The Library of Mistakes

- Published

A group of Edinburgh financiers has set up a gem of a library, dedicated to learning from financial fiascos and failures.

It was opened five years after Royal Bank of Scotland published the record £24.1bn loss for 2008.

Now aged five and small-scale, it has a big ambition - to become the biggest financial and business reference library in the world.

It already has an outpost in India.

To lose one parent may be regarded as a misfortune, observed Lady Bracknell in The Importance of Being Earnest. To lose both looks like carelessness.

It's with that lesson in life that some Edinburgh financiers and business academics have set about limiting the recent decade of frightful unpleasantness for Scottish banking to a mere misfortune. One wouldn't wish to look careless.

So while mainstream libraries face sharp budget cuts and possible closure, they opened the Library of Mistakes five years ago this month. Its mission: to learn how things went wrong in the past and, in particular, how things went badly wrong with money.

Its founders were willing to invest some time and effort in ensuring that the catastrophe that overwhelmed Scotland's two giant banks 10 years ago is not repeated.

The motto is Mundum mutatu errore singillatim - changing the world one mistake at a time.

The notion is that the generation that invented the iPad must be capable of thinking up some new mistakes, but wouldn't it be nice to avoid repetition of previous ones?

It assumes that finance is full of bright people, some of whom do stupid things. One is to depend too much on one's plan.

Von Moltke is quoted as saying: "No battle plan survives contact with the enemy."

Similarly, the boxer Mike Tyson is recalled for having sagely observed: "Everyone has a plan until they get punched in the mouth."

So, Einstein's wisdom is offered on a sign resting on an elegant mantelpiece: "The only thing you absolutely have to know is the location of the library."

Hyperinflation

I paid my first visit on the 10th anniversary of Royal Bank of Scotland publishing its 2008 full-year results, with a record £24.1bn loss. It seemed an appropriate pilgrimage.

The safe house for this "errorist cell" is located in two rooms up a narrow stair and through a theatrically squeaky door in a New Town mews terrace close to the heart of the capital's financial district. Should politicians feel the urge to learn from it, they can find it a couple of minutes' walk from Bute House.

The establishment has the feel of a gentlemen's club, with plush leather armchairs - though when I visited, it wasn't that clubby. The door was opened from an unspoken remote location and no-one else was in.

On the way up the stair, it's worth a look at the decorative approach to the cludgie. Members have contributed bank notes from around the world - notably including those that suffered from very high inflation. The Turkish lira plays a prominent role.

Crash Bang Wallop

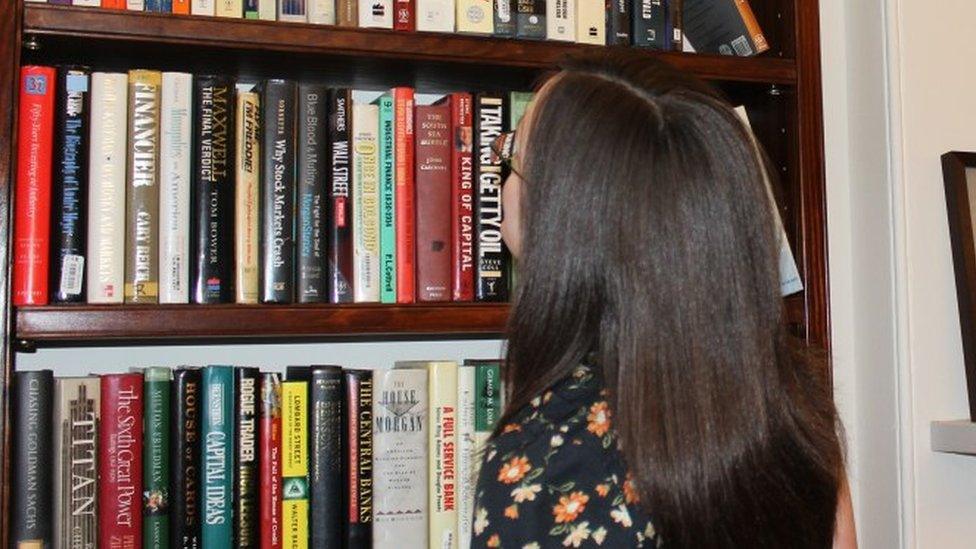

I'd expected something academic and dry. Far from it. This venture is at risk of celebrating failure rather than examining it, and the more spectacular the better.

Book titles sizzle with the excitement of it all; The Alchemists, Crash of the Titans, The Crunch, the Big Fix, the Perfect Prey, the Pride of Lucifer.

