Tough journeys for transport giants

- Published

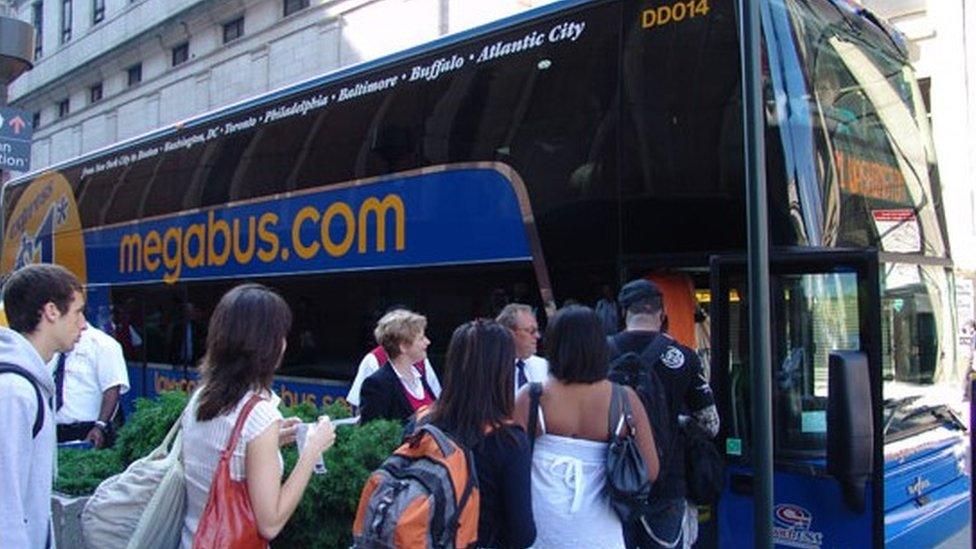

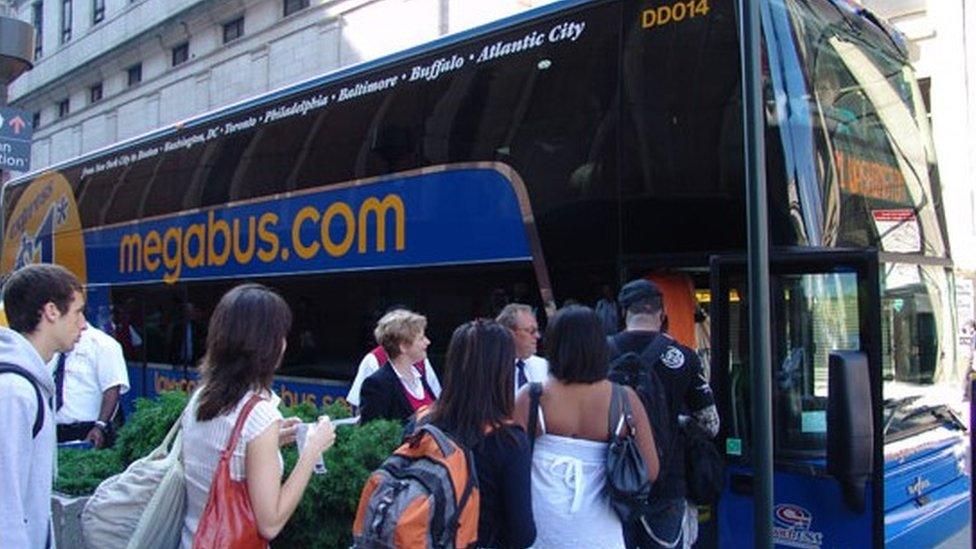

Stagecoach has faced tough competition in North America

Scotland's two big transport firms - Stagecoach and First Group - are going through major changes. For First Group, investor pressure has forced it to break up and focus on North America.

Neither has made a success of long-distance coach services in the US. One wants to focus on UK buses: the other to exit that business.

Both are finding it very hard to make Britain's rail franchises work financially.

Innovation is focused on putting public transport at the heart of green policy, and trials of autonomous buses.

