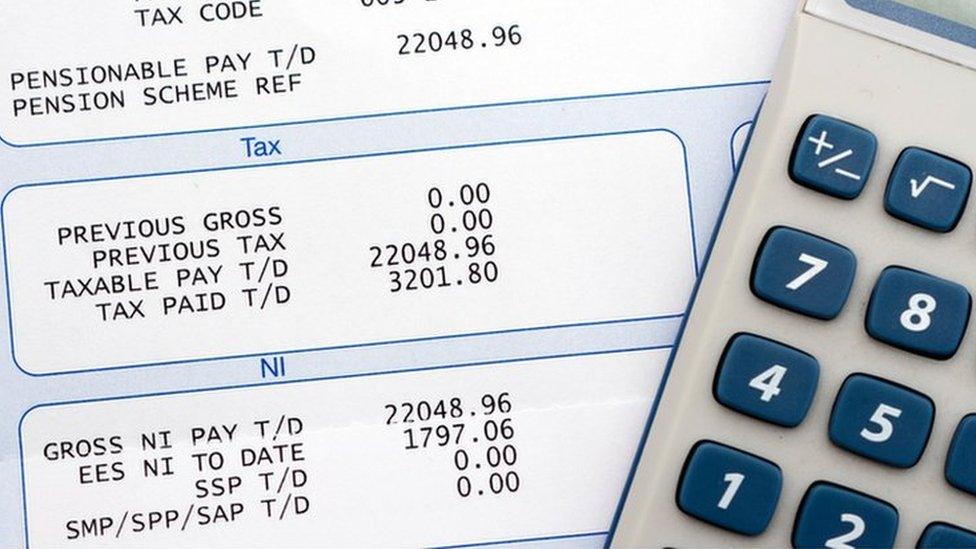

The difference for lower earners may be a mere £20 to the good: for topmost earners on £150,000, it's 2,000 quid to the bad.

Either way, the significance of the divergence is immense, because it begins a process which could go in different directions. It will be steered by the politics of Holyrood, and will probably have a profound effect on shaping the Scotland's economy.

This year, pressure to ease the budgetary pain on councils and public sector workers, alongside manifesto pledges including more childcare, led simply to the taxpayer being handed the bill.

However, there's little sign that the pressure on council funds will relent next year or the year after, or on public sector pay, or the cost of those manifesto pledges as ageing demographics turn the screw.

There may be sufficient economic growth to give some buoyancy to income tax revenue, but for now, not much sign of where that will come from. The tax band changes don't appear to be designed to give it much of a boost.

And remember that the Scottish government is working on an assumption - given to it by the Scottish Fiscal Commission - of only 0.7% growth this year. That's very, very weak.

So how will the budget be balanced in future? Stephen Hay, head of tax in Scotland for RSM accountants, takes a guess: "Do the plans go far enough to support public services, economic growth, home owners and Scotland's fiscal health?

"The additional £219m only just covers the decrease in block grant funding at £200m, so Scotland will effectively break even; and it will make little impact on the growing deficit which sits at £12bn.

"Now the bold step has been taken to use the devolved powers and add additional tax bands, could we see further tax increases in the future to make up the shortfall?"

Scrutiny

For this year though, having reached budget D-Day this year and a yellow-green majority in the bag, is that it?

No, say the accountants. At Deloitte and KPMG, they were quick to tell their clients that there's a lot of detail to be worked out about pension contributions, gift aid and the married couples' allowance. Westminster will have to adjust its law.

Moira Kelly, from the Chartered institute of Taxation, suggested tax returns will become more complex, and not just for the payroll department.

She explained: "The new starter and intermediate rates of tax may mean that increasing numbers of Scots may have to enter self-assessment in order to ensure that they not only obtain the appropriate amount of tax relief, but understand clearly their tax position.

"While it is unlikely we will see such significant and substantive changes every year, the current Scottish budget process does not lend itself well to ensuring adequate scrutiny of devolved tax legislation."

Treasury steamroller

So, what about that process? What about future budgeting, which will again be fiercely squeezed between early December and mid-February, with a festive break in the way?