I could go on. No, hang on. I will. There's: Maxed Out, Boombustology, Debt Shock, Too Big to Fail, Crash Bang Wallop, Shredded, the Manipulators, Extreme Money, Bull by the Horns, and dot.bomb

There's also, inevitably, advice on how to cash in on others' financial misfortune: "Panics and Crashes: how to make money out of them" is authored by Harry D Shultz and published by the Dollar Growth Library.

As soon as you're through the door, the shelf of books about the Royal Bank of Scotland confronts you. It seems that this has been a healthy decade for publishing about finance.

There's the BCCI fiasco, which cost the Western Isles Council very dear back in the 1980s, when it sank its surplus reserves into the fraudulent Bank of Credit and Commerce International.

Council chiefs in Stornoway had failed to remember the age-old advice: If it seems too good to be true, then it probably is.

Tulipmania

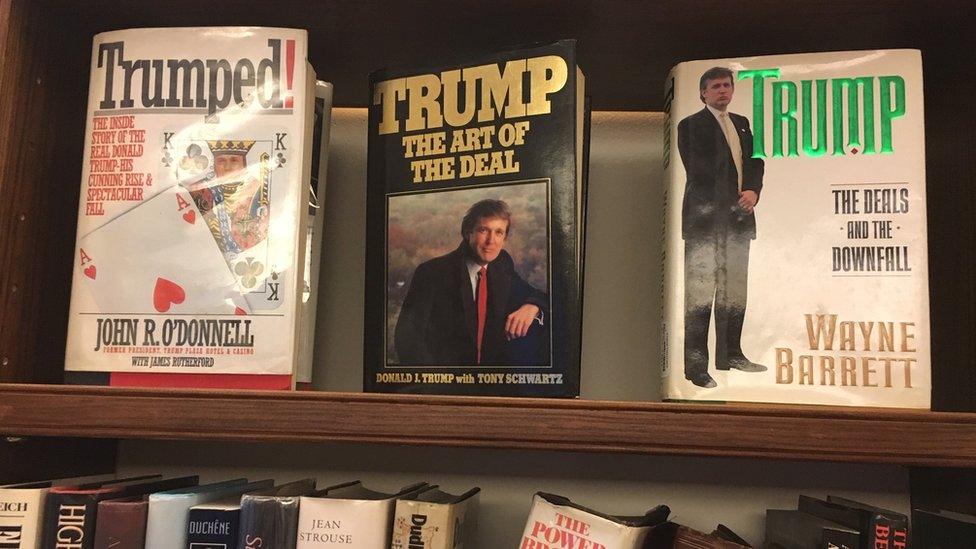

With all the books (that I saw) in English, it's natural that the USA plays a prominent role in the generation of scams, frauds and snake-oil sales. A display shelf has been specially set aside for books about Donald Trump - including his own bestseller about The Art of the Deal, and less generous takes on the road to his business empire's collapse in the early 1990s.

Going back precisely a century, there's a special place for Charles Ponzi, an early exploiter of crowdfunding.

His name is still used for investment scams where the gullible were recruited with the promise of impossibly high returns, and their funds used to pay the previous investors rather than for anything productive.

There's a copy of the royal declaration in pursuit of the cashier of the South Sea Company, and an etching of a ship's company embarked for Darien, now in Panama, on Scotland's most notorious and ruinous colonial exploit. Other certificates bear the names and subscription details of long bust mining and railroad scams in the New World.

A magnificent display of tulips celebrates the granddaddy of all idiotic asset bubbles, from the late 17th century in Amsterdam, when the price of tulip bulbs went stratospheric, and then wilted. A lot.

And there's a selection of board games. One ("not for those aged 13 or under") is a battle of Ponzi Schemes. Bulls and Bears was a less successful cousin of Monopoly. One game - appropriately large - is dedicated to re-working the excesses of the late Robert Maxwell.

Charm offensive

As you can read from its website, www.libraryofmistakes.com, the intention is not to be exclusive, but to be a beacon of learning from past mistakes, visible around the world, and with free access to anyone with an interest.

Edinburgh financiers are showing that such a learning process is not only one they take seriously, but that it can be a fascinating and enjoyable one.

It's also one with ambition - to become the world's biggest financial and business reference library. It already includes an outpost in the Indian city of Pune, at Flame University.

Meeting its target may require a lot more Edinburgh mews adaptations. But at its current scale, it has a lot of charm.

- Published23 January 2019

- Published22 January 2019