Furniture company Havelock Europa close to collapse

- Published

The company has been a major employer in Fife

A major employer in Fife has had trading in its shares suspended over concerns about its financial position.

Havelock Europa is headquartered in Kirkcaldy and employs 320 people. It produces furniture and fittings for shops and public buildings.

It said in a statement that discussions with existing funders and investors on further funding were "unlikely to result in a positive outcome".

However, talks with other interested parties interested were ongoing.

The move to suspend the buying and selling of shares is with immediate effect.

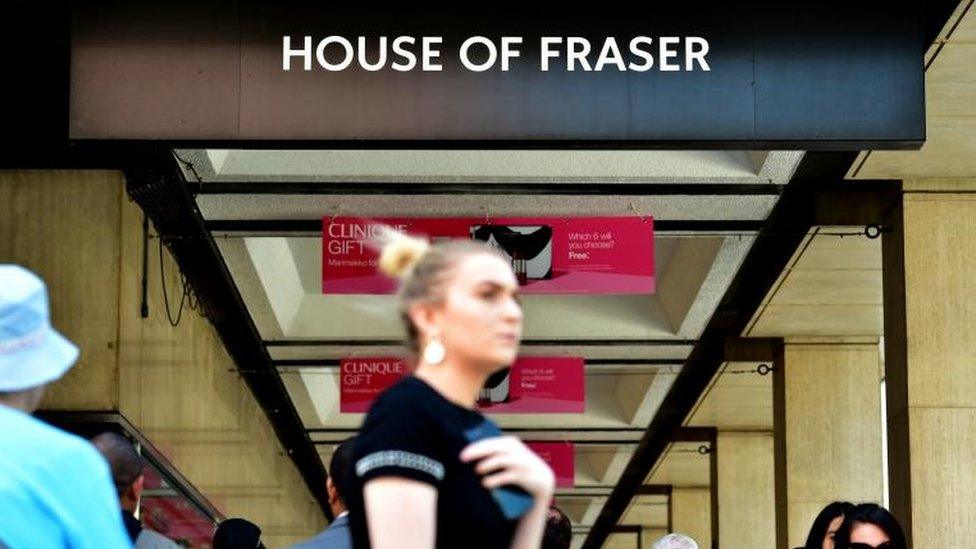

Havelock Europa's customers have included Primark, Holland and Barrett, and House of Fraser.

It has blamed continuing pressures on the retail sector for it a drop in sales.

Last month the company admitted there was "significant doubt over its ability to continue as a going concern".

Fife Council have said they are in daily contact with the company.

Pressures on the retail sector have affected Havelock Europa

Co-leaders David Ross and David Alexander said: "This worrying announcement potentially has a major impact on Kirkcaldy and mid-Fife, as the company is the one of the area's largest employers.

"The Council has been strongly supporting Havelock over the past year with regular officer engagement, and significant assistance from Scottish Government and Scottish Enterprise.

"This will continue as the company considers its options over the coming days, and the Head of Economy, Planning and Employability will be in daily contact with the company and the national agencies as the situation develops, to provide all possible support to the company and its workforce."

The Havelock company statement said: "In its announcement of its results for the year ended 31 December 2017, released on 31 May 2018, the company referred to a material uncertainty that may cast significant doubt over its ability to continue as a going concern and to realise its assets and settle its liabilities in the normal course of events.

"Since then, the company has experienced an unexpected increasing credit squeeze from its suppliers, as a result of which it has substantially utilised its available facilities following the re-financing first announced on 20 February 2018.

"The board announces that it has been in discussions with existing funders and investors in the company regarding the provision of further funding, however it became apparent yesterday evening that these were unlikely to result in a positive outcome."

It added: "The company's ordinary shares will therefore be suspended from trading on AIM with immediate effect pending clarification of its financial position."