Two big transport firms based in Scotland are going through some big changes. They're heading in opposite directions, and in several ways, it's proving to be an uncomfortable ride.

This matters a lot to Scotland plc, as it doesn't have many corporate headquarters with the reach of Stagecoach or First Group. That reach is diminishing rapidly.

Stagecoach, based in Perth, is having the easier journey, for now. On Wednesday, it reported results for the year to April, with revenue sharply down but pre-tax profits holding steady.

Most companies would see themselves in a severe crisis while reporting a drop in revenue from £2.8bn to £1.9bn. Not so if it means exiting a troublesome division in the US, where Stagecoach has left the Megabus inter-city coach business, finding it too hard a road in competition with low-cost airlines and low-cost gas guzzler cars.

Even less troubling for investment is the exiting of Britain's railway franchises. Stagecoach has the West Coast Rail franchise in a joint venture with Virgin. It also has an English Midlands franchise, and it gave up the East Coast line because it was losing too much money on it.

It made clear that it refuses to bid for more franchises while Chris Grayling's transport department in Whitehall insists that bidders take on a big tranche of pensions risk. There is legal action under way on that.

Snoop Dame

Confirming on Wednesday that Stagecoach expects to be out of UK rail operations from this November saw share prices surge from trough to peak by 10%, before falling back to the day's opening price.

Railway franchises are intended to run at a profit. That's why Labour wants to bring them back into the public sector. But where there isn't much profit to be made, it may not have much choice.

Alexander Dennis will build most of the planned new vehicles

This leaves Stagecoach focused back on UK bus operations where it started. Its emphasis is on making bus travel greener, more comfortable and more convenient in a renewed fleet. Much of it is from Alexander Dennis Ltd in Falkirk, recently sold to a Canadian firm by a consortium including Stagecoach founders Ann Gloag and Sir Brian Souter.

The route map includes trials with autonomous buses. Having invested in contactless payments and doing 10% of bookings digitally, the firm wants to remain innovative, and plugged into the decarbonising of the economy as a business opportunity.

It is worth noting also that the Stagecoach board of directors is losing not only deputy chairman Will Whitehorn, after nine years, but also Dame Jayne-Anne Gadhia, former boss at Virgin Money, who wants to spend more time with her new fintech start-up, Snoop, reported to be entering the market for price comparison websites.

First out the depot

First Group, up the road in Aberdeen, has been having a much less happy time with its UK buses, which account for a fifth of town and city buses outside London. At the end of last month, it announced it wanted to sell the lot. The drivers' union is not happy about a new owner and a risk of asset stripping.

While operating rail franchises Great Western, South-West and Trans-Pennine (it used to operate ScotRail too), First's new chief executive is "reviewing" them. Some of the commuter-heavy traffic around London is losing First Group money. Risk is outweighing return.

In the US, the iconic, 105-year old Greyhound bus company is up for sale. It has faced similar long-haul competition to Stagecoach's much smaller Megabus operations.

Despite that, the US is the focus for First Group's future attention, following a root and branch review, and the conclusion that there aren't that many synergies in what it's been doing.

So after exiting UK buses and reviewing rail (usually code for an exit ahead), plus a planned sale of Greyhound, the bit that is left is the yellow school bus operator in North America, First Student, plus the metro and contract bus specialist division, also in the US and Canada.

Unsentimental

It's no secret that this drastic course of corporate action is in reaction to fierce investor pressure. Coast Capital laid siege to the board, demanding a general meeting at which it wanted to vote off existing members, and replace them with its own nominees.

That meeting was on Tuesday in London. The results saw off the Coast Capital boarding party, with between 55% and 85% of the vote backing the incumbents.

With that success at least, First's chairman Wolfhart Hauser announced he's standing down. It will be for someone else to see through the break up of this once mighty transport empire.

His successor may well wonder if there's any point in maintaining Aberdeen as the headquarters of a North American transport group. Any residual sentimental attachment to its roots as the publicly-owned Grampian Regional Council bus operator have long since departed the depot.

- Published26 June 2019

- Published20 May 2019

- Published20 December 2018

- Published22 November 2018

- Published24 June 2019