Are MSPs adequately equipped to scrutinise budgets as they become considerably more complex, requiring an understanding of both sides of the ledger - taxation as well as spending?

While they can now levy an extra £219m to get to a politically attractive outcome, are they sure about the efficient and effective spending of the other £40.4bn?

Auditor General Caroline Gardner recommended changes "to help the parliament and the public in their scrutiny of public finances"

The Auditor General, Caroline Gardner, doesn't seem to think so, though she puts it politely. Before this year's budget process got under way, she recommended changes "to help the parliament and the public in their scrutiny of public finances".

These include:

"Publishing a consolidated account for the whole public sector to outline total assets, liabilities, borrowing and investments"

"Introducing a medium-term financial strategy to outline high-level financial plans for the next five years"

"Finalising policies and principles for using the new borrowing and reserves powers"

Even if the Scottish government published all that, would MSPs know what to make of it? MPs at Westminster are given much of this material. It's not clear that they know either, when faced with the Treasury steamroller.

The Chartered Institute of Taxation has suggested a new committee dedicated to taxation affairs, splitting the role of Holyrood's finance committee. Just one of its roles would be to assess the complex reckoning that leads to the block grant from the Treasury. It matters a lot, but how many people could tell if it is fairly calculated?

Continuous budgeting

The Auditor General was not alone with these ideas. The Budget Review Group, commissioned by MSPs and reporting last summer, recommended:

"Full Year Approach: a broader process in which committees have the flexibility to incorporate budget scrutiny including public engagement into their work prior to the publication of firm and detailed spending proposals"

"Continuous cycle: scrutiny should be continuous with an emphasis on developing an understanding of the impact of budgetary decisions over a number of years including budgetary trends" (There hasn't been a spending review since 2011)

"Output and outcome focused: an emphasis on what budgets have achieved and aim to achieve over the long term, including scrutiny of equalities outcomes"

"Fiscal Responsibility: scrutiny should have a long term outlook and focus more on prioritisation, addressing fiscal constraints and the impact of increasing demand for public services"

"Interdependent: scrutiny should focus more on the interdependent nature of many of the policies which the budget is seeking to deliver."

Even introduced over time, that would be quite a radical set of changes, requiring a lot more scrutiny from MSPs and more exposure to year-round parliamentary buffeting for the finance secretary.

Happiness

At least two more items crowd onto the agenda for future budget setting and scrutiny. One is the lack of data on the wider economy.

The Scottish Fiscal Commission can only guess, and quite wildly, at the 'behavioural effects' of earners shifting income around to minimise their tax bills.

There may be a limited benefit this year, but with further divergence, the benefits will grow for business owners to moving from salary (taxed at Holyrood) to dividends (taxed by Westminster).

A Holyrood committee on the economy, jobs and fair work this month set out the shortcomings of economic stats that are now available. It pointed to the absence of reliable figures on Scottish price inflation, trade, and investment either by business or from abroad.

There are concerns that business data is not broken down into Scottish units, and the lack of measurable gender impact of various policies.

The committee suggested there may be a case for a separate Scottish statistics agency, not least to show its independence of ministers, by denying them pre-publication access to data and the opportunity to spin the numbers.

Meanwhile, the Scottish government has been one of a handful of administrations showcased this week by an international group trying to find a better way of measuring economic outcomes that encompass more than Gross Domestic Product.

It's in quite good, select company: the governments of Spain, Sweden, Italy, France, the UK, New Zealand and Ecuador.

The so-called Global Happiness Council notes praise for the efforts in Scotland to focus on the outcomes from policy decisions rather than the inputs of money. This is through a dashboard of progress towards 55 targets, easily explained by arrows up or down.

However, it adds that "linking the high-level purpose, targets and outcomes of the National Performance Framework with the government's actions and spending programmes remains an ongoing challenge".

We're told that, 10 years on, the "Scotland Performs" dashboard of targets is up for review this winter, including a belated attempt to road test it with the public.

Its future seems secure as a means to help ministers, MSPs and others check on targets and delivery, even if those outcomes are less so.