Clydesdale Bank notes to survive Virgin Money deal

- Published

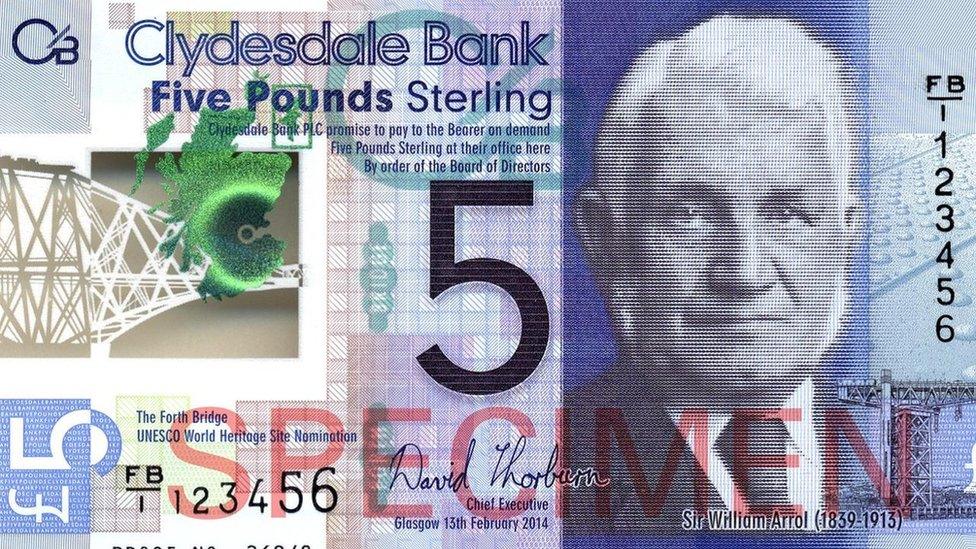

The Clydesdale £5 plastic note featured Scottish engineering pioneer Sir William Arrol

Clydesdale Bank notes are set to survive a Virgin Money takeover as owner CYBG calls time on its 175-year-old brand.

The BBC has learned Virgin Money will continue to issue Clydesdale notes despite the promise to have the entire business rebranded by 2021.

Meanwhile CYBG group warned of further potential job cuts as cost savings were increased from the merger.

B, the digital banking arm of the business, will be the first to rebrand.

It will bring to an end more than 175 years of the Clydesdale and Yorkshire Bank brands in Scotland and the North of England.

Potential cuts

CYBG said it was rolling out further automation within its branches and operations under plans to increase annual savings by another £50m to £200m by 2022.

The firm warned that the extra cost savings could lead to further job losses on top of about 1,500 already set to go as a result of the Virgin Money deal.

On the cost savings, a spokesman said the additional £50m was likely to come from a further push towards automation and its technology transformation.

He said: "It might include some further role reductions and automation in the branch network and other operational areas.

"We will continue to work through the details and will inform our colleagues first of any implications."

The face of the Virgin founder Richard Branson will not appear on Scottish banks notes

The group has already warned that about 16% of the combined workforce - about 1,500 jobs - will go following the Virgin Money deal, although some of these are expected to be lost through natural staff turnover.

It has so far said about a dozen branches would close, but there were plans to roll out more automation and self-service machines in the network.

What's next for Clydesdale customers?

By Douglas Fraser, business and economy editor

If you're a customer of Clydesdale Bank or Yorkshire Bank you would see more rewards-based accounts using the Virgin groups - so there may be incentives.

There's no detail on this, but reading between the lines we're talking about incentives involving things that Virgin runs - broadband to trains, to holidays, to an airline - and further moves also to digitise the bank.

Clydesdale has already gone quite a long way down that road with a brand that just uses 'B' - that's changing as well.

The digitised effort that they've made, they've invested very heavily in it, that's bound to continue as indeed the whole market is moving in that direction.

I have been told they are to continue issuing Clydesdale Bank notes, not Virgin Money bank notes - don't worry there will not be notes with Richard Branson's face, which some folk thought might be the case.

There's a schedule set out today, most of the changes starting later this year if they get the changes to their license through with the regulators and that would roll out over the next year or so.

Timeline

The B rebranding to Virgin Money will complete by next June.

This will be rolled out to Yorkshire Bank in 2019 and Clydesdale in 2020, with the entire business rebranded as Virgin Money by the end of 2021.

The wider CYBG holding company will change its name to Virgin Money by the end of this year.

CYBG chief executive David Duffy said the decision to lose the Clydesdale and Yorkshire bank brands was "not an easy one".

Mr Duffy said: "Both brands are a by-word for reliability and trust and we understand the emotional attachment customers and local communities have towards them.

"Marrying the values and expertise of these heritage brands with the Virgin Money brand will allow us to realise efficiencies and grow our business throughout the UK."

Ahead of an investor event on Wednesday, CYBG also outlined aims to boost its share of the personal current account market from about 2.5% to 3.5% - with the first full Virgin Money offering launching later this year.

The group - which was catapulted into sixth place in the lending market after its Virgin Money acquisition last October - will launch the first ever Virgin Money business current account by summer 2020 and is looking to increase it market share from about 3.5% to about 5%.

Mr Duffy said: "Despite the ongoing Brexit headwinds and continued competitive pressures, the strength of the combination gives us every confidence we will deliver on our targets."

- Published18 June 2018

- Published8 May 2018