Could Rangers have survived?

- Published

The tax bill owed by the company that used to control Rangers Football Club has been sharply reduced. There is a report that it could yet be cut by more.

It does not affect current Ibrox operations.

But it raised the question of what might have happened to Rangers if its debts in 2011 had appeared to be smaller than they did.

The question of what went wrong with the finances of Rangers Football Club is back in the Ibrox floodlights.

A claim has been published by the Times, external that the tax bill hanging over it was inflated by HMRC far beyond the amount that should have been charged.

It doesn't make any difference to activities at Ibrox now but it still matters to quite a lot of fans and foes of Rangers.

Could Rangers have avoided its collapse nearly eight years ago?

To remind you, if you need it, this involves the way Rangers players were being paid from 2001 to 2009, and the tax that was not being paid on that income.

Money was put into Employee Benefit Trusts (EBT), located in offshore tax havens. The trust, which bore an uncanny resemblance to the Ibrox payroll department, ensured that loans were forwarded from the trusts into players bank accounts, with no expectation they would ever be paid back.

Rangers was far from being the only company doing this. It looked like it might be ok - accountants elsewhere were filling their clients' boots with untaxed income via the Cayman Islands - but it wasn't.

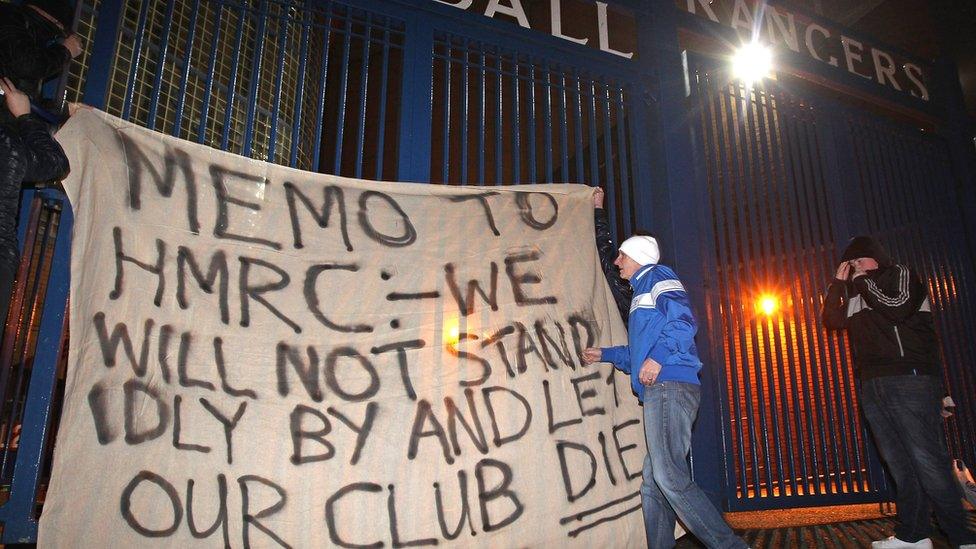

HM Revenue and Customs came after them. It said this was avoidance and slapped a very large bill on Rangers to pay back tax.

Sir David Murray was the owner of Rangers when it set up the EBTs

With that bill hanging over the club, it struggled to find a buyer when Sir David Murray had to put it on the market. And in came Craig Whyte in May 2011.

He bought it for £1, refused to pay further tax bills, and recklessly drove it into financial collapse in less than a year.

BDO, the liquidators of the old company that controlled Ibrox, have continued to tussle with the tax authority about the total bill. That reached a maximum of £94m.

But it has emerged that HMRC has removed a penalty of £24m, after an appeal to the tax authority's Penalty Review Consistency Panel.

When I write 'emerged', I mean that it was made public in June, though it wasn't much publicised.

But there's more, and this is where it gets a lot less clear.

Craig Whyte bought Rangers for £1 in 2011

The Times newspaper is reporting that the bill could be further reduced, as negotiations and legal manoeuvres continue.

That report says that the further reduction could be as much as £30m.

That would take the EBT-related tax bill down to about £20m.

But before you get carried away, consider carefully the words "could be" and "as much as".

It could also be a lot less, and The Times is not saying how its accountancy sources have got to the figures being used.

BDO has responded to the report, saying negotiations with HMRC continue, and they hope for resolution next year.

HMRC says it won't comment on this specific case. But in a brief statement, it reminds us that even if you try to "disguise remuneration" through a trust, that remains taxable.

So, what difference does that make?

For the creditors of the old Rangers holding company, a little.

There is an additional £1m pot of money to be distributed as a result of the reduction in the tax bill. Such creditors, ranging from the Ibrox energy suppliers to a face painter at a children's event, have already received 3.9 pence for every pound claimed. They may now get another 3 pence.

Does it change things for activities at Ibrox? Not at all.

The stadium, the team, the brand and all the other assets are owned and controlled by a completely different corporate entity, Rangers International Football Club.

Does it make any difference to what might have been? Perhaps. That's for fans and their foes to fight over.

I'm not going to take sides, because among my various areas of non-expertise is the question of what might have been.

I would simply offer three observations.

This remains a case of tax avoidance. HMRC is still claiming back tax. The disputes are around extra charges and the way this is calculated.

Even if big, big sums are lopped off the bill, any buyer of Rangers back in 2011 was going to have to pay off a very significant tax bill, of at least £20m, and an £18m loan being called in by the Bank of Scotland/Lloyds Group.

This was 2011. Borrowing from conventional lenders to finance football clubs was far from easy.

Away from all the tussling over the Ibrox legacy and what might have been, a head of steam under this issue was building up at Westminster earlier this year.

Contractors, in all sorts of sectors, are the individuals who were paid through these "disguised remuneration" trusts, such as EBTs, as players and some others were being paid at Ibrox.

They got the money, without tax paid, and they've spent a lot of it. As one does. To claw it back from earnings going back to 1999, which HMRC is now doing, is threatening to ruin some people.

There's a campaign group - the Loan Charge Action Group - which got going 18 months ago. It has been lobbying MPs, and has support from across party lines, mostly Conservatives, claiming that retrospective tax is unjust, and that some of those facing the bills are in extreme distress.

Those on board for the campaign include "NHS workers, teachers, public sector agency staff, power, gas and oil industry contractors, as well as IT, digital and banking sector specialists".

In September, Chancellor Sajid Javid, bowed to pressure to review the law. He commissioned a report from Sir Amyas Morse, former head of the National Audit Office. That should have been published around now. But it has been delayed by the election. It won't be sent to the Treasury before mid-December.

It's not clear how a change in the retrospective nature of this would affect companies, and particularly one in liquidation. The campaign is mainly about individuals, so former Rangers players, who were hit by tax bills as a result of this, may yet find an end or a reduction to retrospective tax demands.

- Attribution

- Published27 August 2018

- Attribution

- Published5 July 2017